Annual General Meeting of Shareholders for fiscal year 2023 HSC on the afternoon of April 25. Photo: BTC

|

The Company predicts that the Vietnamese stock market (VSE) in 2024 will improve thanks to factors such as: the domestic interest rate environment has cooled down and may be lower, continuing to support the repatriation of cash flow and help increase market liquidity; other investment channels such as real estate or gold continue to face challenges or are not favorable; expectations that the new KRX trading system will soon be implemented in 2024, providing additional tools and new services attracting investor trading interest, thereby increasing market liquidity.

In addition, positive solutions continue to be implemented by the State Securities Commission (SSC) to meet the requirements for upgrading the Vietnamese stock market, contributing to the outflow of foreign capital into the market in the coming years.

The company forecasts a 14% increase in market trading value in 2024 compared to the previous year, with an 18% increase in the average trading value per session.

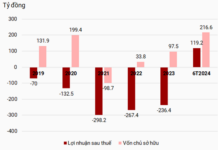

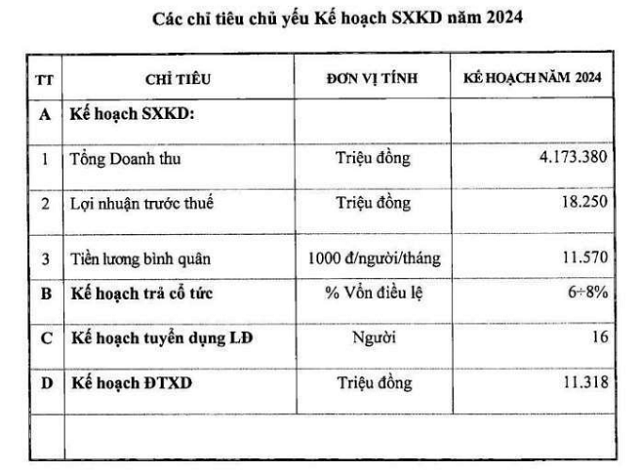

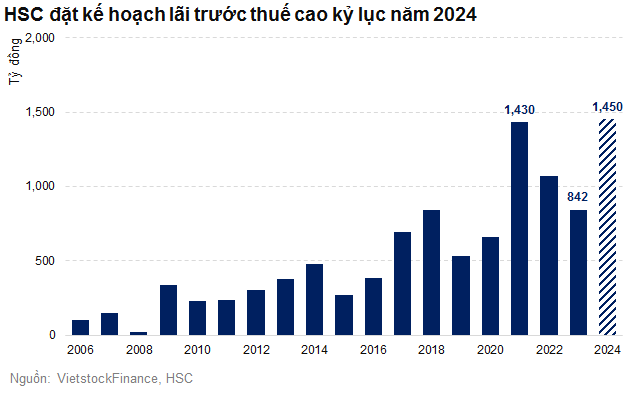

On that basis, HSC sets the target of achieving total revenue of 3.128 billion dong in 2024, an increase of 41% compared to 2023, expecting key areas such as margin lending, proprietary trading and brokerage to have good growth.

The goal of profit before and after tax increased by 72% compared to the previous year, at 1,450 and 1,160 billion dong, respectively. If the target is achieved, this will be the company’s record profit.

|

In the business plan presentation for 2024, Mr. Trinh Hoai Giang – General Director of HSC said that in the current corporate finance consulting plan, there is a portion of revenue from the previous year, in the previous year the operations were completed. This year, there are some new transactions. The approval process of the competent authorities is quite slow, finally in the first quarter, some revenue was realized.

In addition, he said that last year, our foreign loans were long-term loans, and we did not have liquidity problems when domestic banks reduced lending. This year is quite easy and convenient for the company’s margin lending and proprietary trading activities.

In 2023, HSC had a revenue of VND 2,255 billion and a profit before tax of VND 842 billion, both down 21% compared to the previous year.

HSC plans record profit in 2024, “money dividend”

In addition, by the end of 2024, HSC‘s total assets will reach more than 25 trillion VND, an increase of 41% compared to the end of 2023, mainly including margin loans, financial assets and payment security deposits.

The specific plans for using and raising capital in 2024 are also presented in detail. In particular, the debt-to-equity ratio at the end of 2024 will reach 1.3 times, higher than the end of 2023 (1.2 times), due to the assumption of having new capital added and the asset structure is focusing on margin lending and proprietary trading.

According to the recently announced Q1/2024 financial statements, HSC had a profit after tax of 277 billion VND, an increase of 124% compared to the same period last year.

Cash dividend

An important content, the Company wants to submit to the GMS a change in the payment method for the second dividend of 2022 from shares to cash. The payout ratio is authorized by the Board of Directors, ensuring that the total dividend payment is 462.2 billion VND, equivalent to 54% of retained earnings as of December 31, 2022 on the audited financial statements. The implementation time is based on the actual situation.

In addition, the Company will also pay a dividend in 2023 in cash, at a rate of approximately 55% of retained earnings in 2023 on the audited financial statements, equivalent to approximately 368 billion VND.

Regarding the 2024 dividend plan, HSC expects the payout ratio (in cash) not to exceed 80% of profit after tax, approximately 7% (equivalent to 700 dong/share).

The total number of shares at the time of the 2024 dividend payment is based on the basis of completion of the share issuance to existing shareholders with a ratio of 50% and issuance of shares to the Company’s employees (as approved by the 2021 GMS on 08/08/2022).

“With this change plan, we must rely on the number of shares after determining the number of shares outstanding, then pay according to the number of shares at the time we determine. The capital increase dossier that shareholders have recently paid up and completed the issuance phase, but has not been confirmed by the SSC, when received, the newly issued shares will be listed at that time, we will know how many shares are in circulation on the market, then we will take 462 billion VND divided by the number of new shares to know what the percentage is on the par value,” explained Mr. Johan Nyvene – Chairman of the Board of Directors.

Discussion:

The decline in retail market share is due to a capital issue

What is HSC currently doing and what will it do to increase market share on the floor so as not to be left behind by competitors with strong technology such as TCBS or SSI?

General Director Trinh Hoai Giang: Currently, HSC‘s organizational market share is good, leading the market, due to its strengths in research and reputation in compliance, technology, trading and customer relationships. The individual market share fell sharply last year, mainly due to insufficient capital. Last year, central banks sharply raised interest rates, limiting credit limits. HSC‘s capital increase process is delayed, the previous phase took nearly 2 years to complete, and the capital increase was put into use. This is detrimental when the market is booming in trading, and investor demand is large.

The second issue is compliance. Besides the fundamental evaluation of the company; do not manipulate prices, do not violate regulations, to maintain compliance, avoid being fined and damage reputation. The organizational brokerage sector is good and the individual sector is a matter of compliance.

The third issue is that we do not lend shares that are manipulated or lack liquidity; and fourthly, our trading system is not good yet.

To increase market share, the above issues must be improved. First, capital needs to be improved. This year, banks are lending easily, with good interest rates. Second is the issue of compliance, although compliant but not making things difficult.

Third, complete the new trading system. When KRX goes into operation, the system will be upgraded. Fourth, with the new trading system, hopefully in May, we will have a new product that we can be fully proactive on the new technology platform.

With the current market, there is a price war, many companies reduce brokerage fees to achieve high market share, which is offset by lending. We have no other choice but to reduce the price to zero, but ensure competitive fees and flexibility.

Implementing all these measures, market share will improve this year.

We see HSC‘s market share improve well in the retail segment. I am highly confident that our retail market share will double by the end of this year compared to last year.

We have our own way of