Condominium No Longer Considered a “Luxury Item”

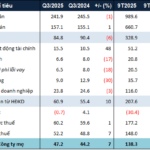

Savills’ Hanoi Real Estate Market Report for Q1 2024 reveals a 41% quarterly and 99% annual increase in the supply of condominium units, with a total of 4,062 units. The primary supply for the quarter reached 12,928 units, indicating a 9% quarterly increase but a 34% annual decline.

The supply-demand imbalance in the condominium segment persists. The market continues to experience a shortage of products priced below VND 30 million/m2 (Class C), with such products accounting for only 4% of the new supply and already sold out. Since 2020, the primary supply of Class C units has decreased by 47% annually.

Ms. Do Thu Hang, Senior Director, Research and Consultancy, Savills Hanoi, commented: “The supply is mainly concentrated in Class B condominiums, accounting for nearly 90%. Class C condominiums in the primary market and Class A condominiums only constitute a very small proportion. Moreover, from now until the end of the year, although major legislation has been passed, the new supply is unlikely to improve significantly.”

Ms. Do Thu Hang, Senior Director, Research and Consultancy, Savills Hanoi

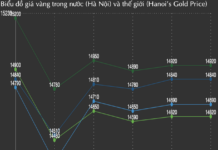

Meanwhile, in major cities like Hanoi and Ho Chi Minh City, the annual natural demand for housing is approximately 50,000 units. This demand stems from factors such as migration, the formation of new households by adults, and the decreasing average household size. This demand has been unmet due to supply constraints for some time, leading to pent-up housing demand. Additionally, macroeconomic factors such as a volatile gold market and low interest rates have prompted investors to seek out viable and long-term investment options, further exacerbating the demand for condominiums in the Hanoi market.

When comparing different product lines, buyers with genuine housing needs may find that condominium prices remain more reasonable compared to other housing types within a project, such as villas and townhouses. This has led to an increase in both demand and primary prices for the condominium segment in Q1 2024. Savills’ quarterly report indicates that the primary price of condominiums in Hanoi reached VND 59 million/m2, representing a 3% quarterly and 14% annual increase.

Furthermore, with primary prices remaining high, the secondary market has also witnessed an increase in transaction volume and prices. Previously, the secondary market offered more reasonable prices compared to the primary market. However, due to the growing demand for housing, secondary prices have also increased during the early months of 2024.

Ms. Hang also observed a change in buyer psychology: “The view of condominiums as a ‘luxury item’ seems to be a thing of the past. Today, this perspective has shifted, and buyers are gradually recognizing that condominiums in major urban areas are also valuable assets. In the past, the decision to purchase a condominium required careful consideration due to its significant financial implications. However, recent buyers are not waiting as long to make purchasing decisions. Decisions are being made more quickly, and down payments are being placed more promptly.”

However, Ms. Hang clarified that this is not the case for the entire market: “For condominium projects where the price does not align with the quality of the product, buyers may not make hasty decisions. The projects that attracted market attention in Q1 2024 are primarily from reputable developers with products that, once introduced to the market, offer a certain level of quality and legal compliance. These developers often collaborate with leading brands and consulting firms, from design firms to landscape architects and product designers. Some projects have even partnered with renowned international firms to enhance their own reputation. Well-received projects with reliable developers and legal security are the ones recording favorable transaction volumes.”

Shift in Demand to Areas with Reasonable Prices

Amidst the escalating prices, some projects have been priced beyond their actual value. Ms. Hang advises buyers to exercise caution, carefully considering the project’s utility value and overall reasonableness.

“Overall, if prices continue to rise, buyers will need to re-evaluate their financial situations. While genuine housing demand remains the primary driver, if prices continue to climb, buyers may consider alternative options such as renting in the inner city or relocating their demand to neighboring provinces with more affordable prices,” Ms. Hang stated.

Homebuyers with genuine housing needs can explore supply options in neighboring localities such as Hung Yen and Bac Ninh, as well as areas along Ring Road 4 or Ring Road 3.5, due to the ongoing development of infrastructure. Infrastructure remains the most significant catalyst for changing the value landscape of the housing market. Infrastructure development brings suburbs “closer” to the city center, reducing travel times. Moreover, in neighboring provinces or suburban areas, developers can access land at lower costs, resulting in a more affordable housing supply.

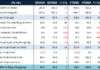

It is anticipated that products in neighboring provinces will increasingly fulfill the housing needs of Hanoi. Hung Yen and Bac Ninh are projected to supply approximately 203,000 condominium units between 2024 and 2026. The revised laws are expected to facilitate the development of the real estate market and contribute to an improvement in supply. From 2025 onwards, the market anticipates approximately 84,400 condominium units from 101 projects.