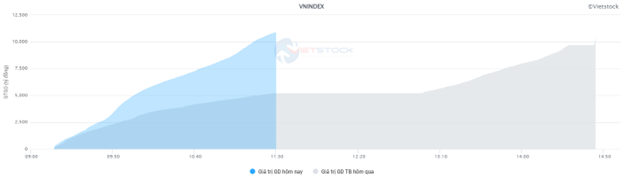

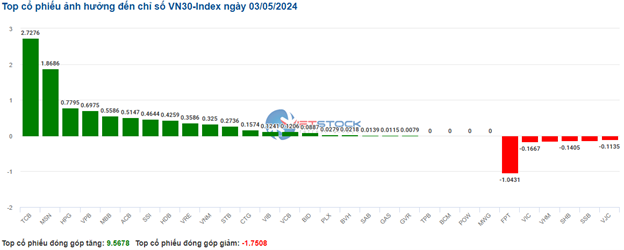

The breadth of the VN30 index is mostly covered in a rather positive green. Among which, TCB, MSN, HPG, and VPB contributed 2.73 points, 1.87 points, 0.78 points, and 0.69 points in that order to VN30-Index. Meanwhile, FPT, VIC, VHM, and SHB are the stocks still under selling pressure and took away more than 1 point from the general index.

Source: VietstockFinance

|

Leading the current uptrend is the banking group which currently has over 60% of the stock codes covered in green. Specifically with some typical codes such as SSI increasing 1.3%, VND decreasing 1.48%, VCI decreasing 1.4%, and HCM decreasing 2.09%… Only 2 codes are left decreasing, namely TVS and VFS, but the decrease is less than 1%.

Furthermore, the group of banking stocks also has a quite good growth rate and a breadth that leans towards the buying direction. Standing out are TCB with a 2.56% increase, BID with a 0.61% increase, CTG with a 0.62% increase, VPB with a 0.82% increase, and ACB with a 0.74% increase…

On the other hand, the real estate group is also an industry supporting the general uptrend of the market but is quite strongly differentiated. In terms of buying, the codes VRE, KDH, KBC, and PDR maintain an increase of around 1.02% to 2.86%… Meanwhile, VHM and VIC are the 2 big players with not very positive developments and have a strong impact on this industry group. As of 10:40 am, this was the industry group with the leading trading value in the entire market, reaching over 787 billion VND, and the matched volume reaching over 36 million units.

A contrasting development with a rather negative red color in the retail stock group. Currently, this is the group that is under quite a lot of selling pressure when investors are trading quite concentratedly in 3 large-cap stocks, namely MWG decreasing by 0.18%, PNJ decreasing by 0.42%, and FRT decreasing by 0.91%.

Compared to the beginning of the session, buyers and sellers were fiercely competitive, with over 960 codes standing still, and buyers somewhat gaining an advantage as the number of losing codes is 193 (17 floor-losing codes), while the number of increasing codes is 391 (32 ceiling-increasing codes.)

Source: VietstockFinance

|

Opening: The market is positive early in the session, and stock prices are breaking out

The market opened the session of May 03 with a positive sentiment. VN-Index turned green right from the beginning of the session. As of 9:30, the index gained more than 5 points, reaching 1,221.45 points. Meanwhile, HNX-Index increased by 1.15 points, reaching 228.64 points.

Buyers are optimistic. With 350 stocks increasing and over 121 stocks decreasing, it is clear that the buying force is prevailing.

Yesterday (02/05), Prime Minister Pham Minh Chinh signed and issued Directive No. 14/CT-TTg dated May 2, 2024, on implementing the monetary policy management tasks for 2024. Accordingly, the Prime Minister requested the State Bank of Vietnam (SBV) direct credit institutions to reduce costs to strive to decrease the lending interest rate to a reasonable level.

At the same time, closely monitor the world and domestic situations to forecast and manage monetary policy proactively, flexibly, promptly, and effectively, especially harmoniously and reasonably managing between interest rates and exchange rates. Effectively manage credit growth associated with macroeconomic stability, inflation control, economic growth promotion, ensuring the safe operation of banks and the system of credit institutions.

The group of stock market stocks are at the top of the list leading the market this morning with a 1.34% increase along with stock codes such as FTS (+2.02%), SSI (+0.86%), VND (+1.23%), VCI(+1.19%), HCM (+1.52%), SHS (+1.1%), MBS (+1.12%), BSI (+3.16%), VIX (+1.49%),…

Besides, the group of banking stocks also recorded positive growth at the beginning of the session with an 0.81% increase along with stock codes such as TCB (+2.77%), MBB (+1.34%), BID (+0.81%), CTG (+0.93%), VPB (+0.82%),…