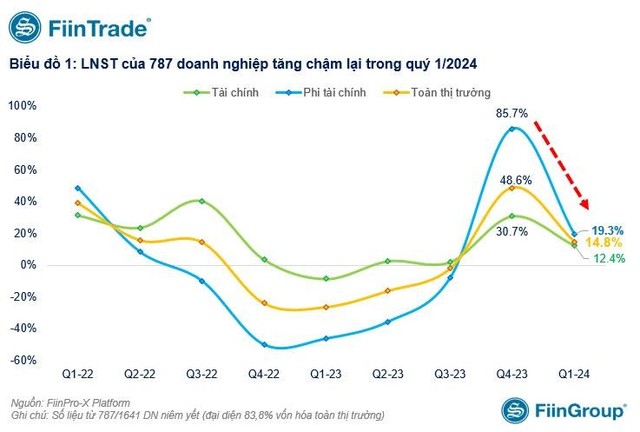

As of May 2, almost all industry leaders have published their Q1 2024 financial statements, providing a comprehensive picture of the first quarter of this year. According to data from the FiinTrade platform, the total after-tax profit for Q1/2024 of 787 listed enterprises grew by 14.8% compared to Q1/2023, significantly lower than the 48.6% growth in Q4/2023, even though Q1/2023 was the lowest quarter for profits in the past two years.

In particular, brokerage companies and steel companies mostly recorded positive results. In addition, some other major business groups such as retail and fertilizer made a spectacular comeback in the past quarter by recording a sharp increase in profits.

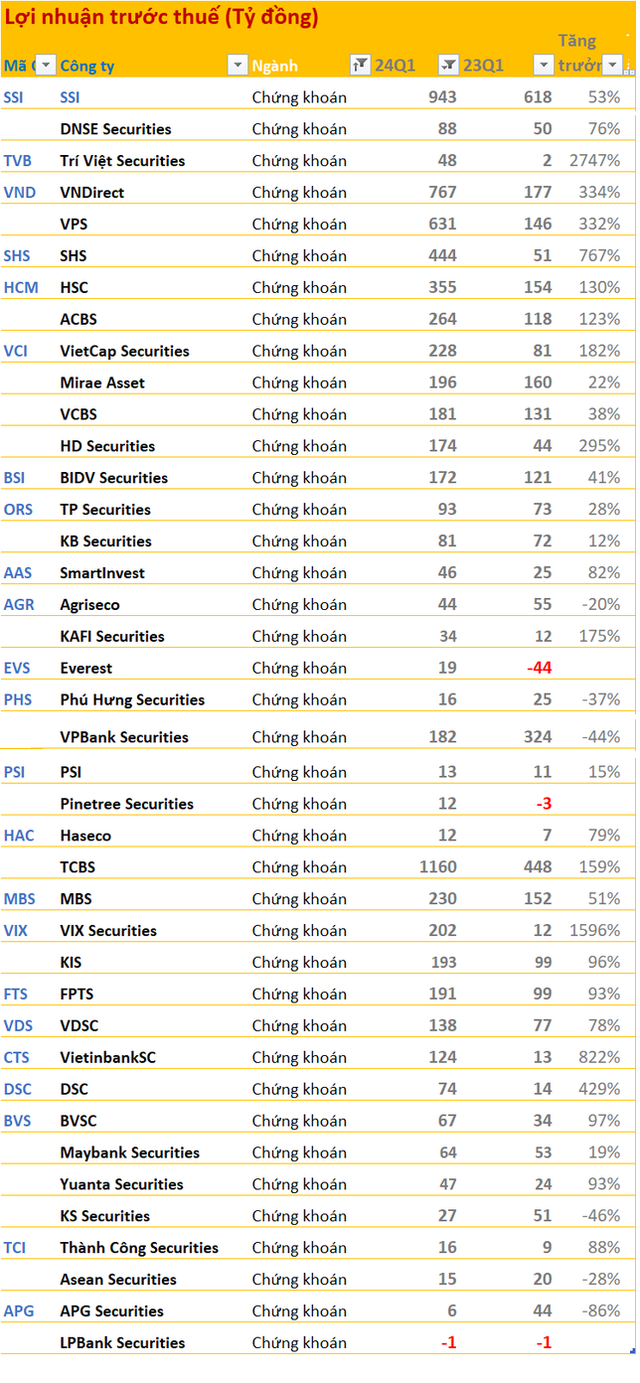

The brokerage group continued the upward trend of 2023 when it received many impressive results in the first quarter of 2024. According to Fiin Trade’s report, the financial services group achieved a profit growth rate of over 122%.

In particular, companies such as Tri Viet Securities (TVB) and VIX Securities (VIX) recorded a four-digit growth rate compared to the same period last year. Some names like Everest Securities, Pinetre Securities have also succeeded in turning losses into profits.

Slightly less impressive, up to 11 brokerage companies recorded a three-digit growth rate. Notable names in the industry include Vietinbank Securities, SHS, DSC, VNDirect, VPS, TCBS, and Vietcap. Among them, TCBS continued to be the brokerage company with the largest profit of 1,160 billion VND.

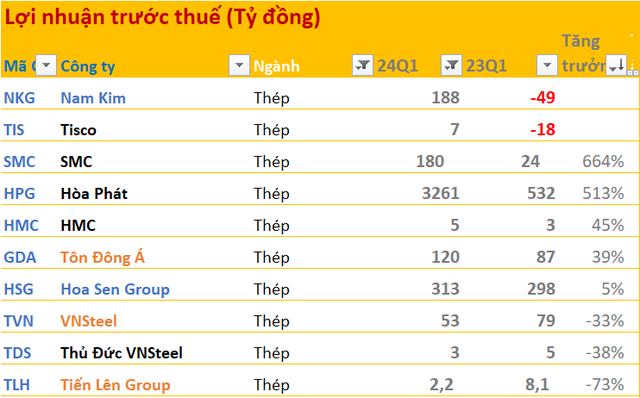

The steel industry is another industry that has maintained the growth momentum of 2023 after a difficult period in late 2022 and early 2023. Industry leaders like Hoa Phat (HPG), Hoa Sen (HSG), Nam Kim (NKG) and Ton Dong A (GDA) all recorded a strong profit growth compared to the same period last year.

In particular, Hoa Phat has regained its position as a major enterprise when it reported a pre-tax profit of over 3,261 billion VND, an increase of 513% compared to the previous year. Companies that often reported losses such as Thai Nguyen Steel (TIS) also returned to profit. However, some enterprises recorded a decrease in profits but none of them have reported losses.

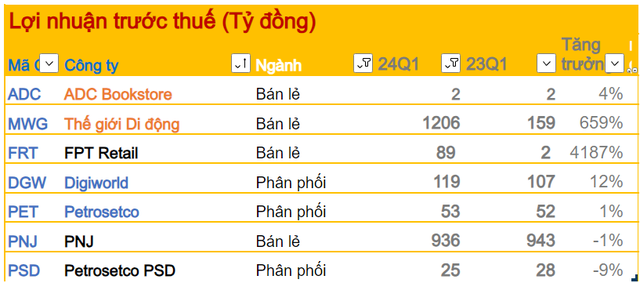

The retail – distribution industry has made a strong comeback since the beginning of 2024 after a serious decline in 2023 due to inflation and people tightening their spending. According to Fiin Trade, the industry’s profit increased by 41% in the past quarter.

FPT Retail (FRT) recorded the most impressive profit growth of 4,187%, reaching 89 billion VND with the support of Long Chau.

Mobile World (MWG) also reported a 659% increase in profit to 1,206 billion VND after a long period of restructuring. Digiworld (DGW) or Petrosetco (PET) also recorded profit increases. Meanwhile, PNJ (PNJ) slightly decreased.

The fertilizer industry also started to grow again in Q1/2024 after a sharp decline in 2023. Noted enterprise DAP Vinachem (DAP) recorded a four-digit profit growth, reaching 33 billion VND. A number of other big names such as Phu My Fertilizer (DPM), Ca Mau Fertilizer (DCM), Binh Dien Fertilizer (BFC) and Da Bac Fertilizer (DHB)… also reported profit increases.

The group that still ‘carries’ the profit of the Vietnamese stock market, the banking industry, received mixed results in Q1/2024. However, according to Fiin Trade, the profit of the banking industry still increased by 9.6%.

Some large banks such as Vietcombank (VCB), ACB (ACB), VIB (VIB), MB (MBB)... recorded a decrease in profit. LPBank (LPB) had the most impressive growth in the banking industry when it reported a profit of 2,886 billion VND, an increase of 84%.

FURNITURE DISAPPOINTMENT NAMED REAL ESTATE

In Q1/2024, the industry group that caused the most disappointment to investors is real estate, with many major players recording a sharp decline in profits or even losses.

Specifically, after-tax profit of 60/130 real estate enterprises (representing 74.4% of the industry’s total capitalization) decreased by 83% compared to the same period due to Vinhomes (VHM) no longer recording income from wholesale projects as in the same period. Excluding Vinhomes, the profits of the remaining 59 real estate companies decreased by -15.1% compared to the same period due to the impact of the residential real estate group such as Novaland, Khang Dien, DIG, Nam Long…

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)