Recently Announced Companies’ Financial Statements for Q1 2024:

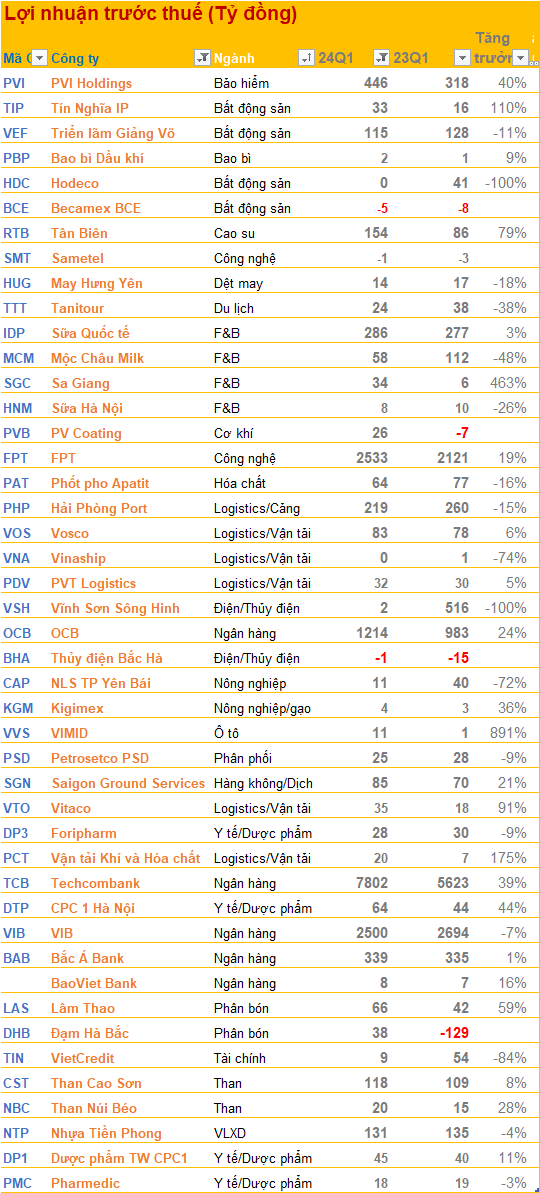

Orient Commercial Joint Stock Bank (OCB) recorded a total operating income of 2,287 billion VND, an increase of 9% year-over-year, and a pre-tax profit of 1,214 billion VND, an increase of 23% year-over-year.

Hodeco (HDC) reported a 52% year-over-year decline in net revenue for Q1, reaching over 85 billion VND. Cost of goods sold decreased less, resulting in a gross profit for Hodeco of 14.7 billion VND, an 81% decrease year-over-year. Hodeco’s pre-tax profit was only 115 million VND, a 99.7% decrease compared to Q1 2023, while its after-tax profit reached 1.1 billion VND, a 96% decrease.

The company attributed the significant decline in net revenue in Q1 2024 to the overall challenges in the real estate market, which also affected the company’s sales activities during the quarter.

IDP International Dairy Products JSC (IDP) reported a pre-tax profit of 286 billion VND in Q1 2024, a 3% increase year-over-year. Moc Chau Milk JSC (MCM) experienced a 48% year-over-year decline in pre-tax profit for Q1, reaching 58 billion VND, while Hanoi Milk JSC (HNM) also saw a 26% decrease.

Phosphate Apatite JSC (PAT), a subsidiary of Duc Giang Chemicals Group (DGC), recorded a 16% year-over-year decrease in pre-tax profit for Q1, reaching 64 billion VND.

Ha Bac Fertilizer JSC (DHB) reported a pre-tax profit of 38 billion VND, while it incurred a loss of 129 billion VND in the same period last year.

Vietnam Exhibition Fair Centre JSC (VEFAC – VEF) released its financial statements for Q1 2024, showing a revenue of 268 million VND, an 88% decrease year-over-year, while its pre-tax profit was 115 billion VND, an 11% decrease year-over-year. During the quarter, VEFAC did not generate revenue from its exhibition and fair activities. The company’s profit primarily came from financial activities rather than its core business operations. In the recent quarter, VEFAC’s financial revenue reached 125 billion VND.

VEFAC is known as a subsidiary of Vingroup (stock code: VIC), with the latter owning over 83% of its shares. The company is also recognized as the owner of the “golden land” at 148 Giang Vo and the 1.5-billion-USD super project in Dong Anh.

With a 27% decrease in revenue, Tien Phong Plastic (NTP) reported a 4% year-over-year decline in pre-tax profit for Q1, reaching nearly 131 billion VND.

Lam Thao Super Phosphate and Chemicals JSC (LAS) recorded a revenue of 1,491 billion VND for Q1, a 19% increase year-over-year, and a pre-tax profit of nearly 66 billion VND, a 59% increase year-over-year.

Bac Ha Hydropower (BHA) reported a pre-tax loss of 1.5 billion VND for Q1, compared to a loss of over 15 billion VND in the same period last year.

Vinh Son – Song Hinh Hydropower (VSH) reported a 99.9% year-over-year decline in pre-tax profit for Q1 2024, reaching only 2 billion VND. The significant revenue decrease was the primary factor behind the company’s plummeting profit.

Tin Nghia Corporation (TIP) reported a pre-tax profit of 33 billion VND for Q1 2024, a 110% increase year-over-year.

VietCredit (TIN) recorded a pre-tax profit of 8.8 billion VND, an 84% decrease year-over-year. However, this marked the second consecutive quarter that the company reported a positive profit after a series of previous losses.

The management of Vincom Retail (VRE) estimated its revenue for Q1 2024 to be 2,250 billion VND, with rental revenue accounting for about 80%, real estate sales revenue contributing 10-12%, and the rest coming from other sources. Net income is expected to reach over 1,080 billion VND – a 6% increase year-over-year.

MSB estimated its pre-tax profit to exceed 1,500 billion VND, slightly higher than the previous year. CIR decreased to 33%, overall NIM was 3.87%, CASA increased by 14.64% and accounted for 29% of total deposits, indicating growth compared to the same period last year.

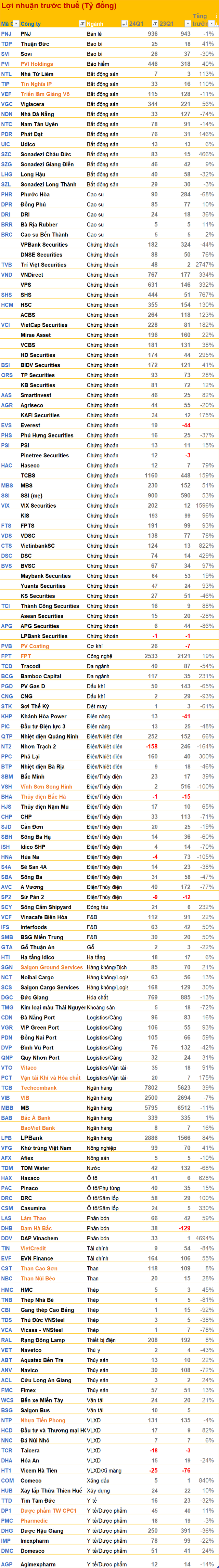

Companies that have announced their financial statements for Q1 2024