According to data from Batdongsan.com.vn, over the past 9 years (2015-2023), investing in land has a 166% profit rate. This number is lower than the stock market (203%), gold (195%), and condominiums (203%). However, the land segment still has a higher profit rate than some other investment channels, such as savings accounts (138%) and foreign currencies (111%).

The Consumer Sentiment Index (CSS) of Batdongsan.com.vn in the first half of 2024 shows that out of 1,000 survey participants, 65% of them said they will continue to buy real estate in 2024. Among this 65%, about 1/3 of the people are interested in land.

Among them, land products with prices under 2 billion VND/lot attract the most attention, accounting for 42%; the price range of 2 – 4 billion VND ranks second with 24% interest; the price range of 4 – 6 billion VND accounts for 10%. The remaining two price ranges 6 – 10 billion VND and over 15 billion VND have interest levels of 9% and 15% respectively.

It can be seen that although the real estate market has not yet fully recovered, land is still the “favorite dish” for investors, attracting the most attention. This segment has the characteristics of easy investment and high profit potential.

Mr. Le Bao Long, Strategy Director of Batdongsan.com.vn, said that due to the mindset of “land is as precious as gold”, the demand for land and the desire to accumulate assets of the Vietnamese people is very high. Therefore, it is not surprising that land receives the most attention from consumers in 2024.

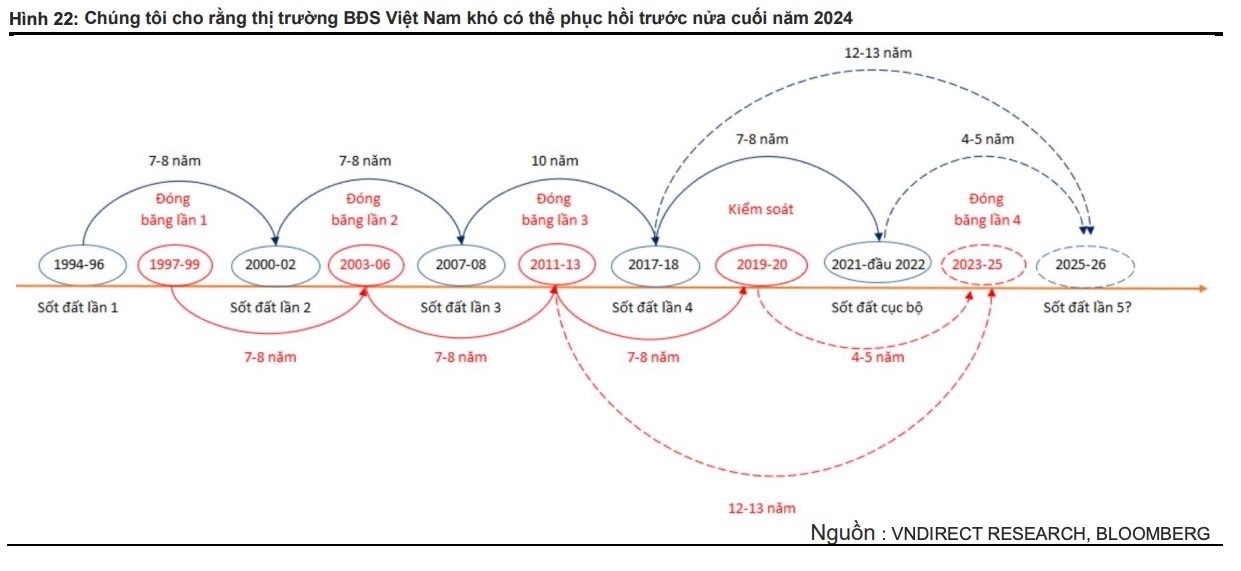

However, the company predicts that the land market will not recover its demand until at least the second quarter of 2024. This segment will not have a hot fever as before. Transactions will mostly only occur in certain areas and have not spread widely. It will not be until 2025 and beyond that the land market enters a phase of price increase.

Many experts in the industry also believe that the land market in 2024 will have a certain recovery. However, it will take more time for this segment to enter a phase of price increase.

Mr. Dinh Minh Tuan, Director of Batdongsan.com.vn in the Southern region, said that in the future, the land market will continue to face difficulties. The amended Real Estate Business Law, effective from early 2025, will tighten the operation of land subdivision sales, which may continue to reduce the level of interest in land. Land prices will also be adjusted downwards, especially for large plots.

“However, in the long term, land prices may continue to rise and transactions will return. Real estate prices depend on other factors such as infrastructure development, economic growth, and people’s income. Meanwhile, land is a type of investment that any member of the market can invest in due to its diversity in terms of area, price, and location. For localities with economic growth, land in these areas will still have sustainable growth,” said Mr. Tuan.

According to Mr. Tran Khanh Quang, CEO of Viet An Hoa Real Estate Investment Joint Stock Company, the recovery of the land market will be slower than previously forecasted. It will not be until mid-2024 that this segment will truly have a clear demand. The demand of investors for land is still high but psychological barriers and profit margin risks are making them somewhat hesitant. According to Mr. Quang, the ongoing infrastructure projects will have an impact on the land segment in the next 2-3 years.

“It will not be until 2025 and beyond that the land market enters a phase of price increase,” he said.

According to the forecast of Mr. Vo Hong Thang, Head of Advisory Services & Project Development Division of DKRA Group, based on a prolonged cycle of repetition, the land fever may return in the period of 2025-2026.

“The current period up to the first half of 2024 can be seen as the beginning of a recovery and the next growth cycle of the real estate market,” emphasized Mr. Thang.

It is worth noting that VNDirect also has a forecast that the next land fever cycle may occur in the period of 2025-2026.