According to preliminary statistics from the General Department of Customs, Vietnam’s soybean imports in the first quarter of 2024 reached 539,997 tons, worth nearly USD 296.62 million, with an average price of USD 549.3 per ton, increased by 8.3% in volume but decreased by 14.4% in value and decreased by 21% in price compared to the first three months of 2023.

In that, March 2024 alone reached 200,868 tons, equivalent to USD 103.58 million, with an average price of USD 515.6/ton, increased by 58.3% in volume and increased by 46% in value compared to February 2024, but decreased by 7.8% in price; compared to March 2023, an increase of 2.1% in volume but decreased by 22.3% in value and decreased by 23.9% in price.

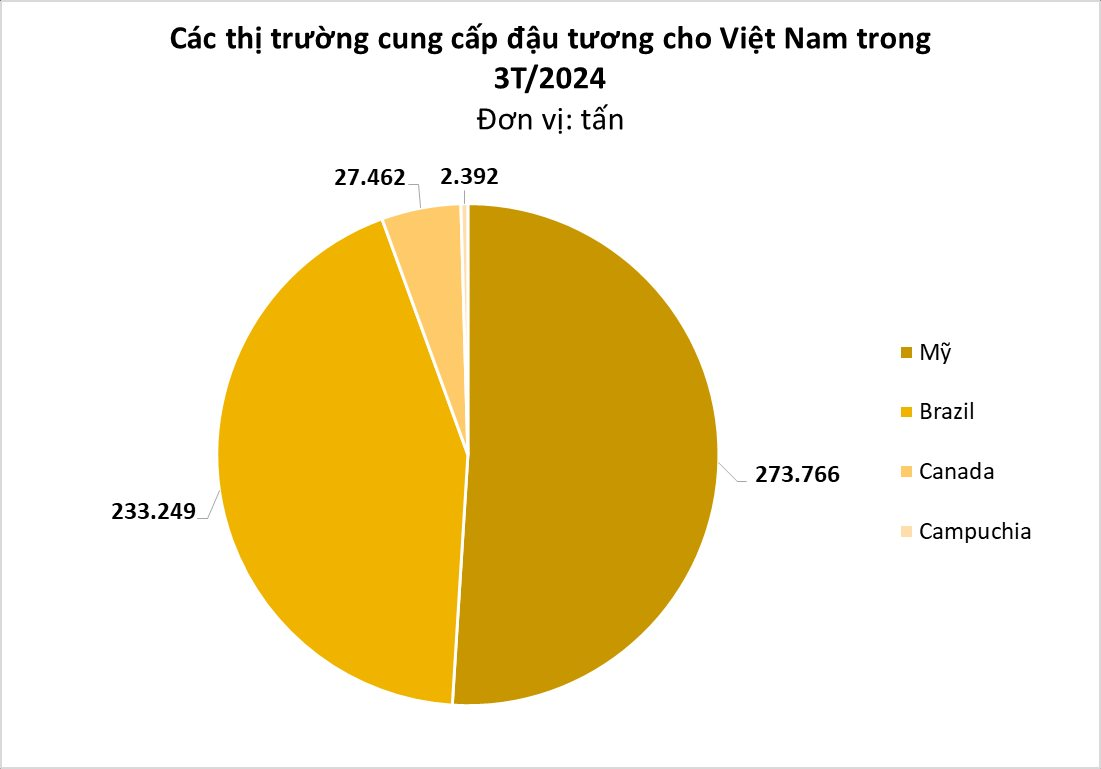

Brazil was the largest market supplying soybeans to Vietnam in the first three months of 2024, accounting for nearly 50.7% of the total import volume and accounting for 49% of the total import value of soybeans in the country, reaching 273,766 tons, equivalent to nearly USD 145.19 million, priced at USD 530.3/ton, increased by 102.7% in volume, increased by 58.6% in value but decreased by 21.8% in price compared to the first three months of 2023.

The second largest market was the U.S., in the first three months of 2024 reaching 233,249 tons, equivalent to USD 130.8 million, priced at USD 560.8/ton, accounting for over 43.2% of the total volume and accounting for 44.1% of the total import value of soybeans in the country, decreased by 29.3% in volume, decreased by 43.2% in value and decreased by 19.7% in price compared to the first three months of 2023.

Then the Canadian market in the first three months of 2024 reached 27,462 tons, equivalent to USD 17.05 million, priced at USD 620.8/ton, accounting for 5.1% of the total volume and accounting for 5.8% of the total import value of soybeans in the country, increased by 1.3% in volume but decreased by 14.7% in value and decreased by 15.8% in price compared to the same period last year.

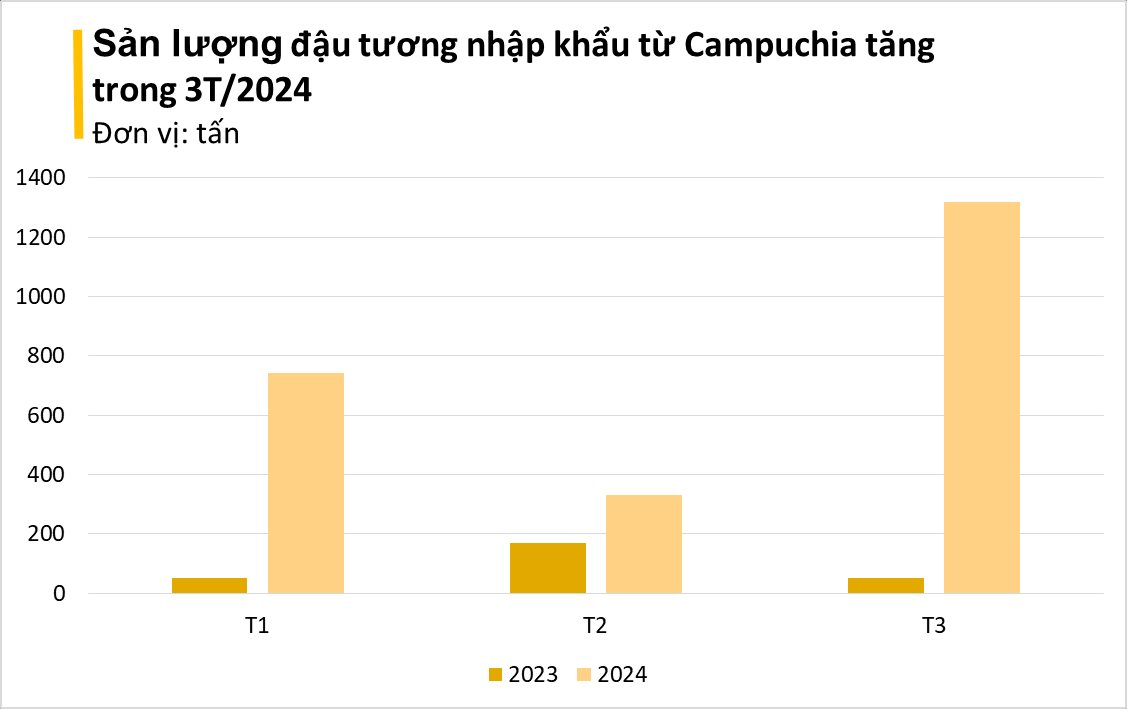

Among all the markets, Vietnam has been actively importing soybeans from Cambodia in recent months.

Specifically, the import from the Cambodian market in March 2024 reached 1,319 tons, equivalent to 952.6 thousand USD, increased by 2,538% in volume and increased by 2,281% in value compared to March 2023.

For the whole three months, Vietnam spent USD 1.72 million to import 2,393 tons of soybeans, increased by 786.3% in volume and increased by 715.54% in value.

The average import price reached USD 720/ton, decreased by nearly 8% compared to the same period last year.

Soybeans are a raw material that is very difficult to replace in the process of producing animal feed – one of the essential production industries in Vietnam. Experts forecast that Vietnam’s soybean imports will increase steadily by 3-5% each year.

According to the Vietnam Mercantile Exchange (MXV), the soybean group plays a leading role in the trend in the agricultural products market.

The latest report by the US Department of Agriculture shows that US soybean sales for the 2023/24 crop year in the week of April 5-11 reached 485,795 tons, an increase of 59.1% compared to the previous week. However, since the beginning of the 2023-2024 crop year to April 11, the cumulative soybean sales in the US only reached over 41 million tons, a decrease of 18% compared to the same period of the previous crop year. This reflects the fact that US export activities are still facing great competitive pressure from Brazil’s supply.

In addition, in a recent report, the International Grains Council (IGC) maintained its forecast for global soybean production in 2024-2025 at 413 million tons, up 23 million tons from the current crop year. The expected supply is expected to expand in the coming crop year, putting further pressure on soybean prices.

As for the South American supply, according to the Buenos Aires Grain Exchange (BAGE), as of the end of last week, farmers in Argentina had harvested 10.6% of the soybean area, up 8.7% compared to the previous week. In addition, the percentage of soybeans with good to excellent quality is 30%, much higher than the 3% recorded in the same period last year. These positive signals have somewhat eased market concerns about the tightening of supply.