During most of the April trading period, selling pressure dominated, causing a corrective rhythm in the market. At the end of the April 26 session, the VN-Index fell to 1,209.52 points, down 6% compared to the end of March. Notably, banking stocks declined less than the VN-Index. Specifically, data from VietstockFinance shows that the banking sector index in April decreased by 5% compared to the previous month, to 684.86 points.

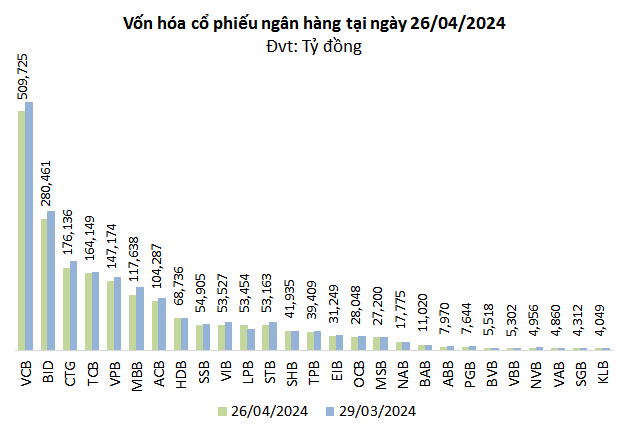

Market capitalization fell by nearly 103 trillion VND

Source: VietstockFinance

|

In April, the banking group’s market capitalization decreased by 102,758 billion VND to 2.02 trillion VND (as of April 26, 2024), down 5% from the level of over 2.1 trillion VND at the end of the March session.

The entire sector’s market capitalization plunged when the three major state-owned banks all saw significant declines in their capitalizations. Among them, VietinBank (CTG) decreased by 8%, BIDV (BID) by 6%, and Vietcombank (VCB) by 4%.

Most private joint-stock banks also experienced sharp declines in market capitalization ranging from 2-16%. In particular, the market capitalization of NVB decreased the most among banks when its price fell by 16% to 4,956 billion VND.

Despite the downtrend, a few stocks still managed to improve their market capitalization thanks to increasing share prices, such as LPBank (up 19%), VBB (up 11%), and VAB (up 10%). The share prices of VBB and VAB increased after their general meetings of shareholders approved the issuance of stock dividends and bonus shares in 2024. VBB plans to issue stock dividends at a rate of 25%, while VAB expects to issue bonus shares in 2024 at a rate of 39%.

As for LPB, its share price increase was driven by positive business results in the first quarter, with pre-tax profit increasing by 84% year-on-year, achieving 27% of the plan. Furthermore, on April 23, LPBank announced a resolution passed by its Board of Directors approving the plan to offer 800 million shares to existing shareholders to increase its charter capital.

Source: VietstockFinance

|

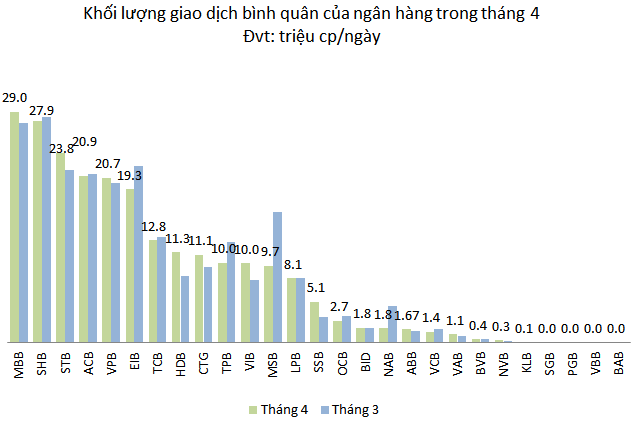

Slight decrease in liquidity

In April, over 231 million bank shares were transferred per day, down 2% compared to March, equivalent to a decrease of nearly 4 million shares per day. Trading value decreased by 1% to 5,389 billion VND per day.

Source: VietstockFinance

|

Notably, banks that experienced significant liquidity increases were VBB (up 77%), SSB (up 61%), and HDB (up 35%).

On the other hand, Nam A Bank (NAB) was the stock with the steepest decline in liquidity during the past month, down to 1.8 million shares transferred per day, a 61% decrease compared to the month when it debuted on the HOSE.

This month, MBB stock liquidity took the lead with over 23 million shares traded and nearly 6 million shares “changing hands” per day. The average total trading volume reached nearly 29 million shares, an increase of 5% compared to the previous month.

BAB remains the bank with the lowest liquidity, with only 5,357 shares traded per day, down 27% compared to the previous month, and a value of only nearly 66 million VND per day.

Source: VietstockFinance

|

Foreign net selling reached 520 billion VND

Foreign selling pressure intensified in April, with nearly 47 million bank shares being net sold, up 68% compared to March. Meanwhile, the net selling value reached 520 billion VND, down more than 10% compared to the previous month.

Source: VietstockFinance

|

With the highest liquidity in the industry during the past month, MBB stock was also favored by foreign investors, with net purchases of nearly 17 million shares (427 billion VND) in April. In contrast, foreign investors took profits from SHB shares, with the highest net selling volume of nearly 30 million shares, equivalent to 328 billion VND.