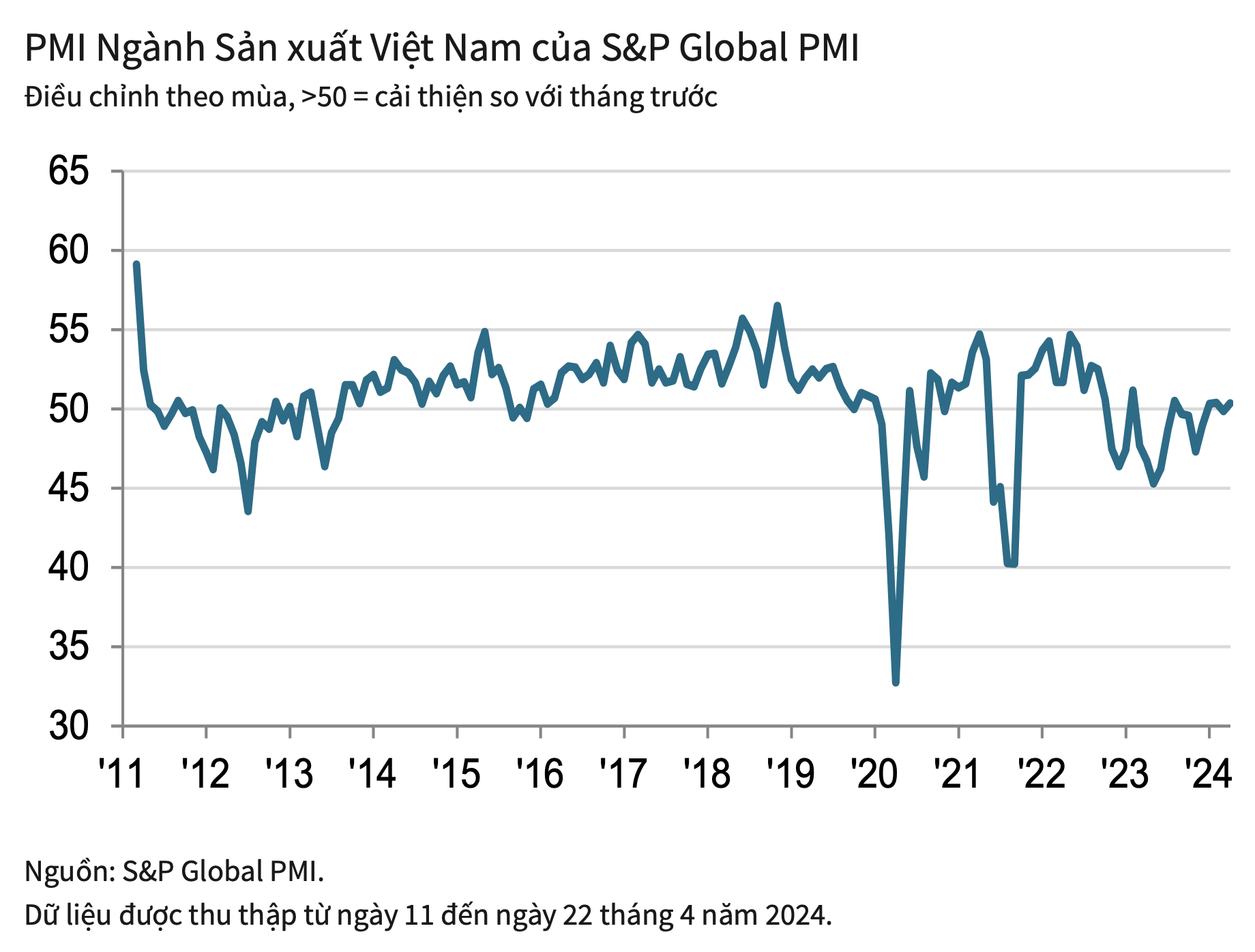

According to the report, the PMI of Vietnam’s manufacturing sector rebounded above the 50-point mark in April, standing at 50.3 points. This indicates a modest improvement in the health of Vietnam’s manufacturing sector compared to the 49.9 points recorded in March.

The S&P Global report attributes this positive development to a robust increase in new orders, marking the fastest pace of growth since August 2022. Survey respondents noted improvements in market demand and success in acquiring new clients.

Moreover, there was also a slight increase in new export orders in April 2024, although the pace of growth was slower than that of total new orders. S&P Global experts also highlighted the role of goods prices in contributing to the increase in new orders during the month. Selling prices declined for the second consecutive month as businesses faced pressure to reduce prices and accommodate customer discounts.

Input costs continued to show a slight upward trend in April, driven by increases in oil, sugar, and transportation expenses. However, the modest nature of these increases allowed companies to absorb them without putting excessive pressure on profit margins.

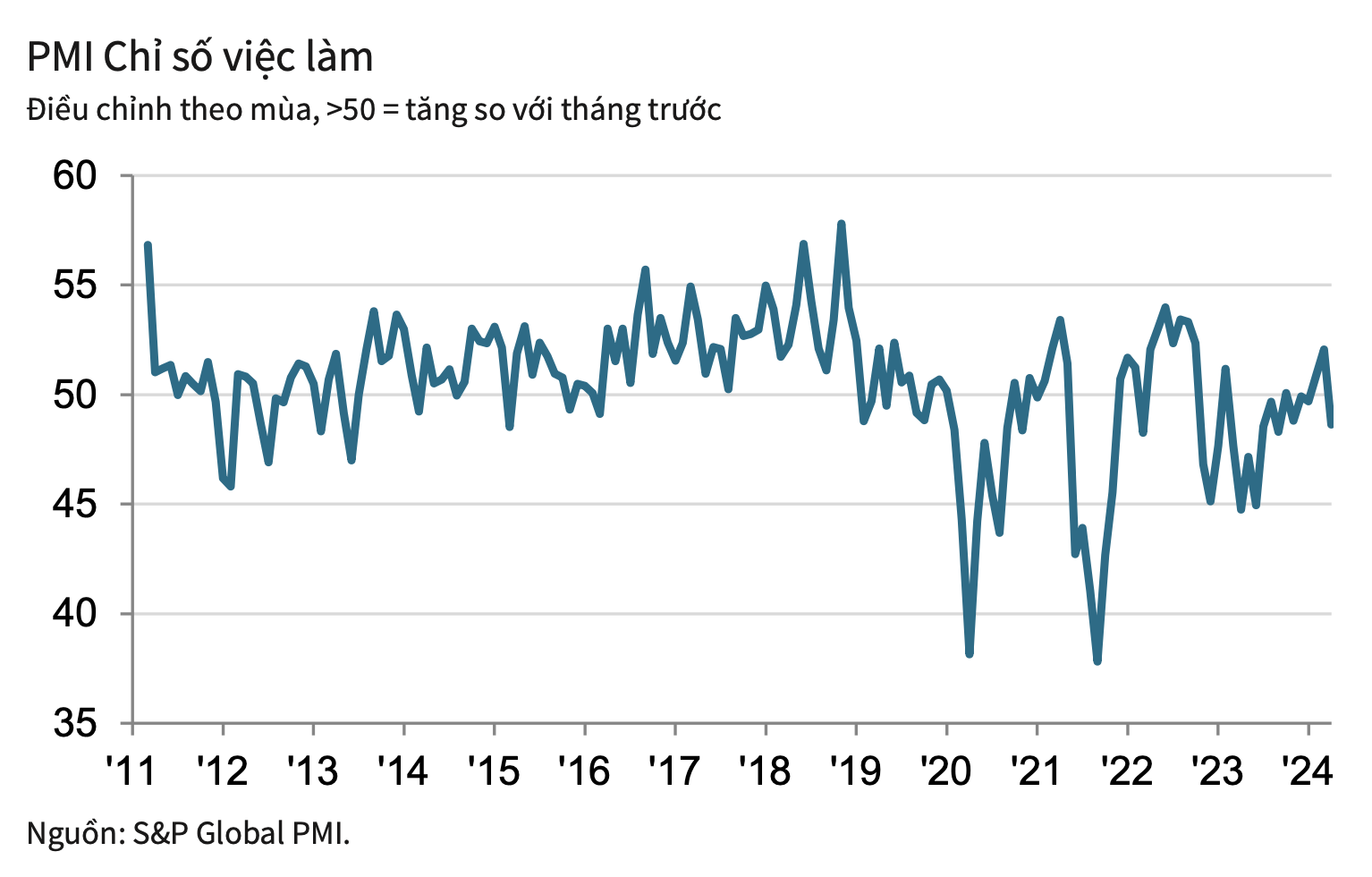

The report also indicates that the surge in new orders led to a modest increase in production volumes in Vietnam’s manufacturing sector. Despite the growth in both orders and output in April, the prevailing demand weakness has led companies to reduce employment for the first time in three months.

However, S&P Global notes that the reduction in staffing levels amid a rebound in new orders has resulted in companies struggling to fulfill orders on time. This has led to a modest increase in backlogs of work after three months of decline.

Furthermore, purchasing activity increased for the first time in six months in response to the rise in new orders. However, the pace of growth remained relatively subdued as companies remained cautious about accumulating excessive inventories. In fact, stocks of purchased items declined further.

Similarly, stocks of finished goods also fell, partly reflecting the need to meet the rapidly growing new orders while production capacity remains constrained.

Supplier delivery times remained unchanged in April, ending a three-month period of lengthening delivery times. Some companies reported that inventory held by suppliers helped to expedite deliveries.

Recent market volatility has weighed on business sentiment, which fell to a three-month low. However, hopes of stable to improving demand in the coming months underpinned optimism that output will increase over the next year.

Commenting on Vietnam’s manufacturing sector in April, Andrew Harker, Economics Director at S&P Global Market Intelligence, said: “New orders for Vietnam’s manufacturers rebounded encouragingly in April, following weakness seen recently. There were also some signs that the upturn may have caught firms by surprise, as they scaled back employment in response to the downturn in demand, leading to a rise in backlogs of work.

“As a result, it is likely that some of these workers will be rehired in the near future. More broadly, the recent volatility in new orders has left companies anxious about the future. Hopefully, we will see a more settled environment in the coming months, which will allow manufacturers to plan production and resource inputs more effectively,” Harker added.