Generating a debt of 8.5 million VND, paying 8.8 billion VND after 11 years

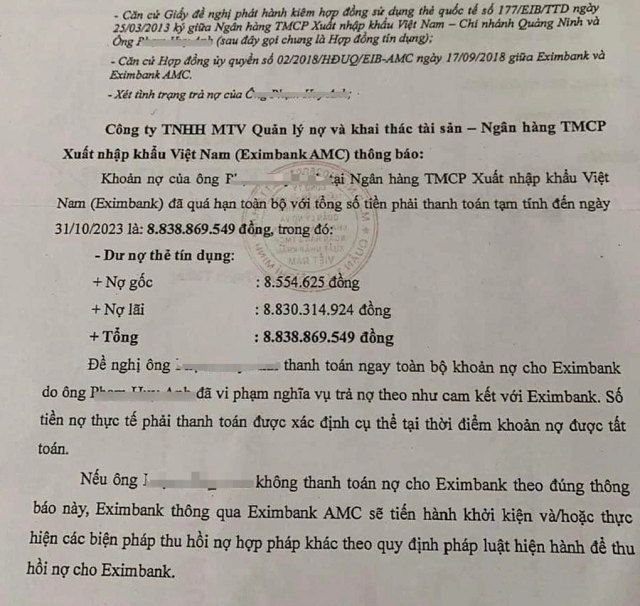

According to media reports, Mr. P.H.A opened a credit card at Eximbank in Quang Ninh, using the credit card and a principal debt of over 8.5 million VND in 2013, until 2023 the total principal and interest debt is over 8.8 billion VND.

Information about Mr. P.H.A’s debt at Eximbank has been posted in the media in recent days.

|

In correspondence with Eximbank, the bank confirms the information. Customer P.H.A applied for a Master Card at Eximbank Quang Ninh Branch on 23/03/2013 with a credit limit of 10 million VND. There were 2 payment transactions on 23/04/2013 and 26/07/2013 at an accepting point. Since 14/09/2013, the mentioned card debt has been transferred to bad debt, with an overdue period of nearly 11 years.

Immediately after that, Eximbank has taken multiple steps to recover Mr. P.H.A’s debt. continuously from 2013 to 2022.

Eximbank stated that this is an overdue debt that has lasted nearly 11 years. Eximbank has repeatedly notified and worked directly with the customer, however, the customer has not yet come up with a plan to handle the debt.

The notification of debt obligations to customers by Eximbank is a regular business activity in the process of processing and recovering debts. Up to now, Eximbank has not received any payment from the customer.

In terms of interest calculation, fees are completely in accordance with the agreement between Eximbank and the customer in the card opening file dated 15/03/2013 with the customer’s full signature (regulations on fees and interest are clearly defined in the publicized issuance and use fee schedule on Eximbank’s website).

Currently, Eximbank is continuing to work and cooperate with customers to have a plan to support customers in debt resolution.

In an exchange with the customer named P.H.A, he confirmed that he is the person in the story and has authorized a lawyer to work and is ready to sue.

How does the bank calculate interest?

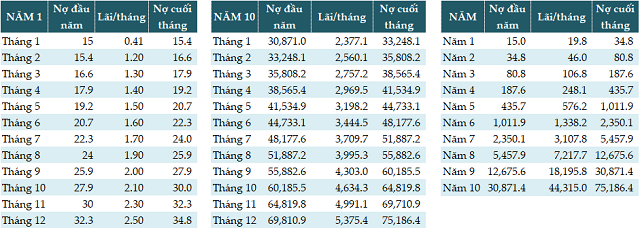

Discussing about the calculation of interest in case of overdue credit card debts, Economic Expert Mr. Dinh The Hien said that it depends on each bank, but commonly, the bank will calculate on a monthly basis, with a penalty interest rate of 5% per month. When the customer does not make the payment, then the following month, the bank will continue to accrue interest and add to the principal. The outstanding balance is still accumulated, including principal debt, overdue interest, interest on unpaid balance, late payment fees… This can be understood as the compound interest calculation, calculating by each month.

Mr. Hien gave an example, when borrowing, the bank announces an interest rate of 33% per year, divided by 12 months, the interest rate may be lower. So each month when the credit is generated, calculate the normal credit interest like consumer credit.

But if the customer forgets or intentionally does not pay, in the following month, depending on the contract and depending on the bank allowing 60 or 90 days not being within the normal repayment term and starting to put it into overdue debt.

According to Mr. Hien, Eximbank’s calculation from 8.5 million VND to 8.8 billion VND is like that. The amount will increase over each debt cycle and the growth rate in the later cycles will be higher.

|

Expected interest calculation table according to the compound interest calculation method for a 15 million VND debt, initial interest rate of 33%/year

Source: Provided by Mr. Dinh The Hien

|

Mr. Ngo Thanh Huan – Director of Personal Finance at FIDT Company said that people often do not understand how credit card interest is calculated. Credit cards will have a minimum payment amount and most users tend to think that when making the minimum payment, no interest will be charged. But when the customer makes the minimum payment, all transactions will return to the date of the original transaction and calculate the interest in full.

For example, the remaining debt is 5 million VND, after making a minimum payment of 4.5 million VND, the interest will be calculated on the total 5 million VND. This calculation method is usually clearly stated in the credit card contract.

Mr. Huan believes that all information and interest calculation methods are fully stated in the credit card contract, but similar to insurance contracts, sometimes customers do not read them carefully until an incident occurs.

How is the process of handling overdue credit card debts at banks?

Sharing from a foreign bank with a long history in credit card products, the bank said that each bank will have different handling procedures, but will include the following main steps.

Firstly, the bank will send a text message notifying the statement and the amount to be paid 1 day in advance. And then, continue to send the message after 1.5 days and after 7 days.

Secondly, if the customer still hasn’t made the payment, the bank will call the customer to request payment.

Thirdly, if the customer still hasn’t made the payment, the bank will continue to send letters to the address recorded in the credit card file via postal service or directly verify.

As for local banks, in a conversation with a Commercial Joint Stock Bank with headquarters in Ho Chi Minh City, in addition to the above processing steps, if after sending letters by mail and verifying at home still failed to recover the debt, the bank will contact relatives recorded on the credit card file.

After that, if all the above steps fail to recover the debt, the bank will create a file and send it to the relevant authorities to transfer the overdue debt.

How to use credit cards safely?

In terms of customers, Mr. Dinh The Hien believes that it belongs to the personal financial management of each person. In the US, there is an education system to teach how to use cards, which is the foundation of personal finance. However, in Vietnam, it is not included in the basic education system.

In addition, people have not equipped themselves with knowledge when using credit cards. Users need to equip themselves with knowledge about credit cards in particular and money as well as financial tools in the economy in general.

Mr. Ngo Thanh Huan has 3 recommendations for smart and secure credit card users.

Firstly, never withdraw cash using a credit card, because cash withdrawal fees are quite high, usually around 4%. In addition, customers can take advantage of cashback when using cards.

Secondly, customers must pay off the entire debt, not minimum payment, then the interest rate of over 20% will start to accrue from the date of the transaction.

Thirdly, the most important thing is that users must have a personal financial management habit. Customers must have a habit of thoroughly researching financial products, how to use them before using. It is still the story of ‘the fishing rod and the fish’, users need to equip themselves with personal financial knowledge.