Vietnam Investment and Capitalization Joint Stock Company (Hai Phat Investment, stock code HPX-HOSE) announces personnel changes – resignations of the Board of Directors, and the Board of Supervisors.

Accordingly, on April 19, HPX received resignation letters from many leaders, including board member Mr. Vu Hong Son, board member Mr. La Quoc Dat, and supervisor Mr. Bui Duc Tue.

The reason for the resignation of the three leaders of Hai Phat Investment is that they are busy with personal work and cannot fulfill their positions.

According to the 2023 audit report, HPX’s Board of Directors has five members: Chairman Mr. Do Quy Hai, three members: Mr. Nguyen Van Phuong, Vu Hong Son, Nguyen Van Dung, and independent board member Mr. La Quoc Dat.

Recently, Mr. Chu Viet Hung – a member of the Board of Supervisors – registered to sell all 60,000 shares, accounting for 0.02% of HPX’s capital to restructure his investment portfolio, from April 16 to May 15.

Previously, on April 1, 2024, Mr. Hoang Van Toan – a group of shareholders related to Toan Tin Phat Investment JSC, a major shareholder of HPX, announced that it had sold more than 35.1 million HPX shares, reducing ownership from 16.54% to 4.997% and officially no longer being a major shareholder at Hai Phat Investment.

In the market, after more than 6 months of suspension of trading since September 11, 2023, HPX shares have been traded again since March 20, 2024, and as of April 19, 2024, they are trading at VND 6,060 per share, 39.4% lower than the par value of VND 10,000 per share.

It is known that HPX will hold its 2024 Annual General Meeting of Shareholders on April 26. Accordingly, the company has prepared documents for the Annual General Meeting of Shareholders on April 26 with many contents of interest.

Accordingly, HPX said that 2024 is predicted to continue to be a difficult year for real estate enterprises, and it is difficult for the company to access capital from credit institutions and issue bonds. Therefore, to increase capital and cash flow for its operations, the company focused on restructuring and handling sources of due bonds, buying back bonds, and repaying credit institutions in the fourth quarter of 2024.

Therefore, HPX announced the submission of a plan to issue shares to increase charter capital to shareholders.

Specifically, HPX plans to issue 315.2 million shares, with a total issuance value at par value of VND 3,152 billion. If the issuance is successful, the company’s charter capital will increase from nearly VND 3,042 billion to nearly VND 6,194 billion.

In which, HPX Invest plans to issue 15.2 million shares to pay dividends in 2023, at a rate of 5%. The enterprise also plans to issue 159.6 million shares to existing shareholders at an offering price of VND 10,000 per share. The estimated exercise ratio is 2:1.

In addition, the enterprise plans to offer 140.3 million shares privately to professional securities investors at an offering price of VND 10,000 per share.

The proceeds from the issuance of shares to existing shareholders and private offerings will be used for specific purposes in order of priority. Specifically:

Firstly, restructure debt and pay the company’s maturing debts. Secondly, invest capital in subsidiaries to restructure debt and pay maturing debts of subsidiaries. Thirdly, invest in developing the company’s projects, including existing projects and finding investments in new projects. Finally, supplement business capital, other necessary and legitimate expenses.

In 2024, HPX expects consolidated revenue and income in 2024 to reach VND 2,800 billion; the parent company will reach VND 2,223 billion; consolidated profit of VND 105 billion, the parent company will reach VND 69 billion.

According to the audited 2023 financial report, HPX’s revenue reached VND 1,680 billion, equivalent to 67.2% of the year plan (VND 2,500 billion); After-tax profit reached nearly VND 135 billion, exceeding 12.4% of the year plan (VND 120 billion) – in the same period, the loss was more than VND 58 billion.

At December 31, 2023, Hai Phat Investment owned only VND 24.711 billion in cash and bank deposits – a sharp decrease compared to the VND 131 billion at the beginning of the year and at the beginning of the year, there was VND 15 billion in term deposits under 3 months, but at the end of the year there was no record. Liabilities decreased sharply from VND 6,009 billion to VND 4,709 billion – of which, short-term borrowings were VND 1,828.4 billion and long-term borrowings were VND 637 billion. Retained earnings after tax increased from VND 154.3 billion to VND 277.86 billion.

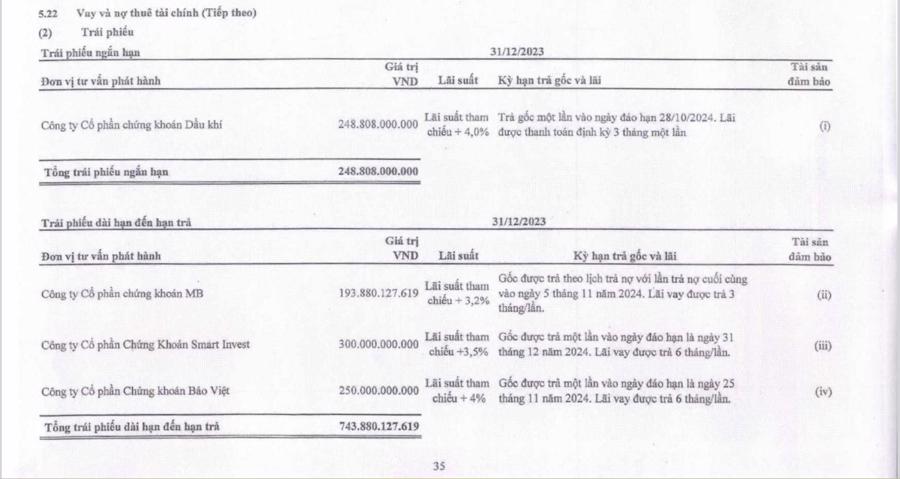

According to the explanatory notes to the 2023 Financial Report, Hai Phat Investment has more than VND 743.88 billion in long-term bonds maturing – of which, on October 28, 2024, it will have to pay VND 248.8 billion in bonds issued by PetroVietnam Securities JSC; On November 5, 2024, it will have to pay VND 193.88 billion in bonds from MB Securities JSC; On December 31, 2024, it will have to pay VND 300 billion in bonds advised by Smart Invest Securities JSC, and finally on November 25, 2024, it will have to pay bonds with a value of VND 250 billion issued by Bao Viet Securities JSC.