Vietcombank, one of the three banks that controlled input costs the best in 2023.

|

The banking sector is a pillar of the economy, playing a vital role in providing credit for consumption and business production. Annually, credit growth in the banking sector directly impacts GDP growth. It is the reason why the State Bank of Vietnam (SBV) frequently urges banks to accelerate credit growth to support economic growth.

An economy without healthy credit growth from banks will find it difficult to develop sustainably. Therefore, the banking sector’s stability and efficiency are prerequisites for economic prosperity.

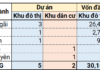

Banking is one of the industries with exceptional business efficiency, with annual profit growth rates consistently in the double digits. The banking sector’s average return on equity (ROE) is always at 15-17%, significantly higher than the 10% average of other industries. Although the banking sector often leads in annual profit growth, its P/E ratio stays low, at only about 8-9 times, much lower than the average P/E ratio of about 15 for the entire market through the VN-Index.

Poor profit quality, despite overall high profits, is the main reason for this. High risk provisions and bad debt issues affect profit quality. Compared to the VN-Index, the banking sector has a much lower P/E ratio, reflecting higher risk and uncertainty. Therefore, to accurately assess the actual value of bank stocks, investors need to look at the quality of earnings rather than just absolute profits.

Bank profits are heavily influenced by bad debt provisioning policies.

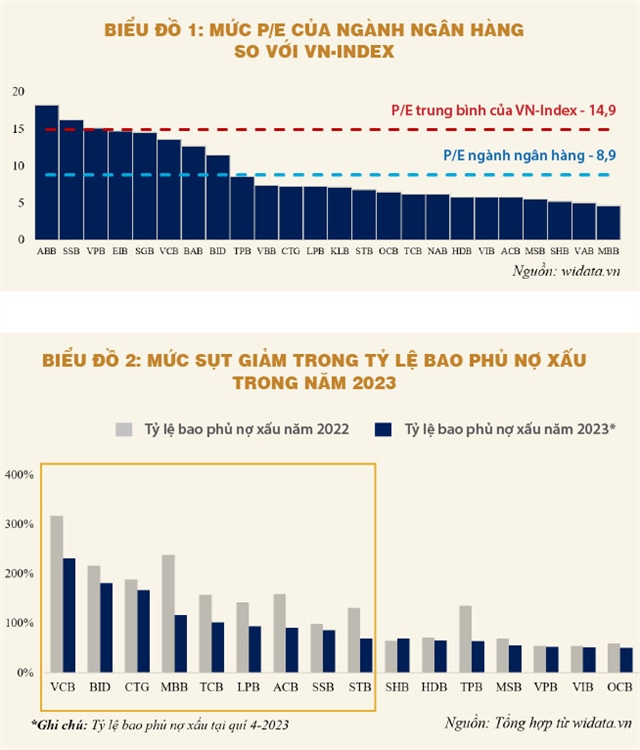

The SBV’s recent issuance of Circular 02/2023/TT-NHNN allows banks to benefit significantly as bad debts can be deferred, thereby reducing the pressure to make provisions immediately. This regulation has helped improve the interim profit reporting of many banks. However, this deferral also carries a significant risk of concealing the underlying financial weakness and not accurately reflecting asset quality. As a result, even though profits improve on paper, it does not necessarily mean sustainable profit growth.

Vietcombank, one of the three banks that controlled input costs the best in 2023. |

In reality, banks’ provisioning levels have decreased significantly compared to the end of 2022, as evidenced by the sharp decline in the bad debt coverage ratio at most banks. The bad debt coverage ratio is measured by dividing the provision made by the bank by the total bad debt. The sharp decline in the bad debt coverage ratio indicates a reduction in provisioning.

This decline shows that banks are optimizing costs to improve short-term profit reporting but reducing their long-term financial reliability. This points to a weak financial mechanism, which may not be fully reflected in the regular accounting figures.

| The stability and efficiency of the banking sector are prerequisites for economic prosperity. |

The low valuations of bank stocks may reflect potential risk factors that have not yet fully emerged. A company’s P/E valuation depends on factors such as the company’s current profit level, future profit growth rate, the risk level of profit reflected in the volatility, and finally, the quality of profit.

Based on our analysis of the size and growth rate of the banking sector above, the low P/E ratio of the banking sector can only be attributed to two factors: profit volatility and the quality of banks’ profits.

Profit quality reflects whether current profit is a good indicator of a company’s future profit. When manipulated excessively, bank profits will no longer accurately indicate future profits. This will genuinely make investors hesitant and unwilling to pay a high P/E for the current EPS (earnings per share) generated by the banking sector.

The quality of banks’ profits

2023 has witnessed a marked shift in investment strategy by investment funds as they gradually reduce their weight in bank stocks. A typical example is Dragon Capital’s DCDS and DCDE funds, which have continuously reduced their weight in bank stocks since mid-2023. Meanwhile, the Ballad Vietnam Growth Equity Fund of SGI Capital has recently sold off its bank stocks almost entirely.

The market always has opposing views, but we need to understand that the quality of bank profits in the context of a volatile macroeconomic environment will make investors, especially professional institutional investors, very cautious about bank stocks.

While the figures show strong credit growth, the reality is a different story. Most credit growth does not come from real economic activities such as manufacturing or services but is instead disbursed to real estate companies restructuring their finances, while personal lending at many banks is growing very low or even declining.

This further indicates significant uncertainty about the quality of banks’ credit portfolios. Investors are becoming cautious because they cannot clearly determine the safety and profitability of these loans. This reduces the market value of bank stocks due to concerns about debt collection and sustainable profitability.

Meanwhile, each bank has different target customer groups, with different credit growth strategies, which has made the loan portfolio risk of the banking system like a “black box.” Diversity in business strategy can create a competitive advantage but also significantly increases the risk to the loan portfolio.

With each strategy, risk management capabilities and transparency of lending information, as well as credit quality assessment, become even more difficult, not simply through the financial figures published. This uncertainty increases investor caution, and hence, the low valuations of bank stocks reflect high risks that are not clearly disclosed.

Assessing the quality of bank profits plays a crucial role for investors to assess the attractiveness of bank stock prices. The quality of bank profits is a key factor influencing stock prices. A good profit figure on paper may not accurately reflect the actual situation if the underlying asset quality is poor. Investors need to approach information cautiously and comprehensively assess risk factors to determine the actual value of bank stocks and make wise investment decisions.

Le Hoai An – Phung Thi Hong Gam