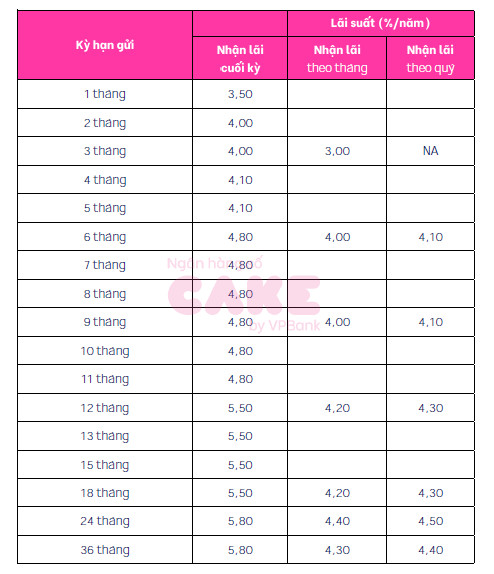

According to the latest interest rate chart from Cake by VPBank, the interest rate for term deposits with interest paid at the end of the term currently ranges from 3.5% to 5.8% per annum, an increase of 0.3% to 0.7% across all terms compared to the rates recorded a month ago.

Specifically, the interest rate for the 1-month term is 3.5% per annum; 2-3 months is 4% per annum; 4-5 months is 4.1% per annum; 6-11 months is 4.8% per annum; 12-18 months is 5.5% per annum; and the 24-36 month terms offer the highest interest rate of 5.8% per annum.

Source: Cake by VPBank

Compared to traditional banks, Cake by VPBank’s interest rates for terms under 6 months are currently significantly higher. Specifically, the interest rate for the 1-month term at this bank is 0.5% to 1.9% higher, the 3-month term is 0.75% to 2.1% higher, and the 6-month term is 0.1% to 1.9% higher.

The interest rates for the 9-24 month terms at Cake by VPBank are also significantly higher than the market average.

| HIGHEST DEPOSIT INTEREST RATES (%/YEAR) | ||||||

| BANK | 1 MONTH | 3 MONTH | 6 MONTH | 9 MONTH | 12 MONTH | 18 MONTH |

| CAKE BY VPBANK | 3.5 | 4 | 4.8 | 4.8 | 5.5 | 5.5 |

| KIENLONGBANK | 3 | 3 | 4.7 | 5 | 5.2 | 5.5 |

| OCB | 3 | 3.2 | 4.6 | 4.7 | 4.9 | 5.4 |

| HDBANK | 2.95 | 2.95 | 4.6 | 4.4 | 5 | 5.9 |

| VIETBANK | 3 | 3.4 | 4.5 | 4.7 | 5.2 | 5.8 |

| CBBANK | 3.1 | 3.3 | 4.5 | 4.45 | 4.65 | 4.9 |

| NCB | 3.2 | 3.5 | 4.45 | 4.65 | 5 | 5.5 |

| BAC A BANK | 2.95 | 3.15 | 4.35 | 4.45 | 4.85 | 5.25 |

| NAM A BANK | 2.7 | 3.4 | 4.3 | 4.7 | 5.1 | 5.5 |

| BAOVIETBANK | 3 | 3.25 | 4.3 | 4.4 | 4.7 | 5.5 |

| VIET A BANK | 2.9 | 3.2 | 4.3 | 4.3 | 4.8 | 5.1 |

| PVCOMBANK | 3.15 | 3.15 | 4.3 | 4.3 | 4.8 | 5.3 |

| ABBANK | 2.9 | 3 | 4.3 | 4.1 | 4.1 | 4.1 |

| SHB | 2.8 | 3 | 4.2 | 4.4 | 4.9 | 5.2 |

| VPBANK | 2.7 | 3 | 4.2 | 4.2 | 4.8 | 4.8 |

| GPBANK | 2.5 | 3.02 | 4.15 | 4.4 | 4.85 | 4.95 |

| EXIMBANK | 3 | 3.3 | 4.1 | 4.1 | 4.9 | 5.1 |

| MSB | 3.5 | 3.5 | 4.1 | 4.1 | 4.5 | 4.5 |

| BVBANK | 2.85 | 3.1 | 4.1 | 4.35 | 4.7 | 5.25 |

| LPBANK | 2.6 | 2.7 | 4 | 4.1 | 5 | 5.6 |

| VIB | 2.5 | 2.7 | 4 | 4 | 4.8 | |

| DONG A BANK | 2.8 | 3 | 4 | 4.2 | 4.5 | 4.7 |

| OCEANBANK | 2.9 | 3.2 | 4 | 4.1 | 5.4 | 5.9 |

| TPBANK | 2.8 | 3.1 | 4 | 4.9 | 5.1 | |

| SAIGONBANK | 2.3 | 2.5 | 3.8 | 4.1 | 5 | 5.6 |

| PGBANK | 2.6 | 3 | 3.8 | 3.8 | 4.3 | 4.8 |

| SACOMBANK | 2.3 | 2.7 | 3.7 | 3.8 | 4.7 | 4.9 |

| MB | 2.2 | 2.6 | 3.6 | 3.7 | 4.6 | 4.7 |

| TECHCOMBANK | 2.25 | 2.55 | 3.55 | 3.55 | 4.45 | 4.45 |

| ACB | 2.3 | 2.7 | 3.5 | 3.8 | 4.5 | |

| BIDV | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| SEABANK | 2.7 | 2.9 | 3.2 | 3.4 | 3.75 | 4.6 |

| VIETINBANK | 1.8 | 2.1 | 3.1 | 3.1 | 4.7 | 4.7 |

| AGRIBANK | 1.6 | 1.9 | 3 | 3 | 4.7 | 4.7 |