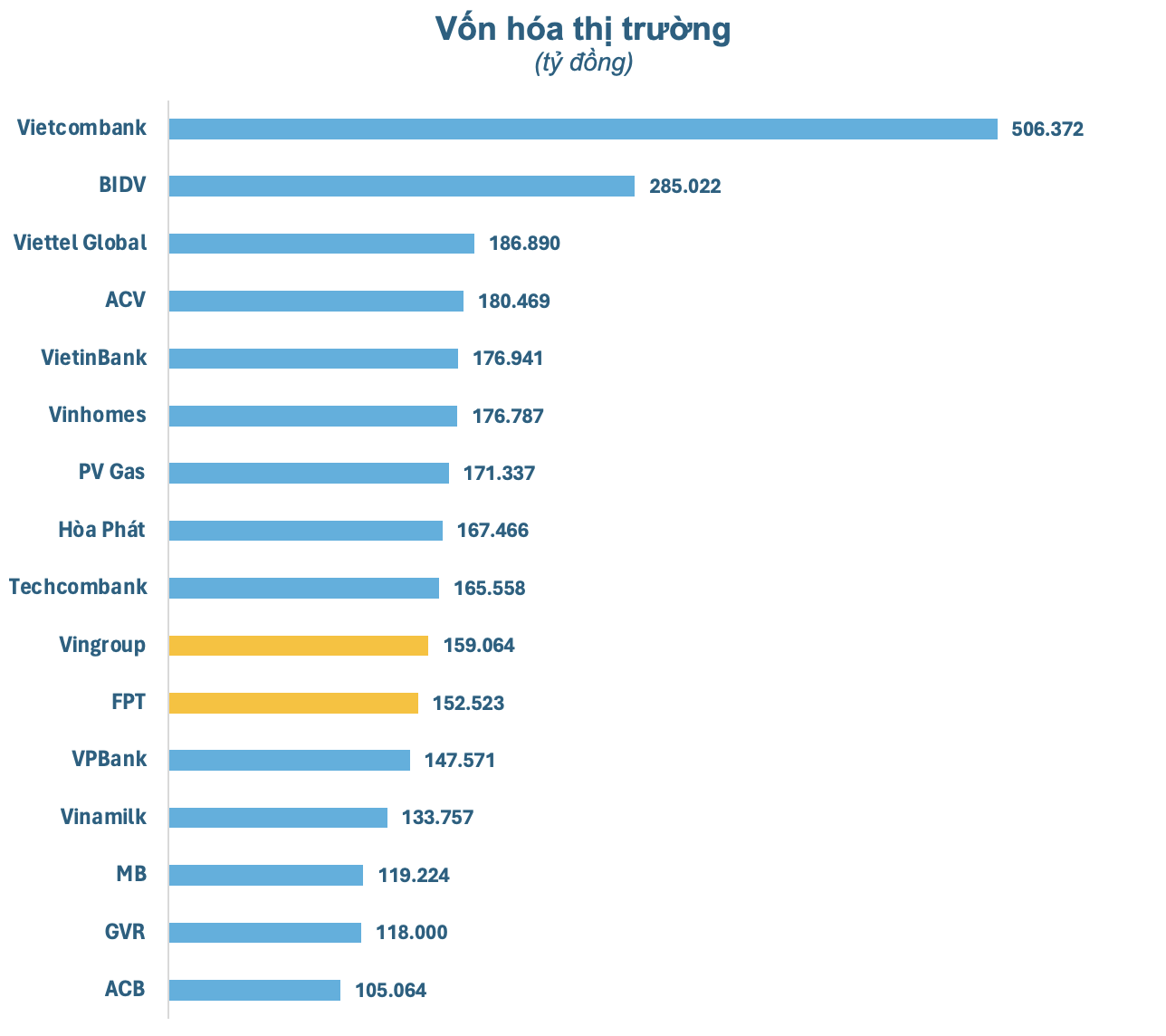

Following the partnership with NVIDIA, FPT stock unexpectedly had a limit-up session to establish a new peak of 120,100 VND/share in the session on April 24th. Its market capitalization also set a record of 152,523 billion VND, an increase of over 30,000 billion (equivalent to 25%) compared to the beginning of 2024. This breakthrough helped FPT significantly narrow the gap between it and the top 10 market capitalizations on the stock exchange.

Compared to the company ranked 10th in the list of most valuable enterprises in the market, Vingroup (VIC), FPT’s market capitalization is only 6,500 billion less, equivalent to about 4%, which is not equivalent to a limit-up session. It is possible that there will be a change in the order of capitalization between the two leading private corporations in Vietnam in the near future.

FPT was once the most valuable name on the stock exchange in 2006. However, this leading technology corporation in Vietnam gradually lost its position when the wave of state-owned enterprises and a series of private “blockbusters” were listed on the stock exchange from 2007 to 2008, of which Vingroup was one of the most notable.

Vingroup’s predecessor was Technocom Group, which was established in 1993 in Ukraine. In the early 2000s, Technocom returned to Vietnam, focusing on investment in tourism and real estate, with the two initial strategic brands being Vinpearl and Vincom. In January 2012, Vincom and Vinpearl merged and officially operated as a corporation named Vingroup Corporation – JSC.

Since its listing on HoSE in September 2007, Vingroup has always been among the most valuable enterprises on the stock exchange. In fact, Mr. Pham Nhat Vuong’s corporation maintained the top position in the market for many years, with its market capitalization reaching over 20 billion USD at one point in April 2021. At that time, Vingroup’s capitalization was eight times that of FPT.

However, the situation has changed rapidly since the end of 2021 when the industrial-technological sector was oriented to become Vingroup’s spearhead but has not brought about much profit, even though VinFast has made certain marks. To date, the capitalization of this corporation is only about one-third of its peak.

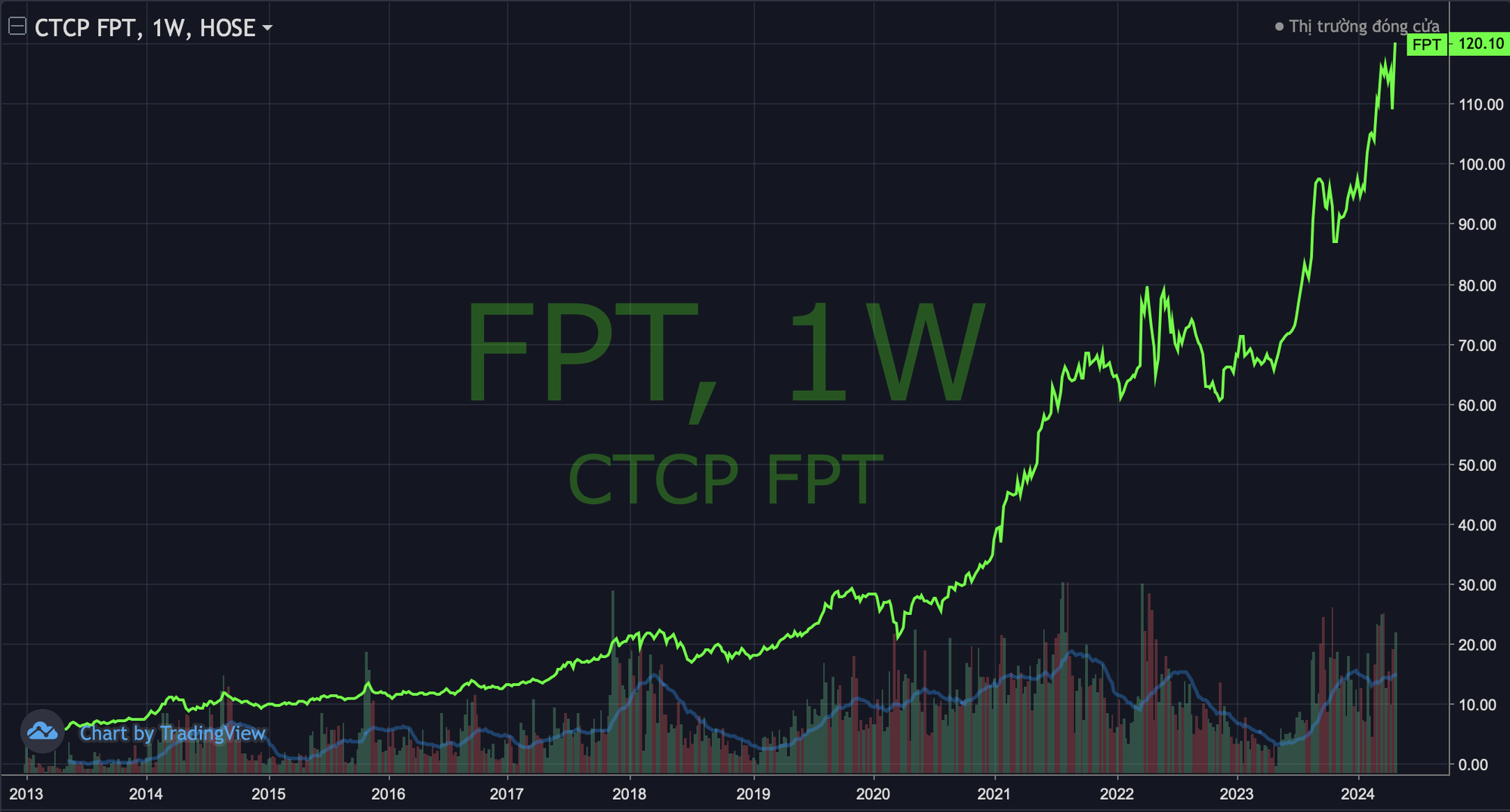

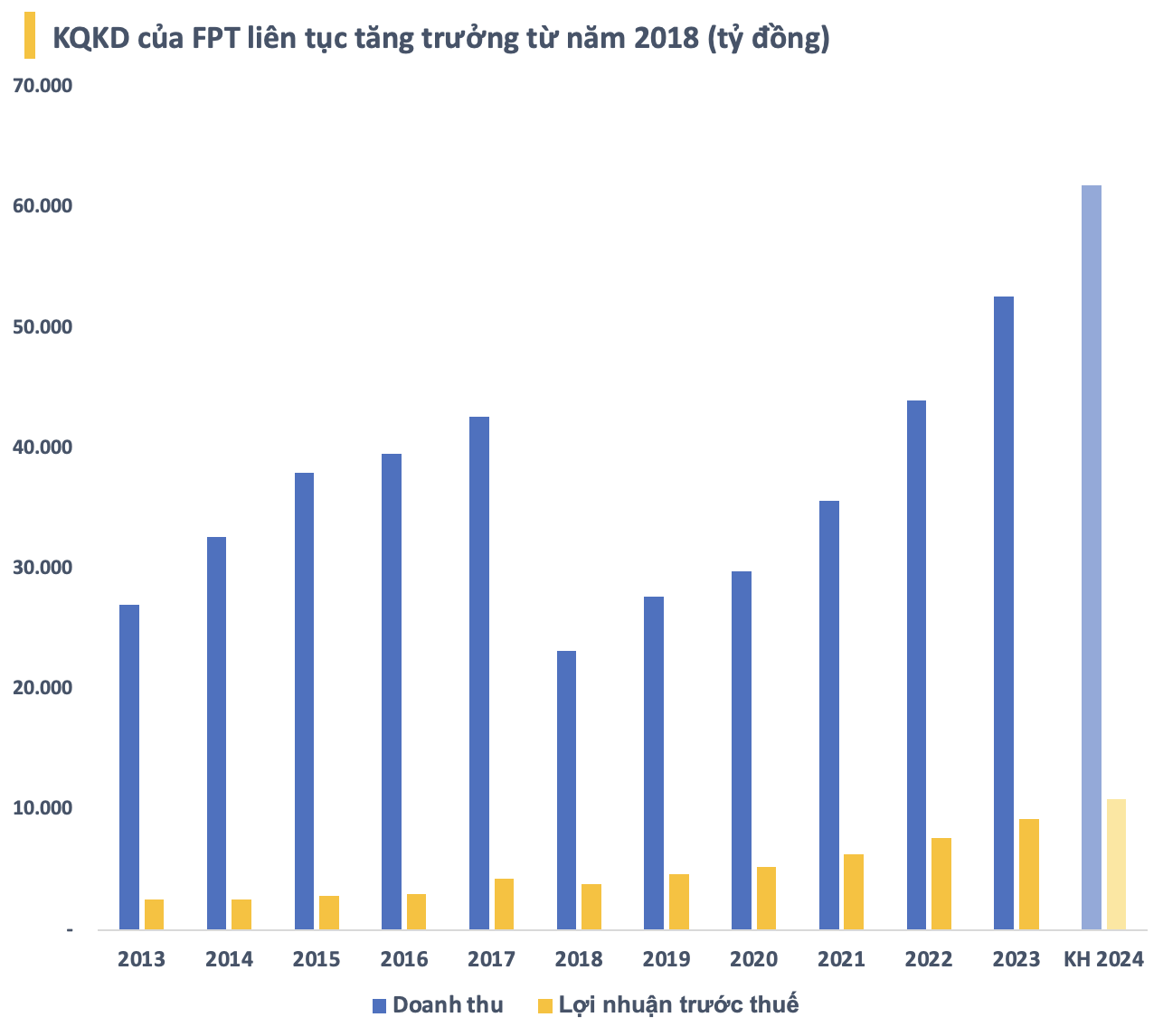

On the contrary, FPT has been growing continuously. FPT is one of the most consistently growing stocks on the Vietnamese stock market. It is worth noting that over the past decade, this stock only experienced one year of no growth, which was 2018. Compared to 10 years ago, FPT has increased by more than 11 times, equivalent to an average return of 27% per year.

The driving force behind FPT’s continuous stock growth is its stable and long-term business growth. Since restructuring the corporation’s operating model in 2018, FPT has continuously achieved strong growth in both revenue and profit year after year. In 2023, the corporation recorded revenue of over 52,600 billion VND, and pre-tax profit of 9,203 billion VND, both increasing by 20% compared to the previous year and being record highs since its operation.

In 2024, FPT set a revenue target of 61,850 billion VND (~2.5 billion USD) and a pre-tax profit of 10,875 billion VND, both increasing by about 18% compared to the results achieved in 2023. If this plan is completed, this technology corporation will continue to break last year’s record. In the first quarter of this year, FPT completed about 23% of the set plan.

However, it should be noted that, after the rapid increase, FPT shares may face strong profit-taking pressure. On the contrary, Vingroup’s VIC shares may attract money as they have been deeply discounted from their peak, particularly if there are more positive information flows from VinFast’s, Vinhomes’, or Vinpearl’s operations or listing plans. Therefore, the capitalization gap between FPT and Vingroup seems very small but it may not be easy to catch up in the short term.