Bank profits unlikely to surpass Q1/2024 in Q2

During the Vietstock LIVE program, “Interpreting Business Results for Q1/2024 and Vietnam’s Economic Outlook” held on the afternoon of April 24, Ms. Do Minh Trang, Director of Analysis Center of ACB Securities Company (ACBS) said that up to this point, there is not enough data from listed enterprises, but the general characteristics of the Vietnamese stock market are that the proportion of market capitalization and profits from the banking and real estate industries account for more than 60%, so it is still possible to see the overall results.

The proportion of bank profits on the VN-Index has increased for the past eight years. From around 30%, it increased to 65% in Q4/2023. In which, profits of the real estate and construction industry fluctuated from 10% to 20% but have now reduced to 5.7% in the recent period.

According to an ACBS expert, it is important to pay attention to the banking group to grasp the prospect of the VN-Index because after the banking industry crisis in 2012, it took the entire industry about five years to deal with bad debt issues and started to turn around to the growth trend from 2016 and went through a relatively steady period. Up to now, most banks have been listed and have been increasing in both quantity and quality.

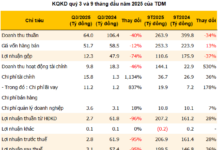

Currently, only about half of the banks have announced their profits, but according to the research center of ACBS, it is estimated that the trend of quarterly profit growth is slowing down and has only increased by about 4.5% compared to the previous quarter.

“Usually people often look at the growth compared to the same period last year, but why do we look at the growth compared to the previous quarter? Because the banking industry is cyclical, but this industry’s cycle is that of the economy, it is very long. Banks do not have seasonality, but profits are based on outstanding loans that increase gradually over time. We see the growth very clearly and it reflects the strength of business operations and the potential of the banking industry, mainly in comparison with the previous quarter rather than the same period last year. If compared to the same period last year, there may still be an increase of 11-12%, but if compared to the credit growth rate in the same period last year of 12-13%, it means that the profitability of the industry is gradually decreasing,” Ms. Trang explained.

Q1/2024 could be a relatively favorable quarter for the banking industry as well as the stock market because interest rates have started to decrease since the second half of 2023 and have remained low for the past nine months. But credit growth by the end of the first quarter only reached 1.34%. Although this figure is not disappointing because in fact, the fourth quarter of last year increased by nearly 5%, so somewhere outside of the technical measures, the growth demand in the past quarter was not weak.

But with such low interest rates and many loan-stimulating policies, bank profits have not yet shown the growth expectations of the industry. And those favorable factors seem to be diminishing in the coming Q2, even some factors may become more difficult in the context that the Fed will lower interest rates later than expected.

Therefore, in order to stabilize the VND exchange rate, the general interest rate may increase while other activities have not yet taken effect and thus the profit outlook for Q2 is unlikely to show better growth than Q1.

ACBS Expert Ms. Do Minh Trang at the sharing session. Source: Screenshot

|

Interest rate increase is still not too risky

Regarding the bad debt ratio, according to Ms. Trang, there are two very high bad debt periods in the past 3-4 years, which are the COVID-19 period and the period of real estate crisis and corporate bonds (TPDN).

When COVID-19 occurred, many activities were stalled, but the support from the import-export cash flow still maintained the bad debt quality of banks. But to the 2023 period, when imports and exports and many other activities were affected by the slowdown in global consumption, the bad debt ratio increased gradually, more persistently, and did not fall as quickly as in Q4/2020. High provisioning expenses will be the focus that the banking industry needs to address in 2024, especially for real estate enterprises.

Besides, data from the securities industry shows an increase of nearly 73% year-on-year in terms of profit and a 21% increase compared to the previous quarter. The profit and liquidity of the market are closely correlated. Because when liquidity increases, transaction fees increase, and margin fees increase, these are the main components that create profits for the Securities Company (CTCK).

And if a market is in a relatively long “uptrend” period, these companies will profit from the proprietary trading division. That is a factor that consolidates and supports CTCK’s profit in the past Q1.

However, there could be risks from the interest rate hike in the coming period, but this increase is not significant and will not harm the borrowing demands to carry out healthy business activities of many enterprises as well as people. And that increase is not enough to make all the money return to form of savings deposits in banks. Therefore, the stock market channel will still benefit from the cash flow of individual investors.

“In addition, we are still in the stage of being determined to upgrade the market, so there will be more liquidity from foreign organizations and investment funds. Although Q2 may be relatively quiet, we believe that the liquidity in 2024 is very promising, it can approach the level of 2022. If Vietnam successfully implements the steps to upgrade the market in 2025, the liquidity of the market will be significantly improved. That will be a supportive factor for CTCKs”, Ms. Trang analyzed.

We should look into the factor of homebuyers paying in advance and unrealized revenue

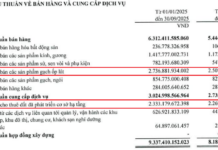

Talking about the profit as well as the prospect of the real estate industry, according to Ms. Trang, firstly it is the contribution in revenue and profit of the Vingroup group of stocks, especially the Vinhomes JSC (HOSE: VHM) accounting for a large proportion of nearly 100 trillion VND and the profit of nearly 30 trillion VND. The outlook of VHM reflects the common outlook of the industry.

Secondly, for the real estate industry, the revenue and profit of the current period are only the result of sales activities in the past and therefore it has been reflected in the increase in price as well as the outlook of the real estate stock. What needs to be noticed more for this industry is the current status of new project deployment and new sales.

Based on the experience of the expert, new sales and unrealized revenue are two factors that investors need to look at in a real estate enterprise to find opportunities in the future, rather than just looking at the profit figures.

According to CBRE’s Q1/2024 report, the new supply for sale is still quite low, and the market really picked up towards the end of this quarter but mainly concentrated in the urban apartment segment. It can be seen that many articles say that Hanoi apartment prices have increased, but only mainly in the secondary market.

As for enterprises in the primary market, the number of sales is relatively modest, more than 2,300 apartments in Hanoi and less than 500 apartments in HCMC. In the period of 2024-2026, CBRE predicts that the supply of apartments and land plots in Hanoi can be sold for an additional 64 thousand apartments, and 42 thousand apartments in HCMC.