Illustrative photo

The exchange rate of USD/VND in the domestic market has been continuously escalating in the first months of 2024, especially in recent days. Updated at noon on April 22, the USD exchange rate listed at banks continued to surge to the ceiling of 25,485 VND. This is the sixth consecutive session witnessing the price of USD at banks increasing to the maximum allowable amplitude, despite the fact that the State Bank has continuously raised the central exchange rate (pulling the exchange rate ceiling up).

Since the beginning of this year, the price of USD at Vietcombank – the bank with the largest foreign exchange trading scale in the system – has increased by nearly 1,100 VND in both buying and selling directions, equivalent to a devaluation of VND by 4.4 – 4.6%. In the last week alone, the price of USD at this bank has increased by 293 VND, equivalent to an increase of 1.2%.

In line with the trend in the official market, the price of USD in the free market has increased sharply to around 25,900 VND, about 100 VND higher than yesterday. Specifically, the buying price at popular foreign exchange points is 25,780-25,800 VND, while the selling price is 25,870-25,900 VND.

Faced with the above development, the SBV has been coordinating to synchronously deploy its tools to curb the exchange rate momentum.

The strongest measure that the Operator is currently implementing is the open sale of foreign exchange intervention to banks with negative foreign currency balances to bring foreign exchange balance to 0, with the intervention price at the rate of 25,450 VND. Accordingly, in the trading session on April 22, despite increasing the central exchange rate by 12 VND, the Operator still kept the selling price of USD intervention at 25,450 VND, which was 35 VND lower than the ceiling that banks are allowed to trade.

“This is a very strong measure by the SBV to ease market sentiment, ensure market supply, ensure a smooth supply of foreign currency, and fully meet the legitimate foreign currency needs of the economy.”, said Mr. Pham Chi Quang at the Press Conference on the Results of Banking Operation in the First Quarter of 2024 on April 19.

Not only being ready to meet the foreign exchange demand for the banking system, the SBV also continues to maintain regular Treasury bill auction activities with gradually increasing interest rates in order to control and raise the interest rate floor of VND in the interbank market.

In the session at the end of last week (April 19), all 5/5 participating members won the Treasury bill auction with a total volume of 4,250 billion VND and an interest rate of 3.73% – the highest level since the beginning of the cycle. and the highest level since the issuance ended in mid-March 2023.

Analysts believe that maintaining the Treasury bill auction channel will help the SBV establish a solid price floor for interbank interest rates through Treasury bill auction interest rates. Accordingly, after absorbing a large amount of excess liquidity, the SBV continues to conduct new Treasury bill issuance rounds to send a message to the market that the Operator is willing to offer an attractive enough rate for banks with excess liquidity to seek the Treasury bill channel instead of lending at low interest rates on interbank markets, thereby making it difficult for interest rates on the interbank market to decline deeply.

For banks in need of support, the SBV is ready to lend through the OMO channel, but these banks must accept a high and fixed interest rate of 4%/year.

The parallel use of the two Treasury bill and OMO instruments serves the dual purpose of both ensuring liquidity for the banking system to maintain a low interest rate level in the market 1, and at the same time reducing pressure on the exchange rate by narrowing the USD – VND interest rate gap in the interbank market.

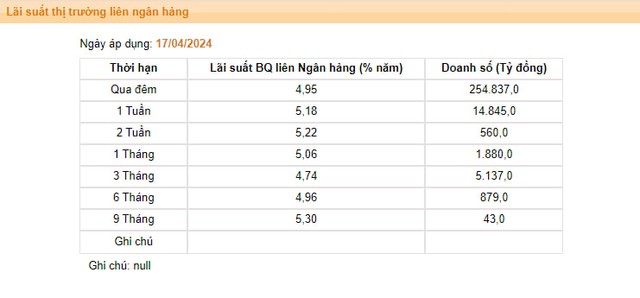

In fact, the latest data released by the SBV shows that the average interbank VND interest rate at the overnight term (the main term accounting for about 90% of transaction value) in the session on April 17 increased to 4.95%/year – the highest level since mid-May 2023.

Along with the overnight term, interest rates for most other key terms have also increased to the 5%/year range and reached the highest level in nearly a year, such as: the 1-week term is 5.18%; the 2-week term is 5.22%; the 1-month term is 5.06%, the 3-month term is 4.74%/year.

Source: SBV

According to Mr. Pham Chi Quang, the SBV has been closely monitoring the exchange rate and has taken measures to ease market pressure since March, through the issuance of Treasury bills to neutralize excess money in the market. “SBV continuously issues Treasury bills to absorb excess VND, reduce pressure on the exchange rate, and keep the exchange rate fluctuating within the allowable range, within the SBV’s management capacity,” he said.

The simultaneous implementation of both measures to directly affect the supply and indirectly through Treasury bills shows that the SBV has grasped the fundamental causes of exchange rate fluctuations and has specific countermeasures for this issue.

Sharing at the recent press conference, Deputy Governor Dao Minh Tu said that all the causes of the exchange rate increase have been assessed by the SBV and adjusted by its tools, including the central exchange rate tool and as well as market management…, in order to ensure a suitable supply and demand of foreign currency. And if necessary, the SBV will use foreign exchange reserves to intervene in the exchange rate, ensuring the set target.

“Vietnam’s exchange rate management approach is very flexible, although we continue to stabilize the exchange rate for the economy but not fix it, but rather fluctuate it to suit the situation and avoid strong impacts from the world. We are also ready to intervene if the exchange rate continues to have adverse effects,” said Mr. Tu.