Foreign investors continue to sell off on the Vietnamese stock market, with the value of many sessions even reaching around the threshold of trillions of VND. Although the selling momentum has gradually narrowed, and there have been sessions of net buying, the value is not significant. After a record net selling in March, foreign investors continued to sell a net of VND 5,313 billion in the entire market in April.

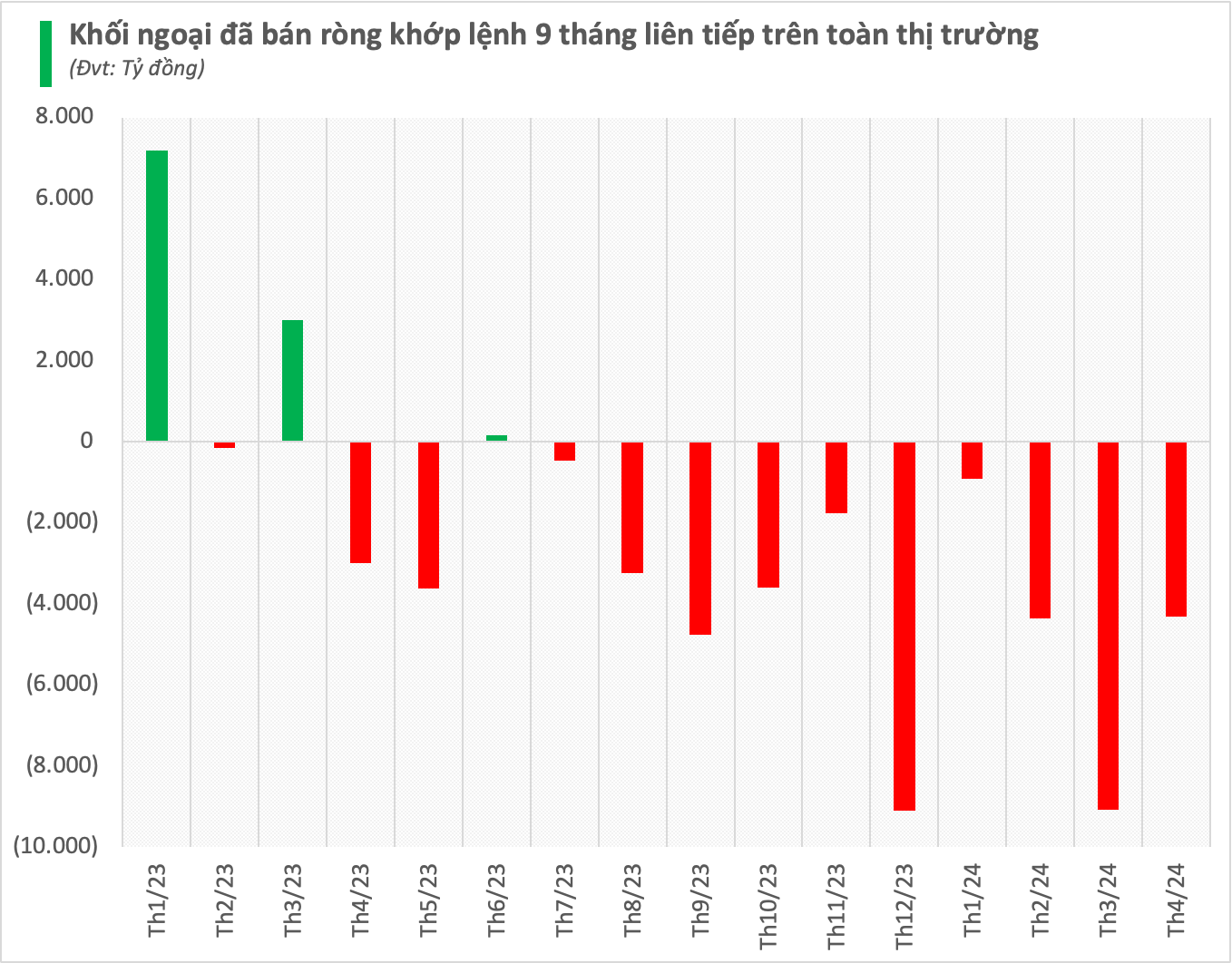

In terms of matching orders alone, foreign investors sold a net of more than VND 4,300 billion. This is also the 9th consecutive month that foreign capital has been “dumping” Vietnamese stock orders.

On each exchange, foreign investors sold a net of nearly VND 6,000 billion on HoSE, mostly through net selling of matched orders; plus a net sale of VND 103 billion on UPCoM, in contrast to a net purchase of VND 778 billion on the HNX floor.

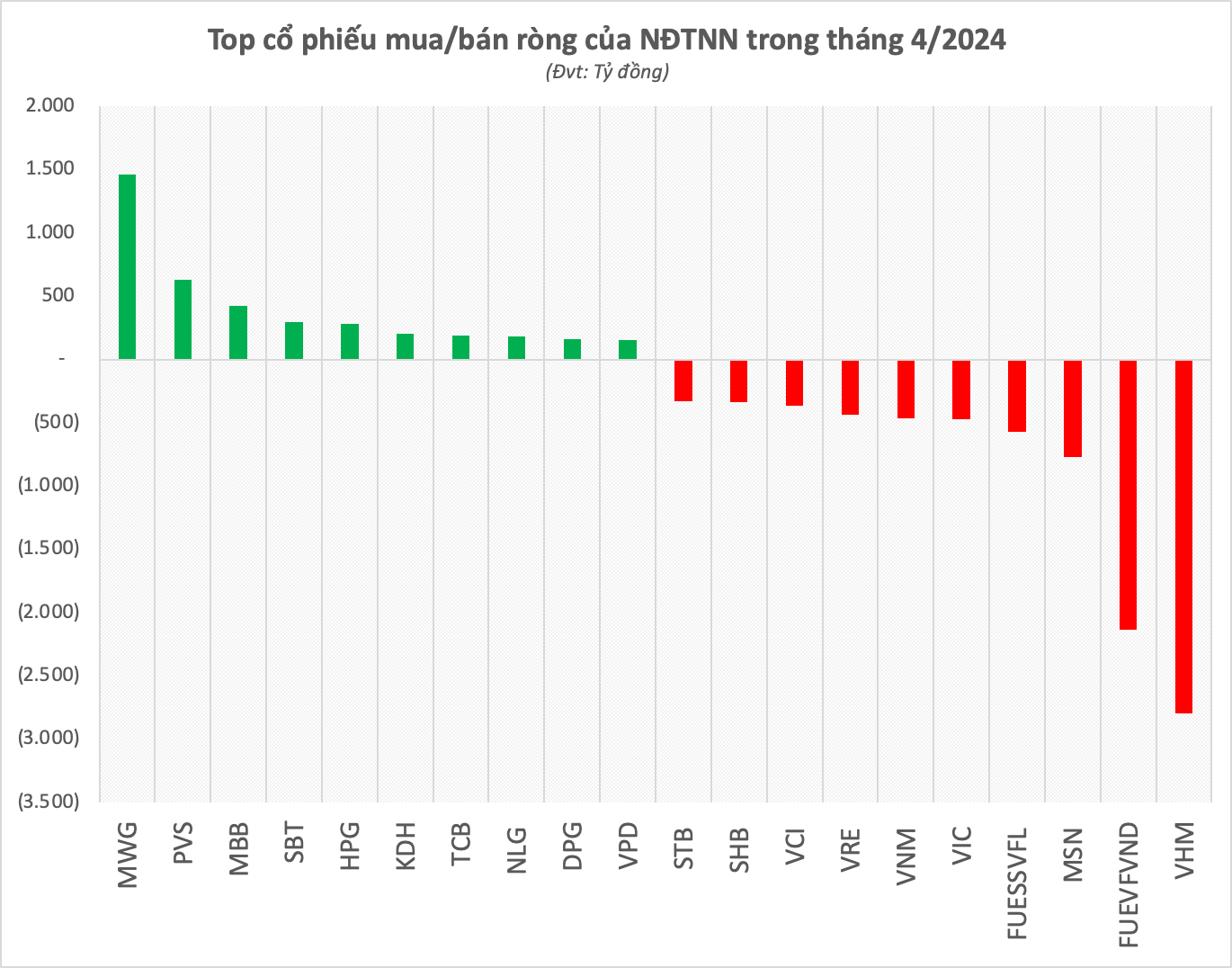

There are up to 2 stock codes that were net sold over VND 2,000 billion in just 1 month, including VHM and FUEVFVND with net sales of VND 2,797 billion and VND 2,131 billion, respectively. While most of VHM shares were sold through matching orders, Diamond fund certificates from Dragon Capital were sold through both channels with VND 589 billion sold by matching orders and VND 1,068 billion sold by agreement.

A series of bluechips also recorded strong net sales including MSN (VND -766 billion), FUESSVFL (VND 570 billion), VIC (VND -467 billion), VNM (VND -460 billion),… Except for FUESSVFL which is mainly traded by agreement, most of the sales were made through matching orders.

In contrast, the stock that was bought the most strongly since the beginning of the year is the retail industry representative MWG with VND 1,466 billion. For about a month now, foreign capital has shown signs of returning to fill the “foreign room” at The Gioi Di Dong. The ownership ratio of foreign investors in MWG as of the end of April 26 was approximately 46.5%, the highest level since November 2023, corresponding to the number of shares that foreign investors can buy more than 37 million units.

In addition, the list of net purchases recorded the HNX floor code as PVS with a value of VND 635 billion. MBB, HPG, SBT, and KDJ were also net bought for over VND 200 billion in each code.

The net selling trend of foreign investors has continued to dominate the stock market for the past few years. In 2023, foreign investors sold a net of nearly VND 23,000 billion. Some comments suggest that foreign capital only sells net due to portfolio restructuring and does not impact the overall market too much. However, it must be said that despite accounting for only over 10% of trading volume, the buying and selling activities of foreign investors still somewhat affect the psychology and decisions of domestic investors.

The net selling pressure partly comes from the capital withdrawal trend taking place in some large ETFs. Typically, the duo of DCVFM VNDiamond ETF (FUEVFVND) and DCVFM VN30 ETF (E1VFVN30) from Dragon Capital have been net withdrawn thousands of billions of VND since the beginning of the year, including contributions from Thai investors selling off.

According to Mr. Nguyen Anh Khoa, the foreign bloc’s net selling momentum may arise from several reasons. Firstly, the interest rate differential between the Vietnamese market and the US makes investing in the Vietnamese stock market less attractive. Secondly, investment flows worldwide tend to flow into technology stocks, while the Vietnamese market has almost none. However, foreign capital can return when the FED begins the rate cuts this year and the Vietnamese stock market is upgraded.

At the conference to deploy the stock market tasks in 2024, Prime Minister Pham Minh Chinh directed the ministries and branches to drastically promote solutions so that Vietnam can upgrade its market from frontier to emerging in 2025. According to the World Bank’s calculation, if it is upgraded to an emerging market, Vietnam’s stock market could attract USD 25 billion of indirect investment capital from international investors up to 2030.