Mr. Dao Minh Tu, Deputy Governor of the State Bank of Vietnam

Mr. Dao Minh Tu, Deputy Governor of the State Bank of Vietnam (SBV), stated during the 2024 Vietnam Economic Forum organized by Nguoi Lao Dong Newspaper on April 25 that a higher USD price on the black market compared to banks is a typical phenomenon.

According to the Deputy Governor, the difference in USD prices prompts the SBV to intervene with the aim of stabilizing the foreign exchange market rather than maintaining a higher exchange rate in banks than outside of banks.

Amidst current circumstances, foreign exchange supply has become tighter than before, as exchange rates rise, coupled with psychological factors leading to an increase in the USD exchange rate on the black market.

“While exchange rates have recently experienced fluctuations, the central bank exchange rate, particularly the core exchange rate, is anticipated to maintain or gradually decrease, leading to a reduction in the USD exchange rate on the black market. This is a natural occurrence in the economy,” affirmed the Deputy Governor.

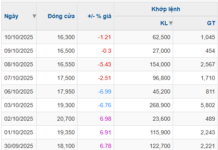

As previously reported, the past few weeks have witnessed considerable fluctuations in the free market (black market) USD exchange rate.

The peak was reached on April 22, when the USD exchange rate on the free market surged to between 25,780 and 25,800 VND for buying and 25,870 to 25,900 VND for selling. This represented a difference of around 400 VND compared to the USD exchange rate at banks.

In line with the cooling down of the exchange rate on the official market, the free market USD exchange rate has become less volatile in recent days. Multiple foreign exchange points in the unofficial market have lowered their USD exchange rate by 150-200 VND in the past two days. The current buying rate is approximately 25,600 VND, while the selling rate is around 25,700 VND.

Addressing the 2024 Vietnam Economic Forum, Mr. Dao Minh Tu, Permanent Deputy Governor of the State Bank of Vietnam, highlighted exchange rates as a crucial economic factor whose ineffective management can impact inflation. Consequently, the SBV will prioritize exchange rate management and control in the coming period.

“We stabilize exchange rates rather than fixing them, ensuring that the foreign exchange status is not in deficit,” emphasized the SBV leader.

According to Mr. Tu, the SBV has implemented solutions to achieve this target, such as regulating the money supply to ensure harmony, controlling interest rates to correspond with exchange rates, and calculating an appropriate level to attain both objectives.

The SBV leader indicated that the core exchange rate is being controlled to combat speculative foreign exchange hoarding. The SBV has strengthened tools to maximize benefits for businesses, with administrative measures, such as mandatory foreign currency sales, serving as a last resort. Although these measures are still in their initial stages of implementation.

“We sincerely hope that businesses and the economy do not harbor expectations or engage in foreign exchange hoarding and speculation, which can strain the economy’s foreign exchange balance and hinder businesses and commercial banks from supporting the economy effectively,” stated Mr. Tu.

Regarding exchange rate trends, the Deputy Governor acknowledged recent fluctuations and the Vietnamese Dong’s depreciation against the beginning of the year. In 2023, the Vietnamese Dong depreciated by approximately 2.6%, demonstrating substantial efforts compared to neighboring countries.

Mr. Tu mentioned that the SBV announced during its 2024 year-end press conference that it would utilize the foreign exchange reserve fund for intervention sales if necessary to stabilize exchange rates. Currently, the core exchange rate has decreased by 4.8% compared to 2023. Nonetheless, this depreciation is still favorable when compared to various markets, such as Taiwan (China) with a depreciation of 5.96% and higher depreciation rates in Thailand, Japan, South Korea, and Switzerland.

“Given the economy’s openness, exchange rate management is currently critical, and the SBV will manage exchange rates reasonably,” said the Deputy Governor.

Mr. Tu indicated that the SBV anticipates a reduction in FED interest rates, but no specific policy information is available at this time. The USD is presently experiencing its highest appreciation in history. This is attributed to declining investment demand, protectionist policies in major countries, decreasing global consumer demand, which impacts Vietnamese businesses’ exports, escalating shipping costs increasing product prices, the impact of raw material prices in other countries, and the fear of rising tensions in the Middle East region pushing up gold prices. Gold prices have surpassed USD 2,400 per ounce, influencing exchange rates and directly impacting Vietnam’s import and export businesses.

Additionally, a rapid decrease in Vietnamese Dong interest rates has created an imbalance between Vietnamese Dong and USD interest rates, contributing to the rise in exchange rates. The import and export sectors are relatively active, resulting in significant foreign exchange expenditures on imports.