The market is still in chaos, and there are plenty of stocks available. There is no need to chase after the prices. The downward momentum is strong, and any intraday rally will be used as an opportunity to cut losses.

The latest news today is that the State Bank will sell USD to intervene in the exchange rate. The issuance of credit notes can be considered ineffective as the exchange rate remains high. We should wait for signals to see if banks will reduce the selling price of USD or at least not keep the same increasing rate as before.

Currently, the market is in a downtrend correction of the medium-term uptrend, so both time and amplitude must be proportional. On the upside, the VNI has little impact on the price fluctuation of specific stocks, but on the downside, the psychological impact is significant. Therefore, it is necessary to observe both the index and the supply and demand of stocks in the watchlist.

A relatively strong bottom-fishing rally in this afternoon’s session shows some greed but seems a bit hasty. The effect of pulling up the index and the actual supply and demand of stocks are two different stories. Depending on the specific portfolio, the selling pressure will vary. Therefore, intraday recoveries are prone to failure. When there is no tug-of-war to “test” supply and demand, such rallies are just traps that hold more money.

I still maintain the view that it is possible to buy at this time, but it should be selective buying with a clear strategy. There will always be losses in such trades, but they are controlled losses that are easy to “erase.” Besides, the gradual buying strategy will depend on the strength of each individual stock. This is easy to observe if the stock outperforms the general trend, has strong buying demand, and maintains a moderate or slight decline in price range. The logic is that in a context of general panic, it is normal to sell off in large volumes, so when there is a reverse flow of money to absorb enough or hold the price, it is necessary to pay attention. Going through many such sessions will form a reliable supply and demand verification price range.

The derivatives market continues to be extremely active, with high liquidity. This is reasonable because trading derivatives at this time is both “high” and easy to manage risks. Bottoming out stocks still has to wait for the goods to arrive, even at a loss, so it must be balanced with derivatives, while derivatives can be traded in both directions very quickly. In the past, before derivatives, the “sawing the table leg” style with stocks was almost “cut off.”

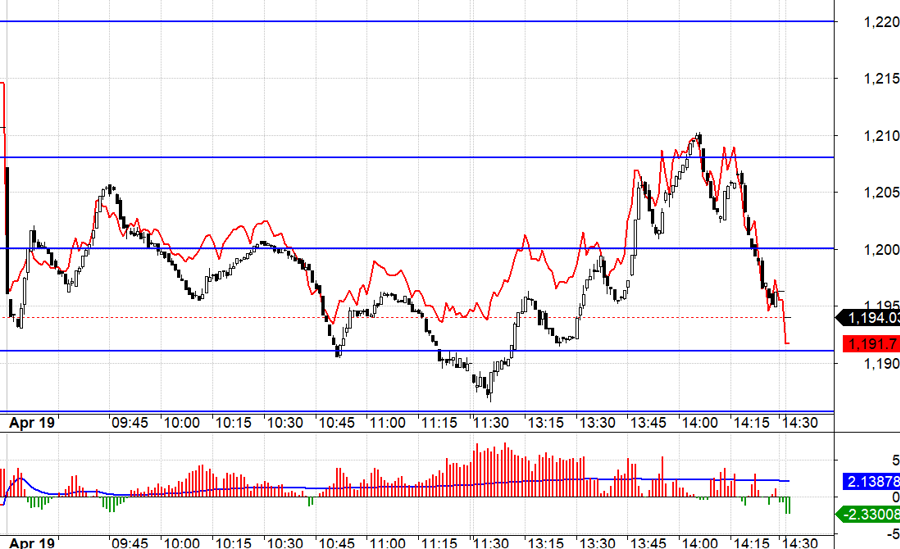

Today, F1 has a quite annoying basis reversal situation. Initially, it was profitable for Short, but when the VN30 fell from 1200.xx to near 1175.xx, F1 widened the basis and narrowed the profit margin. Conversely, in the session when the VN30 was pulled up to the 1208.xx zone, the basis narrowed again, which was disadvantageous for Long. However, all entry points today met the standards and had clear stop-loss levels and high safety.

The recovery rally this afternoon can be seen as a “test” of greed, and the pillars signaling were quite well-received. However, the consequences are somewhat significant. The next session is likely to repeat the same type of fluctuation. The strategy is still to wait and buy stocks, Long/Short flexibly with derivatives.

VN30 closed today at 1194.03. The nearest resistance for the next session is 1202; 1208; 1216; 1222; 1228. Supports are 1193; 1185; 1174; 1168; 1163.

“Stock Market Blog” is of a personal nature and does not represent the opinion of VnEconomy. The views and assessments belong to the individual investor, and VnEconomy respects the views and style of the author. VnEconomy and the author are not responsible for any problems arising from the assessments and investment views posted.