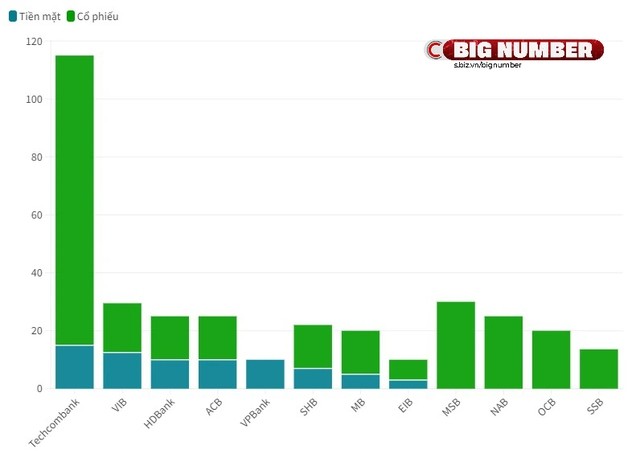

In the race to pay cash dividends this year, SHB and Techcombank are the two banks with the biggest changes in policy.

For Techcombank, this is the first year after 10 years of retaining all profits to consolidate its financial foundation, the bank has decided to pay dividends in both cash and shares.

According to the bank’s management, this will ensure a regular cash flow for shareholders, as they will have direct income from the annual business results, while still optimizing the benefits from the potential price increase.

As a result, at the 2024 Annual General Meeting of Shareholders, the bank’s shareholders approved a plan to distribute a cash dividend at a rate of 15%. The total amount of money provisioned is nearly 5,284 billion VND. In addition to cash, the bank’s shareholders also received a stock dividend at a ratio of 1:1.

Similar to Techcombank, this is the first time SHB has declared a cash dividend since 2013. 10 years ago was the last time this bank conducted a cash dividend distribution at a rate of 7.5%.

In the shareholder consultation document, the bank proposed using 1,831 billion VND to pay cash dividends, at a rate of 5%, and more than 4,000 billion VND to pay stock dividends at a rate of 15%.

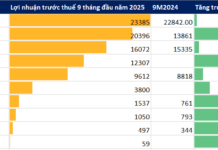

The bank’s dividend payment plan for 2024

The method of distributing profits through both cash and shares is also practiced by 6 other banks, including VIB, VPBank, MB, HDBank, ACB, EIB. If the yield is calculated based on the average share price within 12 months, the dividend yield is estimated to be around 1.5-6%, which is equivalent to the current bank deposit interest rate.

Some other banks, such as SeABank, OCB, NamABank, MSB…, do not distribute cash, but also plan to issue stock dividends at a rate of 13-30%. The nature of paying dividends with shares is to split the shareholder’s shares, but it helps the bank ensure the capital safety ratio and has the potential to expand the credit portfolio room. Paying stock dividends also benefits shareholders who hold on to them and expect a long-term price increase when the bank does business effectively.

In contrast to the above banks, as of April, LPBank is the first bank expected to not pay cash dividends in the next three years in order to improve its financial capacity.

According to Ms. Do Hong Van – Head of FiinGroup Analysis Department at the “Dragon Year Leveraging Interest” conference, in addition to foreign capital inflows, improving asset quality…, the dividend payment story also helps increase cash flow and create price momentum for bank stocks in the near future.

As of March, FiinGroup data shows that the banking industry price index has increased by about 17% since the beginning of 2024, higher than the increase of VN-Index (11%) as well as of some key industries including securities (12%), steel (10%) and real estate (4%).