Regardless of the market downturn today for any reason, the most important thing is that a huge amount of shares have changed hands. With a massive amount of accumulated stocks at the top, but a session like this is beneficial, as expectations are exchanged on a massive scale.

Just counting the matched orders of HSX and HNX, about 1.8 billion shares were transferred with a total value of nearly VND 44.1 trillion. The total trading volume of the three exchanges was VND 47.8 trillion, all of which were unprecedented records.

In a chaotic trading session like today, if you use margin to bottom-fish, it can be said to be “suicide”. Therefore, this money can be considered real money. Of course, it may also include trading actions added to liquidity. Under tremendous pressure, the most liquid shares must have appeared in large numbers.

It can be seen that the afternoon trading slowed down significantly, the selling side could not push the price much (there were still stocks that fell further even though the index did not), but basically they all gradually recovered towards the end of the day. Counting on T2, this afternoon had nearly 1.2 billion shares added, which clearly showed that there was a phenomenon of holding on to stocks. The bottom-fishing money flow was very cautious, not enthusiastic but gradually raised the price. That is a good sign.

With such a wide range of fluctuations as today, there are many stocks that offer T+ trading opportunities, but how safe it is depends. Therefore, greed doesn’t need to be too big, and if you want to trade, you should only have a small position to explore the feeling. If we look back at the trading session of August 18, 2023, with a volume of nearly VND 40 trillion on the two exchanges (excluding agreements), we have to wait for three more sessions to know whether the selling pressure has really eased or not. Those who bottom-fished today or had stocks available, or those who waited for the T+ time would all have to “fizzle out” in the next few days before supply and demand stabilize again.

The reaction of bottom-fishing money when specific stock prices fell to support or the deepest range is the development that needs to be observed today. The more the price recovers, the better, regardless of the liquidity. If the afternoon recovery has low liquidity, it means that most of the selling in the morning has dissipated; If there is high liquidity, it means that there is strong bottom-fishing. The amount of forced sell-off in the morning is the active supply, while pulling up the price in the afternoon is the active demand. In the next few sessions, the price will continue to fluctuate and the downward movements with low liquidity are positive.

At this time, it is not necessary to pay attention to rumors, but to look at the actual supply and demand on the board. If the market is declining, it will continue to decline, and the information only stimulates trading psychology. A sharp decline is not necessarily bad because sometimes losses come so fast that you don’t feel pain anymore. The most important thing is not to be “paralyzed” and not know how to act. Preserving resources or avoiding margin pressure, there is nothing to fear because the fundamental foundation of the market has not changed.

After a quite good bottom-fishing session this afternoon, the market may rebound tomorrow but there will soon be short-term selling. Overall, the market only has individual trading opportunities with stocks, but the adjustment trend in the index is not over. Therefore, if you want to trade, you should only trade on a small scale, with flexible Long/Short derivatives.

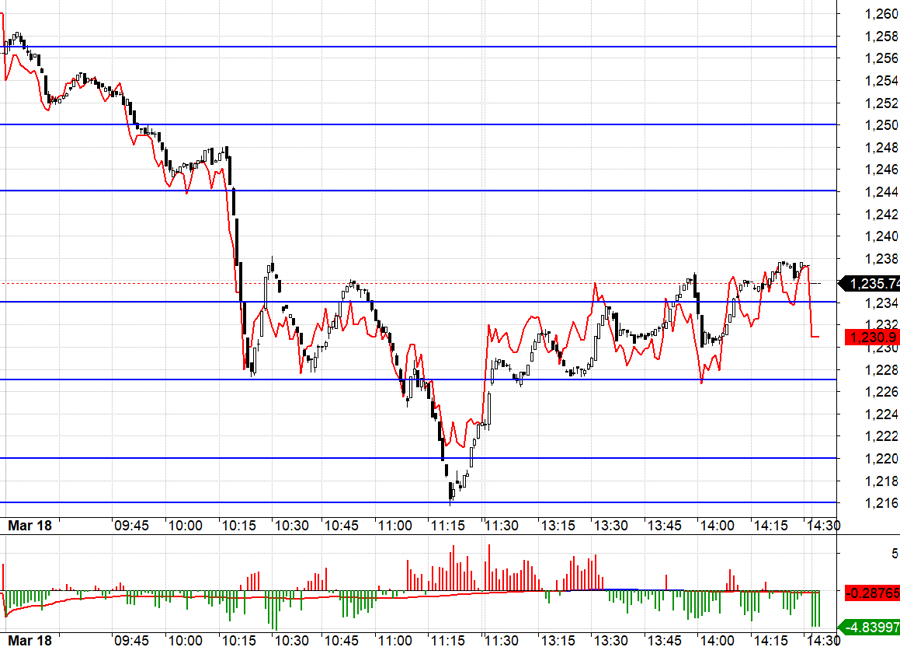

VN30 closed today at 1235.74. The nearest resistances tomorrow are 1244, 1250, 1257, 1261, 1267. The supports are 1234, 1227, 1220, 1214, 1208, 1200, 1191.

“Stock Blog” is personal and does not represent the views of VnEconomy. The opinions and evaluations are those of the individual investors and VnEconomy respects the opinions and writing style of the author. VnEconomy and the author are not responsible for any issues related to the published evaluations and investment opinions.