However, cash flow has been withdrawn heavily, probably due to cautious psychology ahead of April 30th – May 1st holiday break, with 3 consecutive trading days off. Volume and transaction value on the HOSE floor decreased by approximately 40% compared to the previous week to 700 million units/session and VND16.5 trillion/session.

On the HNX floor, liquidity has plunged by 45%, volume has decreased to 74 million units/session, and value has decreased to VND1.4 trillion.

|

Overview of market liquidity in week 22 – 26/03

|

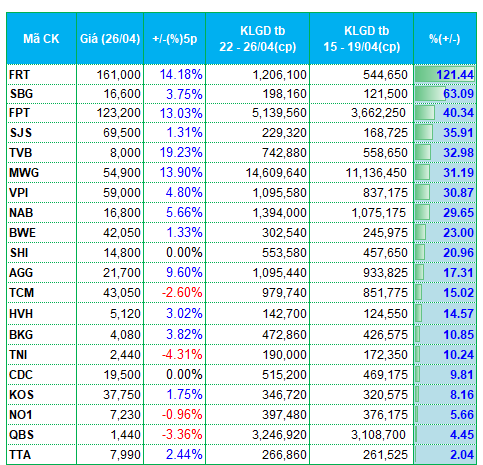

Cash flow in the retail stock group performed well during the past week. FRT led the HOSE floor in terms of liquidity growth with an average trading volume that increased by 120%, recording 1.2 million units/session.

MWG also recorded a 30% increase in trading volume compared to the previous week, reaching 14.6 million units/session.

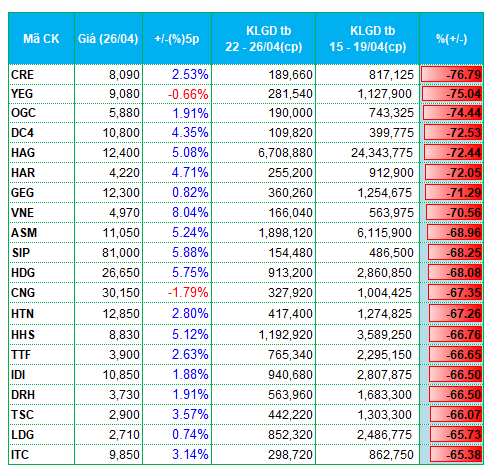

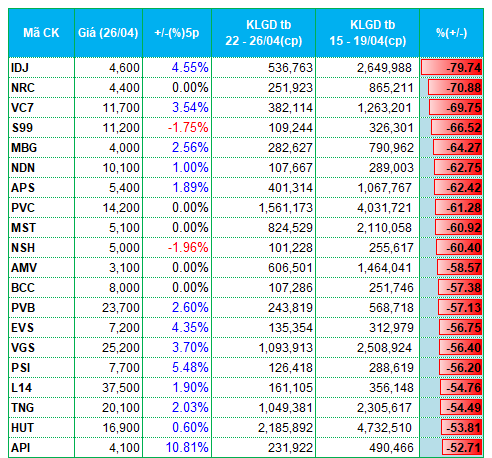

The real estate group has witnessed a significant withdrawal of funds. Many stocks have sharply decreased in liquidity, which are representatives of the real estate group. These include CRE, HAR, HDG, DRH, LDG, ITC, IDJ, NRC, VC7, NDN, L14, API, whose trading volume has decreased by 50 – 70% compared to the previous week.

The construction group has also seen some representatives decline in liquidity, such as DC4, VNE, HTN, S99, MST, HUT.

|

Top 20 stocks with the highest increase/decrease in liquidity on the HOSE floor

|

|

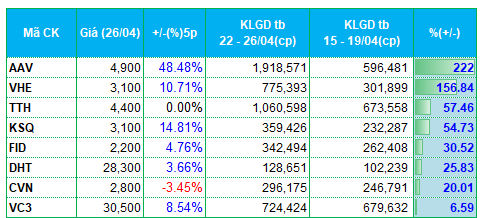

Top stocks with the highest increase/decrease in liquidity on the HNX floor

|

List of stocks with the highest increase/decrease in liquidity in terms of average trading volume above 100,000 units/session.