Proprietary trading accounts for 60% of SSI’s total profit. SSI’s proprietary trading includes three main areas: capital raising, equity trading, and derivatives trading. Equity accounts for 40% of profits, while derivatives and capital raising account for 15% each.

2024, TARGET PROFIT OF 339.8 BILLION VND

On the afternoon of April 25, 2024, SSI Securities Corporation (code SSI) successfully held its annual General Meeting of Shareholders 2024 at Thong Nhat Palace, Ho Chi Minh City.

Reporting to shareholders on the company’s operations in 2023, Mr. Nguyen Hong Nam, General Director of SSI, stated that in 2024 the stock market will continue to rise with a forecast of an average profit growth of 14% for listed companies compared to 2023. The capital of individual investors will return to the market.

In addition, the KRX trading system will be put into operation and positive changes are expected from the determination to upgrade the stock market in 2024. The inflow of foreign investors may not recover immediately, but at least the selling pressure from foreign investors will not be as strong as last year.

VN-Index is forecasted to reach 1,300 points in 2024, with the market’s average liquidity reaching 18,000 – 20,000 billion VND/day.

Nguyen Hong Nam, General Director of SSI.

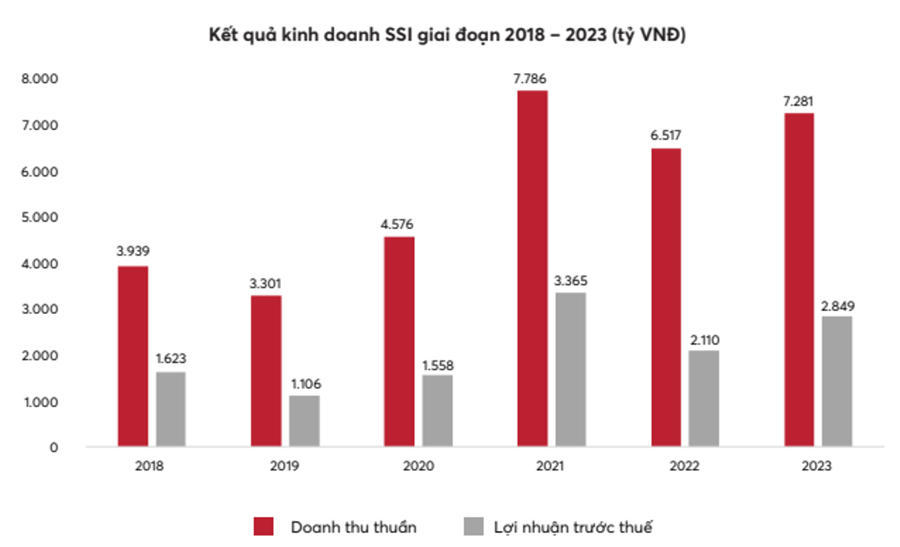

In anticipation of positive changes expected from the determination to upgrade the stock market in 2024, SSI sets a target for consolidated revenue of 8,112 billion VND, an increase of 11%; consolidated profit before tax of 3,398 billion VND, an increase of 19% compared to the previous year.

In addition, SSI will also continue to implement the share offering and issuance plan approved by the General Meeting of Shareholders in 2023. At the end of December 2023, SSI shareholders approved two capital increase options, including issuing more than 302.2 million bonus shares to increase capital at a ratio of 100:20 and offering over 151 million shares to existing shareholders at 15,000 VND/share at a ratio of 100:10. In total, SSI will issue more than 453.3 million new shares. Accordingly, SSI’s charter capital is expected to increase from over 15,111 billion VND to nearly 19,645 billion VND, consolidating its position as number one in terms of capital in the group of securities companies.

In the discussion, in response to a question from an investor about the disclosure of proprietary trading figures on the price list, Mr. Nguyen Duc Thong, Deputy General Director of SSI, believes that investors should not follow proprietary trading figures too much, sometimes securities companies do business for ETF, hedging for CW. Therefore, data on proprietary trading can be useful but is not a compass for the market.

Ms. Nguyen Vu Thuy Huong, Director of the Senior Block in charge of the Investment Block and the Capital Source & Financial Business Block SSI, said that proprietary trading accounts for 60% of total profit. SSI’s proprietary trading consists of three main areas: capital raising, equity trading, and derivatives trading. Equity accounts for 40% of profits, while derivatives and capital raising account for 15% each. In 2023, the profit margin of the equity segment increased by 20%, higher than VN-Index. SSI has four main business segments: Retail, capital raising, investment banking (IB), and wholesale (SSIAM and TO Institutions). The profit plan for 2024 will increase by 19%, then the company plans for all of these business segments to increase by 19%.

Ms. Vu Ngoc Anh, Director of SSI’s retail segment, provided information about SSI’s margin debt plan, which will increase to 20,000 billion VND by the end of this year. In addition to providing services, SSI will also manage risks for customers. In the next 10 years, there will be two ongoing trends: the new rich (Gen X, Gen Y) and the transfer of assets from parents to children. When this trend occurs, the demand for asset management will grow. For Vietnam, finance companies, banks, and securities companies are all interested in this segment. SSI identifies this as a necessary demand and has a strategy. The company has completed phase 1 of its asset management development strategy. SSI also has its own products such as iFollow.

Ms. Nguyen Ngoc Anh, General Director of SSIAM, said that the fund management segment has 90,000 individual and institutional clients. The company also has an investment trust for high-end clients, a minimum of 50 billion VND/client. These are the first steps for the asset management segment.

Regarding meeting the requirements to connect to SSI’s KRX system, Mr. Nguyen Duc Thong said that SSI has undergone several testing phases and there are no problems. The staff is working day and night for the April 30 test. KRX is a premise for developing new products for the market: Day trading, put options, and call options. Therefore, in the long run, KRX will change the face of the stock market.

Regarding the security of the information technology system after VnDirect’s incident, Mr. Nguyen Duy Hung, Chairman of SSI’s Board of Directors, shared that SSI cares about security to the extent that many customers and employees feel like they care too much. Requests to change passwords regularly, having multiple cameras at various points… The system must have someone monitoring it to detect strangers entering. If a stranger enters the house, we must eliminate them immediately. If unfortunately the system has a problem, we must be able to start the backup system and how long it will take to recover.

Regarding SSI’s margin lending interest rate, Mr. Hung shared that SSI’s interest rate for customers is always lower than that of large companies. The capital for margin lending consists of two parts: self-owned and borrowed. SSI is always able to borrow at a low interest rate.

SUCCESSOR PREPARATION

At the end of 2023, SSI’s total assets were recorded at 69,241 billion VND, an increase of 32.6% compared to 2022, continuing to maintain the number one position in the securities industry in terms of asset size.

Net revenue reached 7,281 billion VND, an increase of 11.5%; profit before tax reached 2,849 billion VND, an increase of 35% compared to 2022, exceeding 105% of the revenue plan and 112% of the profit plan set by the General Meeting of Shareholders.

A major contribution to SSI’s profit was its securities brokerage activities, reaching more than 1,500 billion VND, a decrease of 200 billion VND compared to the same period last year in the context of the general stock market having many fluctuations.

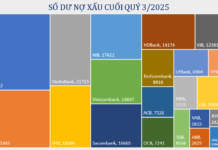

Total outstanding margin loans and advances on sale of securities reached 15,134 billion VND by the end of the year, an increase of 37% compared to the beginning of the year.

Regarding senior personnel, Mr. Nguyen Duy Hung said that according to the provisions of the Enterprise Law (effective in 2021), the general director and the chairman of the Board of Directors are not related persons.

However, the current Chairman of the