Source: VietstockFinance

|

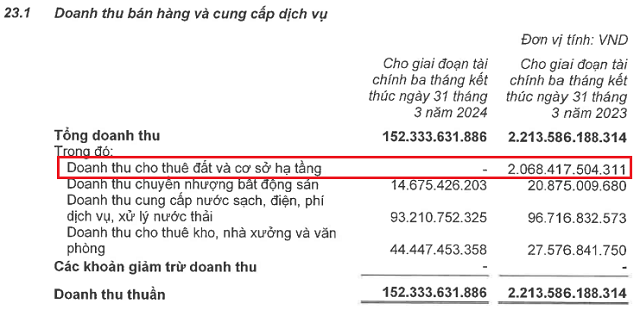

In the first quarter of 2024, KBC recorded revenue of over VND 152 billion, a 93% decrease compared to the same period last year. The main reason is that the Company did not record any revenue from leasing land and infrastructure of industrial parks (IZs). In the same period, this core business of KBC reached over VND 2.068 billion.

Source: KBC

|

After deducting the cost of goods sold, gross profit was nearly VND 74 billion, a decrease of 95%. Thus, the gross profit margin decreased from 70% in the same period to over 48%. Financial revenue also decreased by 56% to nearly VND 68 billion.

Although during the period, KBC‘s total expenses decreased by 55% to nearly VND 169 billion, it was not enough to offset the large “loss” from revenue. As a result, Kinh Bac City lost nearly VND 86 billion, while in the same period it gained nearly VND 941 billion.

| KBC‘s Net Income from Q1/2020 – Q4/2023 |

At the Extraordinary General Meeting of Shareholders in 2024 held at the end of March 2024, KBC approved the 2024 business plan with total consolidated revenue of VND 9,000 billion and profit after tax of VND 4,000 billion, respectively increasing by 47% and 80% compared to 2023.

Mr. Dang Thanh Tam, Chairman of KBC, said that in the first quarter of 2024, KBC‘s business activities were “difficult” and not as favorable as in the first quarter of the previous year. KBC hopes to have major projects in the coming time so that when the market recovers, foreign investment in Vietnam will be stronger, and KBC will be the leading unit in that growth.

Compared to the plan, KBC has only achieved 2% of the total revenue target and is still far from the profit after tax target after the first quarter.

Low share prices in IZ real estate businesses: What did the Chairman of KBC say?

Cash in banks surged to over VND 6,200 billion

As of the end of March, KBC‘s total assets were over VND 39,337 billion, an increase of 18% compared to the beginning of the year. Notably, deposits at banks skyrocketed to nearly VND 6,229 billion, 7.4 times higher than the beginning of the period and accounting for 16% of total assets; of which, the majority are term deposits from 4-12 months at commercial banks with interest rates from 3.5-6%/year (over VND 5,658 billion).

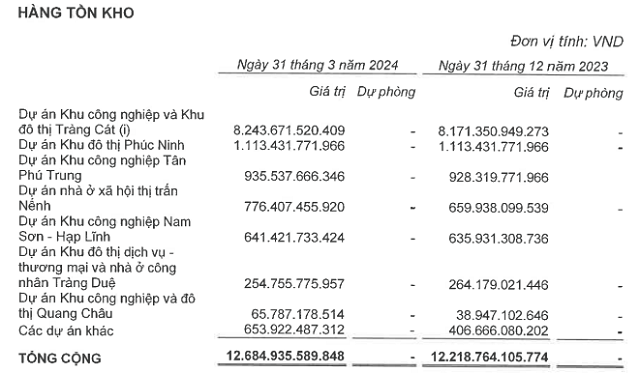

Inventories were recorded at nearly VND 12,685 billion, an increase of 4% compared to the beginning of the period and accounting for 32% of total assets; mainly concentrated in the Trang Cat IZ and urban area project at nearly VND 8,244 billion, the Phu Ninh urban area project at over VND 1,113 billion, the Tan Phu Trung IZ project at nearly VND 936 billion, etc…

Source: KBC

|

On the other side of the balance sheet, KBC‘s liabilities increased by 45% to over VND 19,193 billion. Of which, short-term and long-term financial borrowings were over VND 4,003 billion, an increase of 9% compared to the beginning of the period and accounting for 21% of total debt.