Liquidity and price range today show a fairly stable market, selling decreases and buying also supports well. Of course, the pressure from the massive volume on March 18th will have to wait for 2 more sessions to know. The weakness in the blue-chip group is of concern because this group can cause more loss than the clearer trend in the index and affect the general psychology.

For now, the ability to hold prices is consolidating the T+ advantage for quick trading. Many stocks today still have good price increases, the profits of bottom fishing stocks yesterday are very stable. The hanging session today still keeps the risk signals, the correction phase has not ended, only strong in individual stocks. So depending on the fluctuations of the index, the level of interest in the index will determine how short-term trades will behave differently.

Typically, intraday rebounds like yesterday afternoon will stimulate bottom fishing and quick trading. Stocks will be settled as they reach the account – or like recently to add to T3. In the next 2 sessions, there is a high chance of stronger short-term selling pressure.

The huge turnover on the first day of the week is the transfer of stocks – cash on a massive scale. The issue at this point will depend on the amount of money withdrawn in that session, choosing which strategy. Even if that satisfaction is met, stocks have been sold off but the money has also correspondingly declined. The patience of cash being withdrawn will always be the cause of the ongoing decline because over time, the endurance of stockholders will weaken.

On the other hand, it’s just been one big trading session and recovery still hasn’t created a stable accumulation ground. Cash holders still have a reason to wait, after a prolonged uptrend, a correction phase never ends in a few days. The end of the bottom accumulation always has specific signals to assess the level of risk. Patience is not necessarily waiting to buy cheaper, but to reduce risk.

Of course, with large fluctuations, surfing will be popular. The point is that these experienced players accept risk in a methodological way rather than based on the premise that the market has bottomed out. The upward jerking during the downward afternoon is a regular occurrence, but without enough money to continue, mainly on short-term speculation, it is difficult to be sustainable.

A fairly good signal today is the amount of issuance of new shares has decreased to 10 trillion VND after 6 sessions of regular withdrawals of 15 trillion VND. Reducing the amount of issuance usually reflects market probing actions, similar to the phase in September last year starting with a regular 10 trillion dong and then rising to 20 trillion dong and then gradually decreasing. However, USD still hasn’t cooled down, Vietcombank still closes the selling price at 24,895 VND/1USD, yesterday was 24,880 and the highest level last week was 24,890. This week, FED meets and the USD-Index is still rising. After a week of restructuring, foreign investors still have a large net selling.

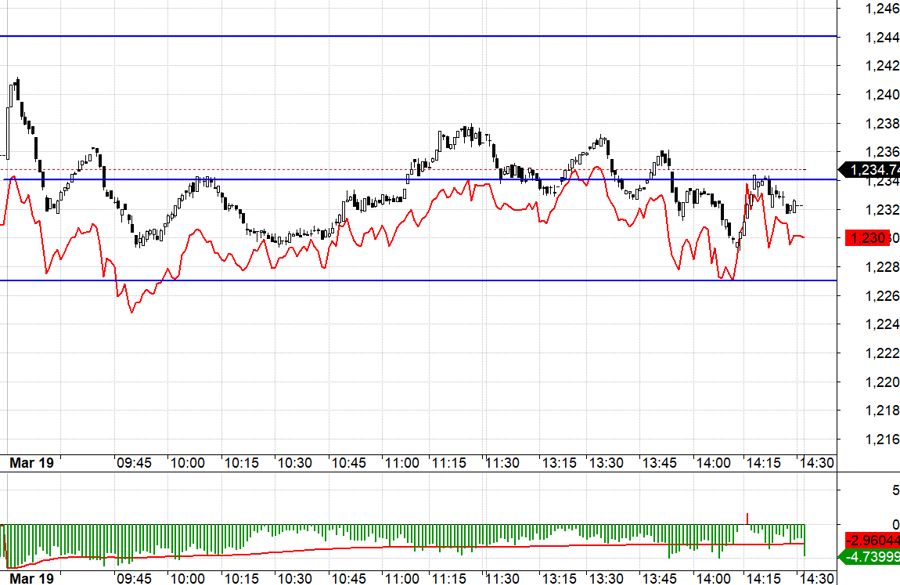

The derivative market is feeling the discomfort of weakness in the blue-chip group. VN30 today is mainly red, with a narrow range. VIC, VHM are the only two significant pillars. Narrow fluctuations are more difficult to trade, F1 liquidity also decreased by 27% compared to yesterday. On the 21st, F1 will expire along with the convergence of events this week, the possibility of further decline is high. F1 is still accepting a discount of nearly 5 points, F2 is less discounted, about 0.5 points. The strategy is to take a short position depending on the advantage in which term.

VN30 closed today at 1234.74, right at a level. The next resistance tomorrow is 1243; 1250; 1257; 1261. Supports are 1227; 1220; 1214; 1208; 1200; 1197; 1187.

“Stock blog” is a personal opinion and does not represent the views of VnEconomy. The opinions, and evaluations are those of individual investors and VnEconomy respects the views and style of the author. VnEconomy and the author are not responsible for issues related to the published assessments and investment opinions.