Amidst the recent market turmoil, which saw the stock market plummet over 100 points last week with no signs of abating, news of the impending launch of the KRX trading system has emerged as a calming balm for investors’ nerves. The market has responded favorably, particularly for brokerage firm stocks, which are expected to reap significant benefits from the successful implementation of the KRX project.

Almost all brokerage stocks have experienced significant gains, with some even hitting ceiling prices. Although they cooled down slightly towards the end of the trading session, increases of over 4% were prevalent across a wide range of stocks. Trading activity was notably vibrant, with foreign entities exhibiting a strong proclivity for purchasing. VND, SSI, and VCI were among the top stocks bought during the April 22nd trading day.

According to the Ho Chi Minh City Stock Exchange (HoSE), brokerage firms will conduct connectivity tests with HoSE on April 24th and 25th. End-of-day data will be transferred to the new trading system on April 26th. Brokerage firms are required to actively prepare data for the Cutover test.

From April 27th to 29th, HoSE will implement the trading system conversion. Brokerage firms will proactively plan and execute preparatory tasks to facilitate a successful deployment. On April 30th, brokerage firms will conduct the Cutover test. The official trading day on the KRX system is set for May 2nd, 2024.

HoSE requires brokerage firms to ensure seamless trading operations on their systems with the exchange’s new system, as on a typical trading day. HoSE leadership emphasizes that brokerage firms must refrain from using automated order entry software and from testing unrealistic or unusual scenarios. In the event that the official deployment is postponed, brokerage firms will need to prepare their systems to resume trading on the current trading platform.

If the new KRX system operates as planned, it will pave the way for the Vietnamese stock market to introduce a wider range of products, attracting investors, particularly foreign entities. This will be a significant step towards upgrading the market from frontier to emerging status.

In preparation for the market upgrade, foreign investors may no longer be required to post 100% collateral prior to trading. This will necessitate that brokerage firms possess ample capital resources to fulfill their settlement obligations. Consequently, most brokerage firms are planning capital increases during the 2024-25 period.

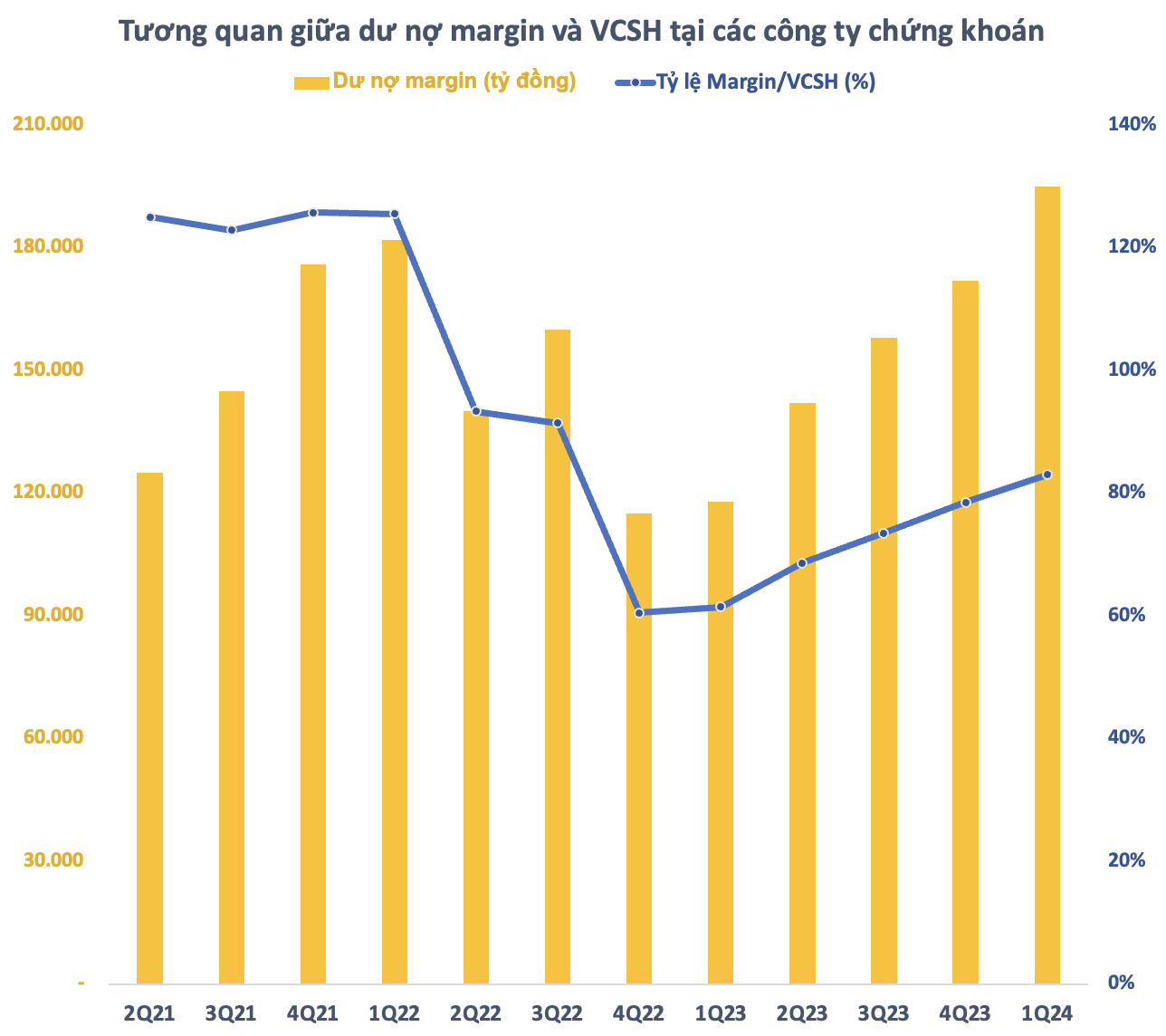

As of the end of Q1 2024, the total equity capital of brokerage firms stood at approximately 235,000 billion VND, reflecting an increase of 16,000 billion VND since the beginning of the year and representing an all-time high. Brokerage firms’ equity capital also experienced substantial growth in the first quarter, driven by strong earnings performance and capital raising activities. This has provided brokerage firms with ample liquidity to extend margin loans.

On March 31st, 2024, the outstanding margin loan balance at brokerage firms had increased by an estimated 23,000 billion VND compared to the end of 2023, reaching approximately 195,000 billion VND. This represents a record high in the history of the Vietnamese stock market, surpassing even the levels seen in Q1 2022 when the VN-Index reached its historical peak of 1,500 points.

Regulations stipulate that brokerage firms cannot extend margin loans exceeding twice their equity capital at any given time. With the Margin/Equity ratio currently at around 83%, brokerage firms estimate that they have up to 277,000 billion VND available to provide margin loans to investors in the near future. It is important to note that this figure is a theoretical calculation, and in practice, the market-wide Margin/Equity ratio has never reached the 2x threshold, even during periods of intense trading activity.