Online

The 2024 Annual General Meeting of Shareholders of VietABank was held on the morning of April 26 in Hanoi. Photo: The Manh

|

Bonus shares of nearly 211 million, increasing capital to 7,505 billion

One noteworthy proposal is that the VietABank Board of Directors proposes that shareholders approve the plan to increase charter capital in 2024 by issuing shares from the owners’ equity (bonus shares).

Specifically, the Bank plans to issue a maximum of nearly 210.6 million bonus shares at a ratio of 39% (owning 100 shares will receive an additional 39 new shares). These shares are not subject to transfer restrictions. The capital source used from owners’ equity includes undistributed profits after full allocation to funds (nearly 1,970 billion VND) and additional charter capital reserve fund (nearly 164 billion VND), based on the audited 2023 financial statements.

If the bonus share issuance is completed, VietABank’s charter capital will increase from nearly 5,400 billion VND to over 7,505 billion VND. The expected issuance time is within 2024, after approval from the SBV and the SSC.

VietABank’s management said that the additional capital will help the Bank improve its financial capacity, scale, and quality of income-generating assets, enhance its investment and business capabilities. At the same time, upgrade and modernize the information technology system to serve the strategy of expanding the operating network. In addition, enhance competitiveness, increase resilience to operational risks, and ensure safety indicators.

In addition, VietABank proposes that the GMS approve the listing of bonds issued by the Bank to the public. At the same time, it will approve the investment policy of contributing capital, purchasing shares, establishing and acquiring subsidiaries and associated companies.

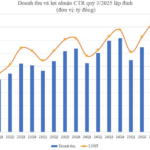

Pre-tax profit target increases by more than 15%, listing on HOSE/HNX

In 2024, VietABank sets a pre-tax profit target of 1,058 billion VND, an increase of 15.4% compared to the 2023 realization. The Bank sets a target for total assets at the end of the year to increase by 4.3%, reaching 116,988 billion VND. Customer deposits and issuance of valuable papers will increase by 5.6% to 92,027 billion VND; outstanding loans will increase by 12.3%, reaching 77,741 billion VND and will be adjusted according to the SBV’s assigned targets. The bad debt ratio is controlled below 3%.

|

VietABank’s pre-tax profit period 2010-2023 |

The VietABank Board of Directors will submit to the GMS for approval the listing of all outstanding shares of VAB (after approval by State Management Agencies) on the Stock Exchange when market conditions are favorable.

The choice of listing on the Ho Chi Minh City Stock Exchange (HOSE) or the Hanoi Stock Exchange (HNX) will be decided by the Board of Directors. In addition, the Board of Directors will be authorized for other related work of listing on the stock exchange.

The management of VietABank said that the purpose of listing VAB shares on the Stock Exchange is to enhance prestige and facilitate the trading of VAB shares for shareholders and attract foreign investment in the time to come.

In addition, the Bank is also implementing the Government’s policy on the Project “Restructuring the system of credit institutions associated with bad debt handling for the period 2021 – 2025”, by 2025, completing the listing of shares of JSBs on the Vietnamese stock market.

The GMS approved the resignation of Mr. Hoang Vu Tung and elected Mr. Tran Ngoc Hai as a member of the Supervisory Board to replace Mr. Tung. The number of members of VietABank’s Supervisory Board after the GMS is 3.

Discussion:

Why is the compensation plan increasing from 9 billion VND to 12 billion VND, an increase of 30%, while business targets do not plan for such a growth rate?

Mr. Phuong Thanh Long – Chairman of VietABank’s Board of Directors: The remuneration for VietABank’s Board of Management is quite low compared to the general market level, in which it has not increased for many years. The increase in remuneration is based on the contribution of effort and time, but in fact, how much it will increase will be discussed again, it may not increase by 30% as proposed, depending on the development of the Bank.

I hope the shareholders will sympathize with the Bank. In the market, many banks often have fluctuations in senior staff, and it is also very difficult to find staff, and in order to retain staff, benefits and salaries must be provided to motivate them and foster their commitment.

Does VietABank have a retail banking strategy?

Chairman Phuong Thanh Long: The transformation has been determined by VeitABank but at a moderate rate, the Bank has a strategy to provide services to businesses, including retail services, with individual customers who have needs to buy a house, borrow for small business, and consumption. The target for the transformation is from 10% to 15%, about 1,500-2,000 billion VND/year. Currently, VietABank is also considering the work that should be done to allocate risks and optimize benefits for the Bank.

In 2025, strategic investors will be sought

Does VietABank plan to increase capital from private equity issuance?

Chairman Phuong Thanh Long: VietABank’s capital is currently in the top 20 on the listed banking market. This year, the Bank plans to increase capital to over 7.5 trillion VND on the basis of issuing bonus shares. As for the plan to increase capital for non-public or existing shareholders, it is necessary to discuss and study further. With the current economic situation, in 2024, VietABank has not yet proposed this option, but in the 2025 roadmap, the Bank will try to find strategic investors, especially foreign partners, and propose to the GMS.

How is bad debt changing and how is it prevented?

Chairman Phuong Thanh Long: VietABank’s bad debt ratio is low, the absolute figure is small compared to the scale of the Bank and the industry as a whole. All customers have secured assets, the mortgages are real estate, VietABank always ensures to control the handling of bad debts, it can be fully implemented even if there are disputes that need to be handled. The issue of bad debt must be considered on a case-by-case basis for each customer.

What competitive advantages does VietABank identify to attract CASA?

Mr. Nguyen Van Trong – Acting General Director: The Board of Directors always assigns the Executive Board to promote CASA growth. In previous years, VietABank’s technology was quite old, from 2022 to the present, the Bank has completed upgrading core banking and currently, the technology system is the latest version, which helps to compete in relation to account opening, in Before there are 16 digits in the bank account number, it is now only 8 digits according to the date of birth, which helps to increase beautiful account numbers for businesses and customers.

From 2023 to the present, although the CASA ratio is not large, there has been an improvement compared to the previous year, the evidence is that the CASA ratio in 2023 is