FiinTrade’s latest update showed that by April 23, 2024, 441 listed companies representing 28% of the capitalization on the three exchanges had announced their financial reports for the first quarter of 2024, with total profit after tax continuing to increase compared to the same period in the third consecutive quarter, but the growth rate is slowing down by 19.7%, lower than the 48% increase in Q4 / 2023.

This profit increase was contributed by both the Financial sector, which increased by 17.5% compared to the same period, and the Non-Financial sector, which increased by 24.6%.

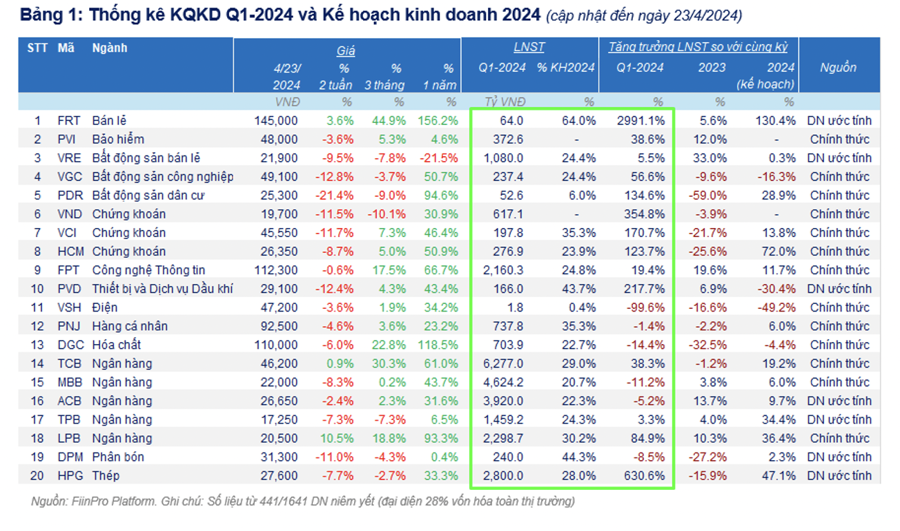

It should be noted that this is a growth on a low base in the same period of 2023, in which: Securities and Steel recorded a strong recovery in profit in the first quarter of 2024 compared to the deep decline in the same period, respectively increasing by +157,4% and 606,1% compared to the same period. However, looking ahead to the coming quarters, businesses in these two industries are planning cautiously for 2024.

For Banks, the growth of 11 banks increased by 10.5% led by TCB and LPB while MBB, ACB and VIB estimated that profit would decline. Of which, TCB recorded VND 7.8 trillion in pre-tax profit, an increase of nearly 39% compared to the same period in 2023. This is also the record pre-tax profit that TCB has achieved.

Information Technology is the only industry maintaining double-digit profit growth for 5 consecutive quarters thanks to FPT’s positive business results with revenue and EBIT margin both increasing. In the first quarter, FPT Corporation recorded a revenue of VND 14,093 billion, pre-tax profit of VND 2,534 billion, respectively up 20.6% and 19.5% over the same period last year. Profit after tax for shareholders of the parent company reached VND 1,798 billion, an increase of 20.4% compared to the first quarter of 2023. This is also the company’s highest profit quarter in history.

In the Export group, Rubber is one of the few industries dependent on commodity prices that has high profit growth in the first quarter, up 24%. The export rubber price increased by +5.3% in the first 3 months of the year, which is the main catalyst for the profit growth of this group (DRI, TRC).

On the contrary, profit continued to decrease compared to the same period in the Seafood, Textile, Chemical groups, contrary to expectations of recovery (which was the driving force supporting stock prices in these industries in the recent time). With Chemicals (DGC), both revenue and profit margin declined, causing profit to hit a new low in the first quarter of 2024.