FPT Joint Stock Company (FPT-HOSE code) announces the annual general meeting documents for 2024 on April 10th at FPT Tower, 10 Pham Van Bach, Hanoi.

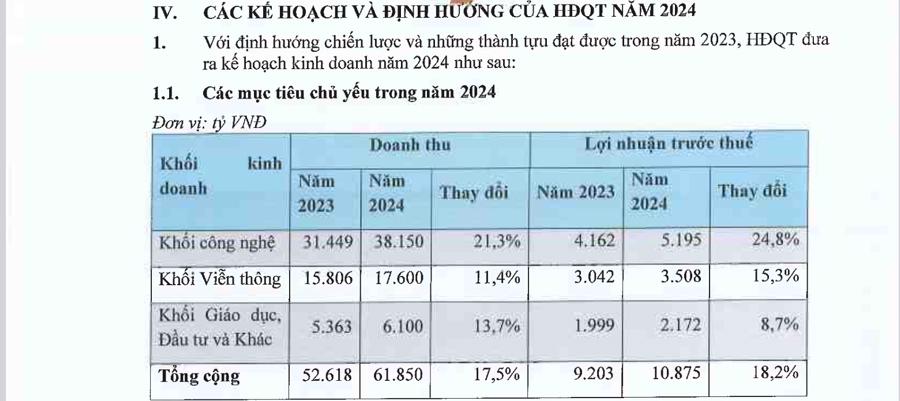

According to the leadership report, FPT Group recorded a revenue of VND 52,618 billion, an increase of 19.6% compared to the same period and achieving 101% of the annual plan; pre-tax profit reached VND 9,203 billion, an increase of 20.1% compared to the same period and achieved 102% of the annual plan; after-tax profit reached VND 7,788 billion.

For the year 2024, FPT Group plans to have shareholders approve a 17.5% increase in revenue to VND 61,850 billion; pre-tax profit to increase by 18.2% to VND 10,875 billion.

In terms of dividend distribution, the company’s general meeting of shareholders approved a cash dividend policy with a rate of 20% – of which, the company has paid 10%, the remaining 10% is expected to be paid in the second quarter of 2024.

In 2024, the company plans to pay a dividend of 20% in cash (based on the number of new shares after implementing the plan to issue shares to increase share capital).

At the same time, the company wants to issue 190,495,331 shares to increase capital for existing shareholders at a ratio of 20:3 (20 shares received 3 new shares). The implementation time is expected to be in the third quarter of 2024.

In addition, the company’s Board of Directors approved the implementation of the share issuance plan under the Employee Stock Ownership Plan (ESOP) for 2,886,227 shares in 2020; the offering price is VND 10,000/share and for ESOP shares issued in 2023 is 6,349,622 shares.

The issuance target according to the 2020 annual general meeting resolution is young senior management personnel designated by the Board of Directors. ESOP shares for this year are restricted from transfer within 10 years.

As for the issuance target according to the 2023 annual general meeting resolution, it is level 4 executives and some employees with outstanding achievements and contributions. ESOP shares for this year are restricted from transfer within 3 years. The issuance list includes 226 people.

Recently, VCSC has maintained its “buy” recommendation for FPT shares and maintained an optimistic view on the long-term growth prospects for FPT’s core business areas including: Global IT, Education and Telecommunications Services.

In general, VCSC maintains the target price while keeping the target equity value for 2024 unchanged compared to previous forecasts. However, VCSC has adjusted the forecast for total net profit after tax attributable to shareholders for the 2024-2026 period to 6% (forecasted net profit after tax attributable to shareholders to increase by 4%/6%/7% in 2024/2025/2026) as VCSC expects an increase in the profit of the Global IT segment.

At the end of the trading session on March 14th, this stock price remained at VND 117,000/share, the highest price in the past 52 weeks.