Vietbank Announces Share Dividend to Boost Capital

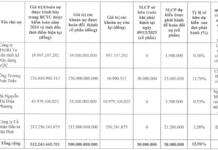

In 2023, Vietbank recorded a consolidated net profit of approximately 647 billion VND. After allocating to various funds and incorporating retained earnings from previous years, the bank now has over 1,593 billion VND in undistributed profits. Of this amount, the bank intends to allocate nearly 1,445 billion VND to a share dividend, retaining the remaining 148 billion VND in profits.

Share Capital Increase through Rights Issue

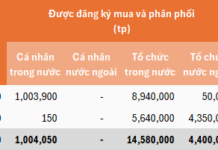

Specifically, Vietbank plans to proceed with its capital increase plan by issuing new shares to existing shareholders (previously approved by the State Bank of Vietnam), raising a total of 1,003 billion VND. As of now, the bank has completed the offering of over 100.3 million shares and is currently undertaking the necessary steps to request the State Bank of Vietnam’s approval to amend its license. The completion is anticipated in Q2 or Q3 of 2024.

25% Share Dividend Issuance

In 2024, Vietbank plans to issue approximately 144.5 million shares as a dividend to existing shareholders, corresponding to a ratio of 25%. The total issuance value is expected to reach approximately 1,445 billion VND, sourced from accumulated net profits up to December 31, 2023. The issuance is预计 scheduled for Q3 or Q4 of 2024.

Capital Utilization for Growth

The additional capital generated from the share issuance for the 2024 dividend is earmarked for asset investment, capital replenishment for expansion and network development, and ensuring compliance with regulatory capital ratios.

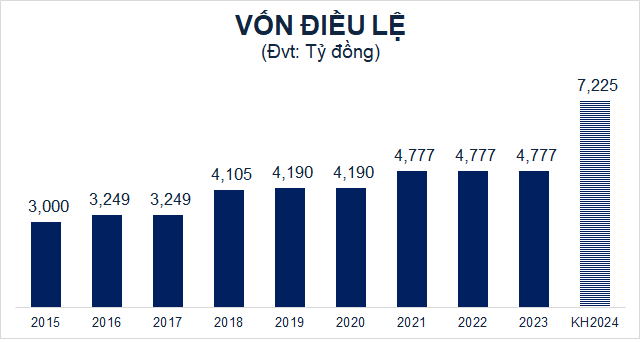

Increased Charter Capital

Vietbank’s current charter capital stands at 4,777 billion VND. Upon completion of the license amendment and successful issuance of shares for the dividend, the bank’s charter capital will increase to approximately 7,225 billion VND.

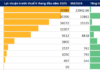

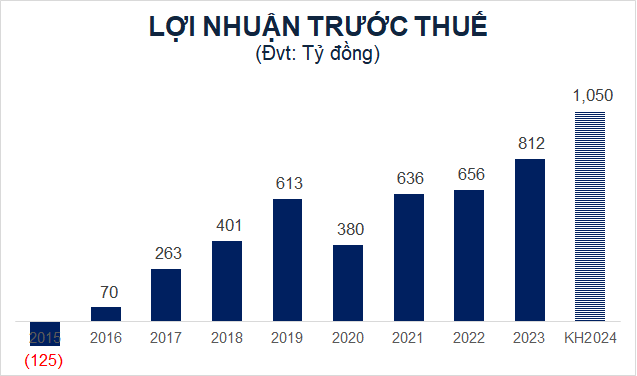

Target of 1,050 Billion VND Pre-tax Profit

Based on the additional capital, Vietbank has outlined two business plans for 2024: a base plan and an aspirational plan.

Base Plan:

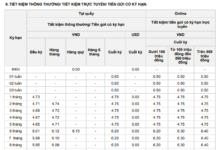

The bank aims to achieve a pre-tax profit of 950 billion VND, representing a 17% increase compared to 2023. By year-end 2024, the bank targets a 5% increase in total assets to 145,000 billion VND. Customer deposits (including negotiable instruments) are projected to grow by 8% to 110,000 billion VND, while gross loans are expected to rise by 11% to 90,000 billion VND. The bank aims to keep the non-performing loan ratio below 2.5%.

Aspirational Plan:

Under this plan, Vietbank targets a 29% increase in pre-tax profit to 1,050 billion VND. Customer deposits and loans are projected to grow by 14% and 18%, respectively, reaching 118,000 billion VND and 95,000 billion VND.

Continued Aim for HOSE Listing

At the 2023 Annual General Meeting of Shareholders, Vietbank approved the listing of its shares (VBB) on the Ho Chi Minh Stock Exchange (HOSE) when market conditions become favorable.

Based on its business performance in 2021 and 2022, as well as its restructuring plan linked to bad debt resolution (2021-2025), Vietbank has met the criteria related to financial results, financial ratios, and corporate governance. However, due to the volatile domestic market conditions in 2023 and events involving companies such as FLC, SCB, and Van Thinh Phat, the bank’s listing would not have reflected its true value and protected shareholder interests. Therefore, Vietbank postponed its listing in 2023.

Consequently, the bank will present a plan for listing on HOSE at the 2024 Annual General Meeting of Shareholders when market conditions are more conducive.

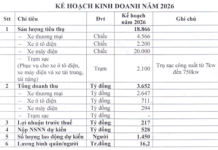

Target of 1,600 Billion VND Pre-tax Profit by 2025

Vietbank intends to transition from a credit-dependent model to a multi-service business.

The bank will focus on bad debt resolution, improving credit quality, and minimizing new non-performing loans to keep the ratio of bad debt (including bad debt sold to VAMC) below 3% by 2025.

Simultaneously, the bank aims to increase the share of non-credit service income in Vietbank’s total income to 12-16% by the end of 2025 and allocate a greater proportion of loan capital to low-carbon production and consumption sectors.

Long-Term Goals:

By 2025, the bank targets a pre-tax profit of 1,600 billion VND. Total assets are projected to reach 170,000 billion VND, market deposits 135,000 billion VND, and loans 110,000 billion VND. The bank aims to increase its charter capital to 10,000 billion VND and achieve an ROE of over 11%.

Additional Information:

Vietbank also presented a report on the implementation of a deposit contract and a sale and purchase agreement for the LIM 2 building. However, specific details were not disclosed.

Vietbank’s 2024 Annual General Meeting of Shareholders is scheduled to be held virtually on April 26, 2024.

Source: Han Dong