After a week of sharp decline, VN-Index continued to record conflicting developments with alternating increasing and decreasing sessions. However, a sudden surge in demand helped VN-Index regain the 1,200 mark. At the end of the trading week, the VN-Index increased by 2.95% to 1,209.52 points. The cash flow was cautious before the holiday when the transaction value on HOSE only remained around VND 14,000 billion.

Although the buying side dominated this week, there was still a strong divergence as the recovery momentum was mostly concentrated in stocks with positive Q1 business results.

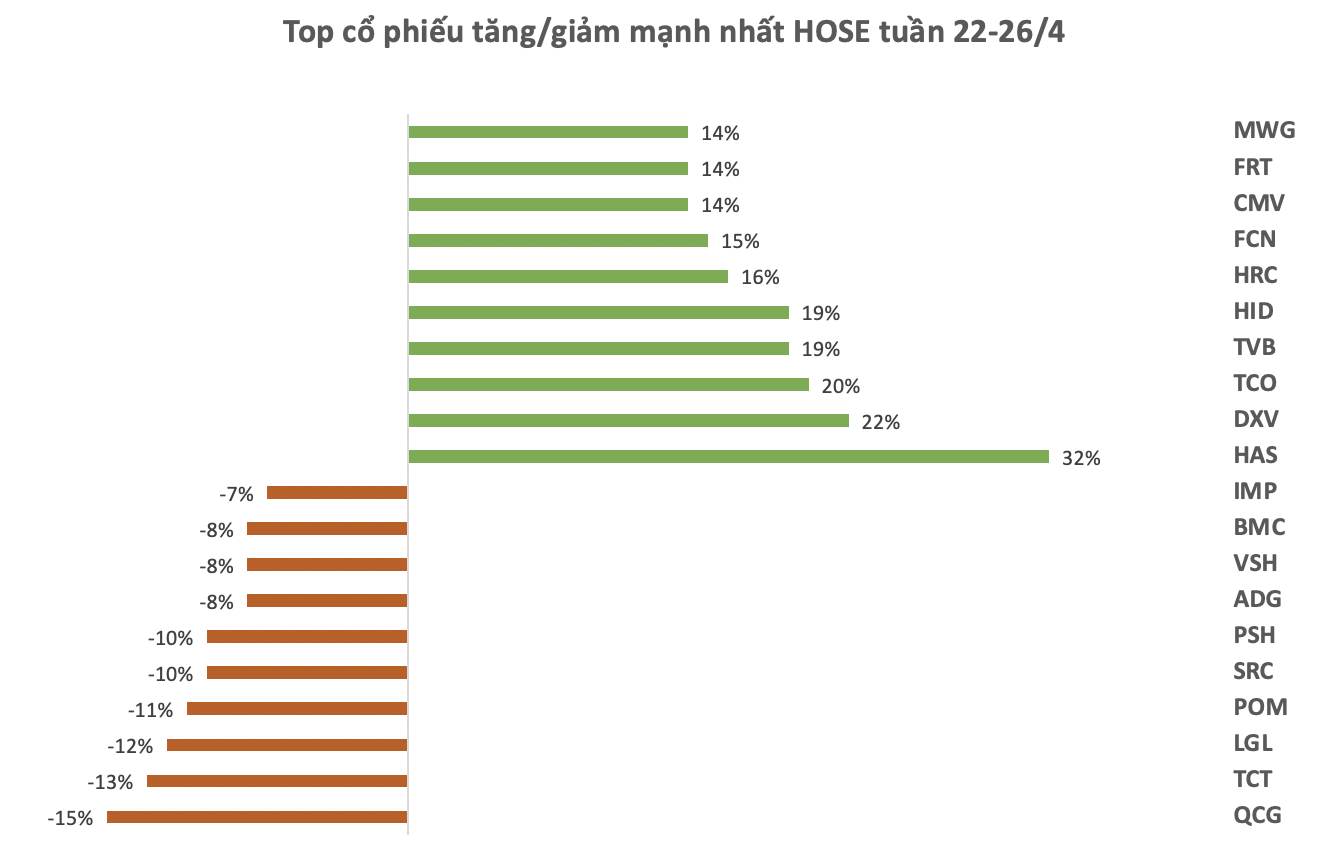

On HOSE, stocks with increasing points were dominant, the highest being 32%.

HAS surprisingly led the list of stocks with the strongest increase when it increased in price all week, including 3 sessions of ceiling price increase. However, liquidity was sluggish when only a few thousand units were matched in the session. HAS’s increase occurred after the enterprise announced its unpromising Q1 business results. Specifically, net revenue reached VND 15.93 billion, an increase of over 35.04% compared to the same period, but after-tax profit was negative VND 2.52 billion, while in the same period last year, it only lost VND 317 million.

It is noteworthy that MWG recorded a 14% increase after 5 consecutive price increase sessions. Trading in the leading retail stock was also active with an average matched transaction volume of over 14.5 million shares “changing hands” each session. In the past six months alone, MWG has gained more than 56% in value.

In contrast, QCG stocks suffered the strongest profit-taking pressure after a series of consecutive ceiling price increases in the recent past.

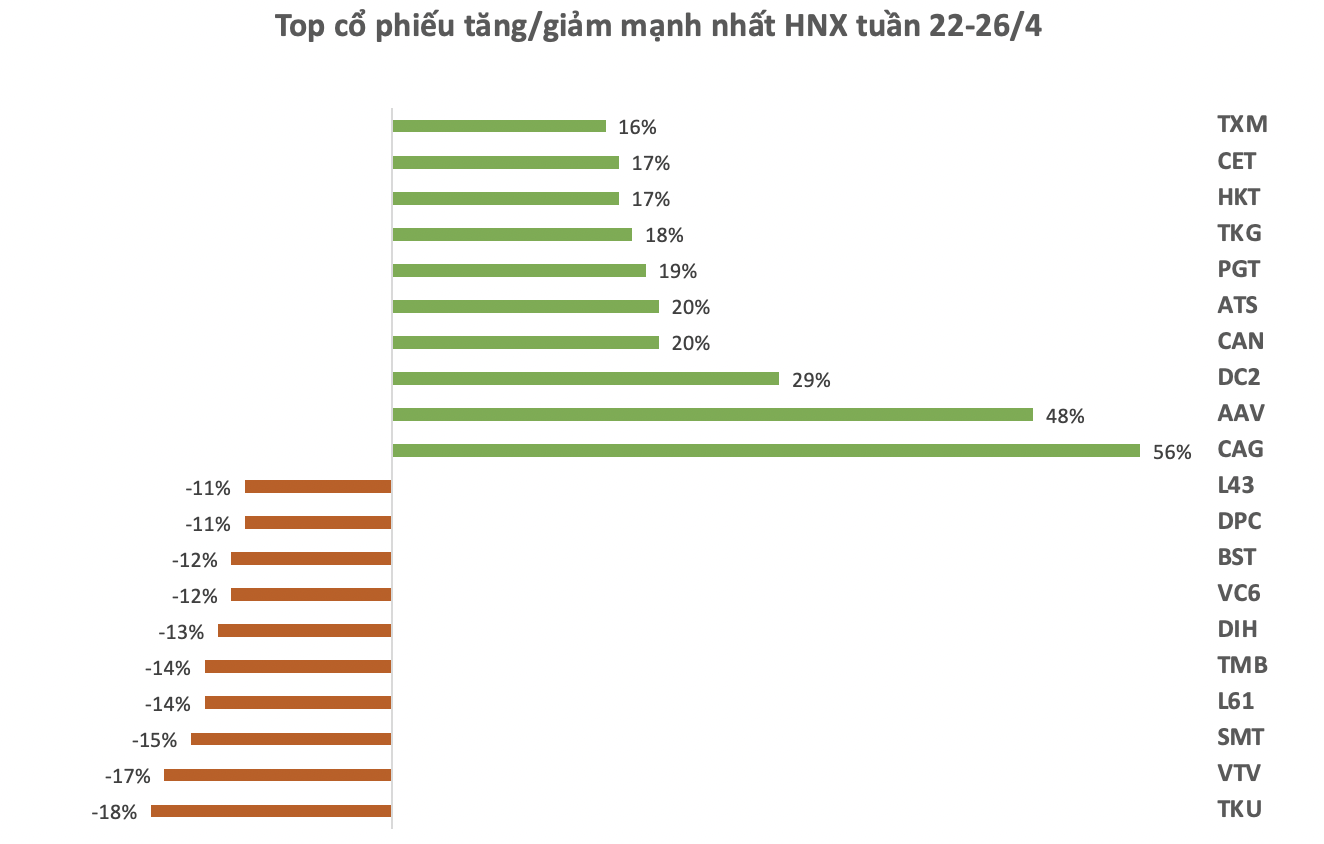

On HNX, increasing stocks also dominated, the focus was on CAG when it broke out by 56% with liquidity improving several times compared to the previous average. In this month alone, CAG has more than doubled to VND 13,400 per share, the highest price of this code in the past 23 months.

However, CAG’s increase was not supported by any special information. Regarding the newly announced 2024 plan, the enterprise set a revenue target of VND 65 billion and after-tax profit of VND 3.6 billion, increasing by 3% and 16%, respectively, compared to the same period.

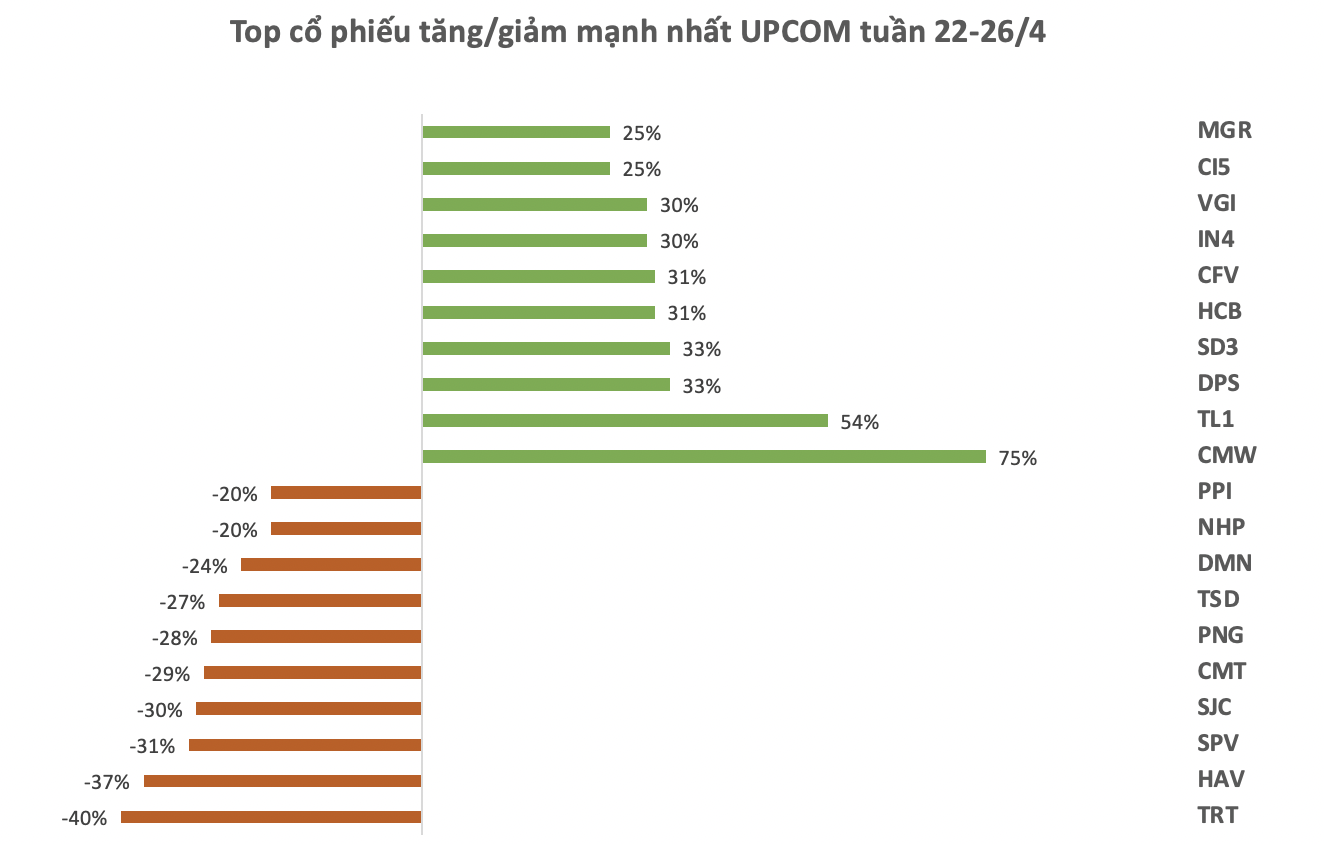

On UPCOM, after a series of days staying at the reference, CMW stock of Ca Mau Water Supply Joint Stock Company suddenly made waves with a strong increase of 75% after 4 ceiling price increase sessions. However, the liquidity of this code was only a few hundred units. The increase in CMW stock price appeared after information about positive Q1 business results with a profit of VND 5.6 billion, an increase of 2.3 times compared to the same period.

On the contrary, in the past week, many stocks on UPCOM also recorded a decrease of 20% – 40%.