Textile is one of the sectors where many global fashion brands request their providers to green their production. Photo: TL |

Green transition challenges for businesses

Recognizing the long-term benefits of the green economy and “greening” their business operations, many enterprises have started to make the switch. However, many pioneers in this trend are facing pressure due to slow-moving policies and a lack of preferential capital.

Mr. Nguyen Hai Anh, Deputy General Director of Shinec Joint Stock Company – a unit that manages and invests in industrial park (IP) and industrial cluster projects in Vietnam, said that Nam Cau Kien IP in Hai Phong has now established three main circulation loops in the IP and disposed of industrial waste outside. However, the transition of more than 70 enterprises in the IP has encountered many difficulties, with 60 enterprises expressing their desire but struggling to make the switch to meet national guidelines.

“Many enterprises reflect that the legal corridor for developing green credit sources, green bonds, as well as specific policies to encourage each sector of activity, is very limited,” said Mr. Hai Anh at a workshop on perfecting the legal framework for developing green credit.

According to him, the transition to an ecological IP, striving to meet the criteria, is very costly in terms of greenery, land, hiring auditors, consulting on ESG (environmental, social, governance) standards, etc. However, incentives for this activity are relatively limited, and there is a lack of mechanisms to encourage businesses to implement the transition and build new ecological IPs.

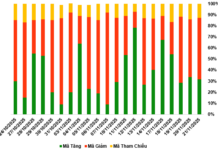

In fact, businesses in the renewable energy sector currently account for the majority (45%) of credit capital that banks lend for green credit, but most of them face difficulties. Specifically, after many delays, the plan to implement the National Power Development Plan for the 2021-2030 period, with a vision to 2050, has been approved, but follow-on policies are very slow, and the electricity price framework for new renewable energy projects is not yet available.

Meanwhile, banks provide loans based on enterprises’ revenue and repayment capacity. This leads to a situation where banks are willing to lend, but businesses and projects still have difficulty accessing green credit.

In the context of enterprises participating in the global supply chain and export enterprises facing great pressure to practice ESG in order not to lag behind or be eliminated from the “game”, a survey on business capital flow using ESG conversion with 10 large and medium-sized factories, released by the Private Economic Development Research Institute (Institute IV) in March 2024, showed that many businesses are using their business production capital to practice ESG.

Accordingly, only a few businesses have received green capital, mainly focusing on the renewable energy and agricultural sectors. The total outstanding green capital balance was only about 4.5% as of the end of 2023, a very modest figure.

Even Assoc. Prof. Dr. Nguyen Dinh Tho, Director of the Institute of Strategy and Policy on Natural Resources and Environment under the Ministry of Natural Resources and Environment (MONRE), said that a number of businesses have “run out of steam” in the green transition process, having to leave the market abruptly in the recent past. “Some textile companies had to leave the market abruptly, ceasing operations because they were causing environmental damage,” emphasized Mr. Tho.

What are the opportunities for businesses?

Emphasizing the message that businesses cannot “go it alone” in the process of practicing ESG but need an ecosystem, Mr. Bui Quang Duy, Deputy Director of Global Investments at the Climate Finance Department – responsAbility Investments AG Fund (Switzerland) said that in the greening trend, senior leaders who understand and are active in green issues and sustainable green development is very good. This helps them orient their investment strategies in the long term. But to invest in green and sustainable transitions requires a large investment, so a long-term vision is needed to invest in modern machinery and equipment, energy saving, etc.

On the business side, it is necessary to develop appropriate policies and have specialized ESG personnel. The fund will support businesses with technical packages and long-term investment grants.

“It is the resonance of businesses, the financial system, and banks in investing and cooperating to put green capital into practice,” said Mr. Huy at a seminar on ESG held late March 2024.

Meanwhile, Ms. Nguyen Thi Huyen, General Director of Vietnam Cinnamon and Cassia Export Production Joint Stock Company (Vinasamex), said that the major factor that investment funds require from businesses is a report proving the impact of the companies’ activities on the environment. If businesses do not measure the impact and do not submit this report, their chances of accessing investment capital will be limited.

“We are fortunate to have specific figures and measurement tables for these indicators, helping the company pass the first ‘screening’ round. Meeting these conditions has created opportunities for us to access green capital from investment funds and banks,” said Ms. Huyen.

From a banking perspective, Mr. Le Ngoc Lam, General Director of BIDV, said that the bank has opened a new capital mobilization channel, laying the foundation for increasing the supply of green capital for the economy through the issuance of green bonds. Recently, BIDV successfully carried out a issuance of VND 2,500 billion in bonds in accordance with the green bond standards of the International Capital Market Association (ICMA). This activity makes BIDV the first bank to issue green bonds according to international standards in the domestic market.

But to promote the flow of green capital, thereby adding resources for businesses to transition to green, Mr. Lam said that a number of solutions need to be implemented.

First, complete the legal frameworks related to green bonds, such as regulations for classifying and certifying national green projects in order to apply incentive policies. In addition, it is necessary to consider the similarities between Vietnam’s green criteria and international standards. This will make it easier for businesses to implement projects and attract domestic and foreign investment according to the same system of standards.

Review the regulations on green criteria, including levels corresponding to different levels of policy incentives. This will help businesses issuing green bonds to gradually access preferential policies, as well as create targets/motivations to achieve sustainable growth. At the same time, issue guidelines for the issuance and post-issuance reporting of green bonds, considering the specific regulations between the operations of credit institutions and economic organizations.

Second, encourage businesses to transition to green and issue green bonds through continuing to research and expand policies to support issuance costs and tax incentives. In addition, businesses should step up training and develop a workforce in the field of environment.

Third, encourage investors to participate in investing in green bonds through solutions such as considering issuing incentive policies that are large enough to encourage investors to buy bonds. For example, provide investors with incentives in terms of credit limits and taxes on investment income. In addition, it is necessary to raise awareness of investors’ responsibilities towards sustainable development, the community, and society.

Regarding the experience of issuing green bonds, Mr. Lam said that BIDV has proactively studied international green bond practices and principles. At the same time, thanks to the technical advice of the World Bank to develop the Green Bond Framework in accordance with the ICMA standard and achieve a very high Moody’s rating.

“This was a key factor in the success of the issuance. Within two months of issuance, BIDV had disbursed all bond capital to finance renewable energy and sustainable transportation projects,” said Mr. Lam.

Van Phong