Economic experts have stated that during the period of 2023-2024, the global economic situation will continue to fluctuate rapidly, complexly, and unpredictably, impacting and influencing most countries and regions on a global scale.

The “headwinds” from the global economy regarding political conflicts, inflation and high interest rates, declining consumer demand, etc. have caused adverse effects, causing Vietnam’s economy to significantly reduce its growth rate, sometimes dropping to its lowest level in many years. The domestic production and business situation has encountered numerous difficulties, orders have declined massively, many enterprises have ceased operations, and workers have lost their jobs.

According to Dr. Nguyen Dinh Cung, former Director of the Central Institute for Economic Management Research, in the first quarter of this year, according to the General Statistics Office, the economy grew by 5.66%, the highest growth rate in the first quarter since 2020. Many are optimistic about this result, but we cannot be subjective and need to clearly identify where this growth comes from; do these factors have sustainability or not? to thereby have corresponding solutions.

The domestic production and business situation has encountered numerous difficulties, orders have declined massively

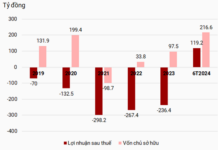

Dr. Nguyen Dinh Cung analyzes: “Social investment is almost very low, not increasing, especially private investment. The private economic sector in the country is really gloomy, indicating low credit growth, low business investment; businesses are withdrawing from the market at an unprecedented rate, businesses entering the market are at an unprecedented low… Although inflation is under control, there are many factors that can increase inflation, firstly, interest rates cannot be reduced further, secondly, exchange rates, thirdly, energy prices, electricity prices will be adjusted; salary increases… a series of factors that will increase costs and have the potential to increase inflation.”

Although many economic indicators have recently shown a recovery trend, there are still many challenges. The recovery of the corporate sector, commercial banks, the real estate sector, and the financial market is still unclear, with many potential risks. “Untangling” the real estate market, corporate bonds, and bad bank debts are prerequisites for a sustainable economic recovery.

Dr. Vo Tri Thanh, Director of the Institute of Strategy and Competitiveness, expressed the viewpoint that it is necessary to revise policies, improve the investment and business environment, reduce procedures and compliance costs for businesses, especially for small and medium-sized enterprises, and micro-enterprises. Together with that, continue policies to stimulate consumer demand, investment, and support business development.

“Along with immediate support, through monetary and fiscal policies, one of the most important things is how to help businesses overcome difficulties, but also gradually catch up with trends. That is the green story, the circular economy story, digital transformation, gradually improving and participating in the supply chain. From that, we can gradually promote innovation and creativity, which is both a short-term policy issue and a long-term issue” – said Dr. Vo Tri Thanh.

Economic experts believe that economic growth drivers are still uneven and uncertain

In the context that the business community in particular and the economy in general are forecast to continue to face many difficulties and challenges in the coming time, it is essential to have effective solutions to renew traditional growth drivers and promote opening up new growth drivers.

Professor Dr. Hoang Van Cuong, member of the National Assembly’s Finance and Budget Committee, said that to promote recovery for business development, institutions play a very important role, so it is necessary to continue to promote reforms to create change. Regarding businesses’ access to capital, according to Professor Dr. Hoang Van Cuong, businesses should not rely too much on capital sources with low interest rates. At the same time, it is considered that accessing capital through the bond market is very important and this market needs to be reformed and innovated. Accordingly, it should not be too tight, nor should it be too loose. This will provide very good support for business resources.

It is clear that the first quarter growth rate is fast, however, the resources of enterprises have been limited over the past many years. Therefore, it is necessary to have support measures, with existing policies, the capital market has had the opportunity to access reasonable prices, but the capital market from corporate bonds also needs to be further cleared. Besides, there must also be a mechanism to ensure safety for individual investors who do not have experience but have the ability to flexibly convert with professional investors when accessing the corporate bond market.

Economic experts also noted that it is necessary to continue decisively in supporting the recovery of growth, especially in supporting sectors and areas of production and business. In particular, it is necessary to pay attention to the domestic production sector; Business environment reform needs to continue to be implemented effectively, more practically. It is necessary to create better and more qualitative fundamental foundations in terms of institutions, infrastructure, and human resources to develop a breakthrough in the coming period.