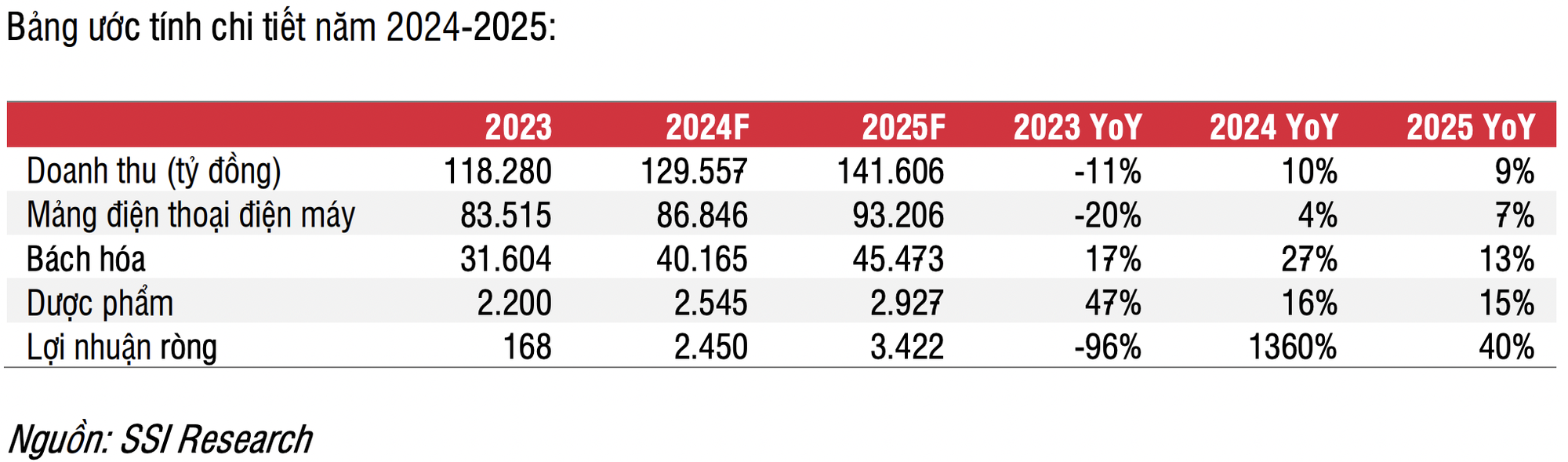

According to the consolidated financial report of the first quarter of 2024 by Mobile World Investment Corporation (code MWG), Bach Hoa Xanh Joint Stock Company (BHX) recorded an additional loss of 105 billion VND in the first 3 months of the year. Accumulated from 2016 to now, Bach Hoa Xanh has lost nearly 8,757 billion VND.

It is worth noting that the loss figure has decreased significantly compared to the heavy loss in previous years. For Bach Hoa Xanh, the supermarket chain lost 354 billion VND before tax in the first quarter of 2023 and 1,257 billion VND in the whole year of 2023. Thus, the loss in the first quarter of 2024 was only 1/3 of the same period last year.

Similarly, MWG’s pharmaceutical segment has not yet been able to “bring money home” as An Khang Pharmacy chain lost nearly 70 billion VND in taxes in the first quarter of 2024, more positive than in the first quarter of last year when the pharmacy chain lost more than 74 billion. Accumulated from 2016 to the end of the first 3 months of this year, An Khang has lost more than 731 billion VND.

Bach Hoa Xanh shows clear positive signs

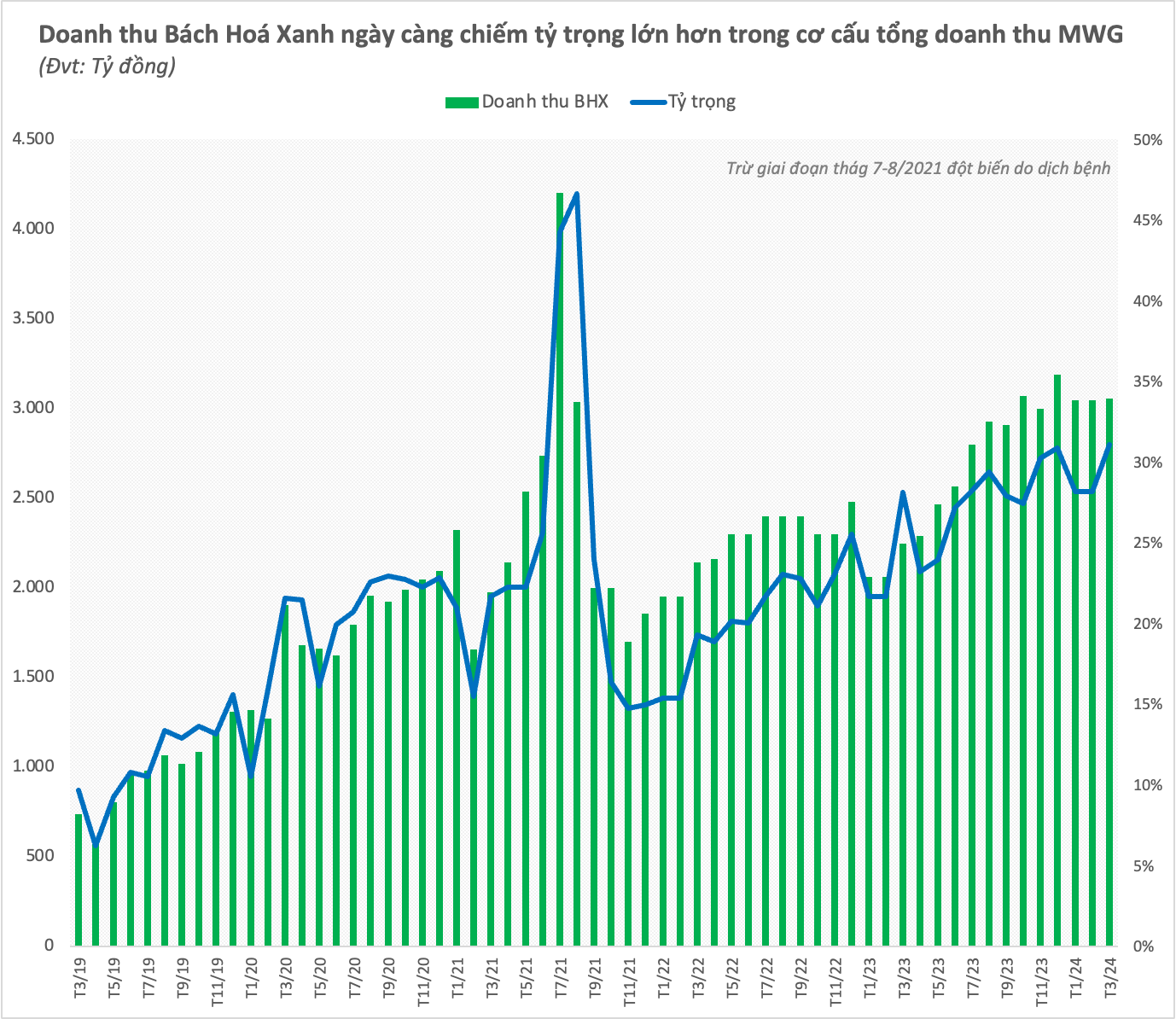

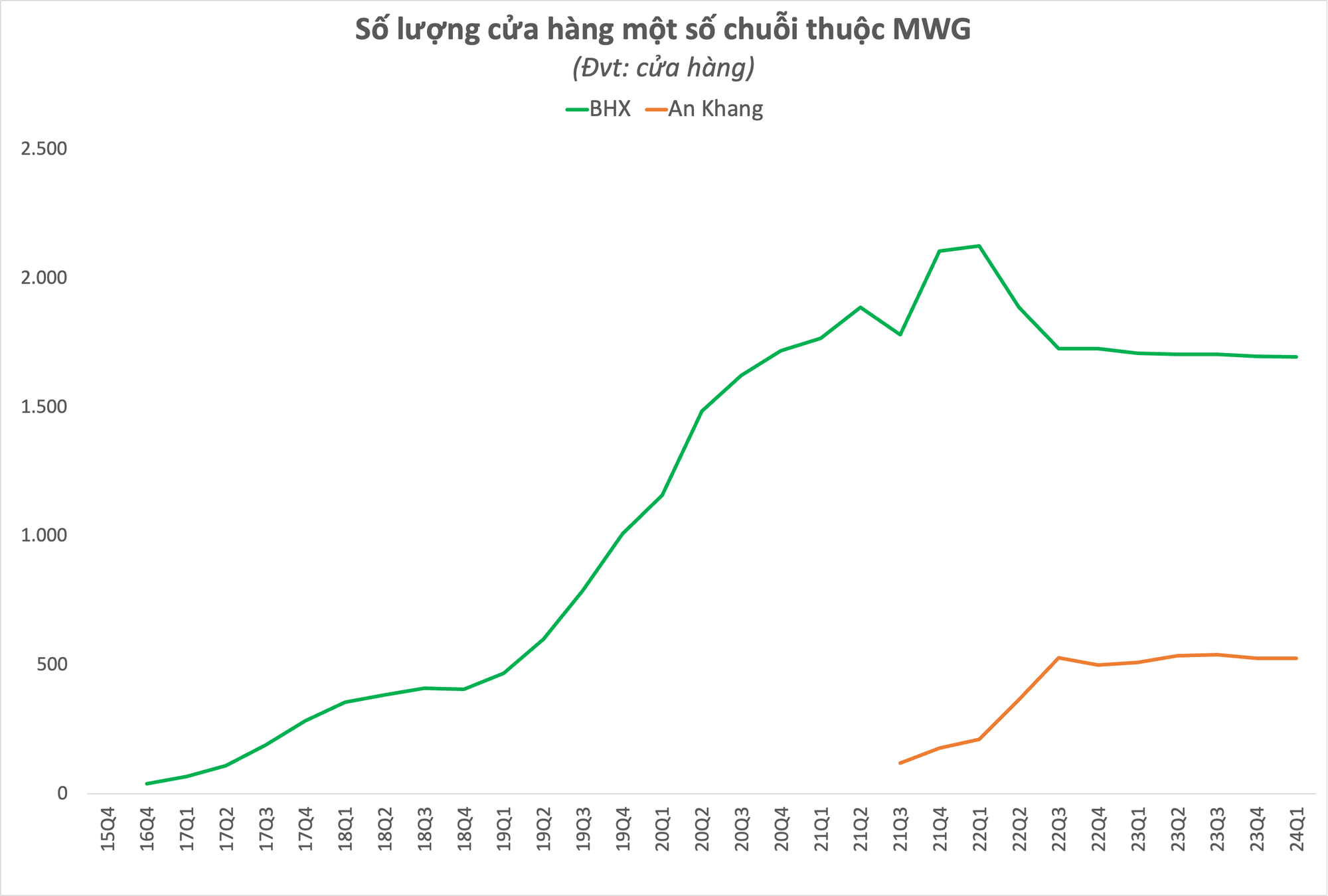

It can be seen that, although it has not yet made a profit, more positive signs have also appeared for the retail and supermarket business segment of Mobile World. In which, Bach Hoa Xanh’s significant narrowing of its loss was made in the context of revenue growth every month, officially reaching and maintaining the breakeven point after all expenses corresponding to actual operations. Average revenue currently reaches 1.8 billion VND/store/month.

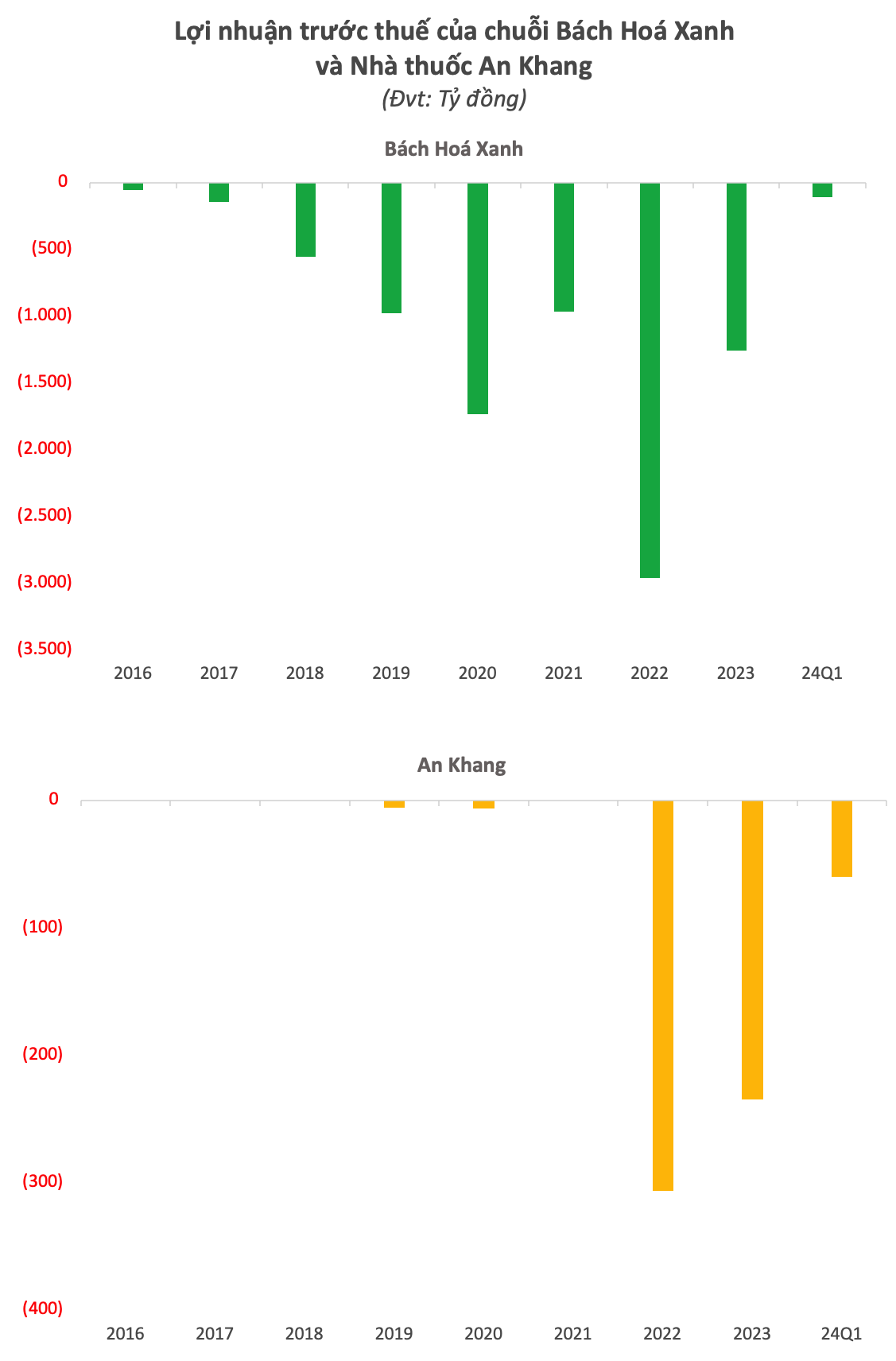

In the first quarter of 2024, Bach Hoa Xanh chain’s revenue reached 9,149 billion, up 44% compared to the same period last year and accounting for more than 29% of the group’s total revenue, an unprecedentedly high figure since the supermarket chain went into operation. It is easy to see that Bach Hoa Xanh is increasingly accounting for a larger proportion of MWG’s total revenue structure.

MWG believes that thanks to the restructuring efforts, despite the strong revenue growth, costs have been well controlled even during the Tet Lunar New Year peak period. On the basis of core business operations, Bach Hoa Xanh still maintains the breakeven point after all expenses corresponding to current operational reality (except for February, which is a special month because the chain has a Tet holiday and does not operate enough days).

In particular, MWG expects business results in the second quarter of 2024 to improve more positively as average revenue tends to continue to increase in April and Bach Hoa Xanh is closely following the targets of reducing the operating cost ratio on revenue, especially logistics costs.

An Khang has yet to make a profit

For the An Khang pharmacy chain, MWG aims to maintain double-digit growth in 2024, optimizing operations through product portfolio diversification, enhancing pharmacists’ consulting capacity, and applying technology. MWG plans to expand market share and achieve the breakeven point corresponding to the average revenue per store of 550 million VND, from 450 million VND at the end of 2023. The leadership team determined that An Khang’s business model is a chain of pharmacies in convenient, easy-to-access locations, with a compact area of about 30-40 m2, but still ensuring display factors and enough medicine to serve most of the needs of the customers. It is estimated that drugs will account for about 65-70% of the product portfolio.

The strategy of temporarily suspending new openings continues and the chain does not plan to open new stores before reaching the breakeven point. As of the end of the first quarter of 2024, An Khang had 526 stores, down 1 store compared to the end of last year.

“This year, An Khang can enter the expansion phase if the operation is stable, effective, and a successful business model is built,” shared the leadership of MWG.

In fact, An Khang is still facing fierce competition with other modern retail pharmacies such as Long Chau, Pharmacity, or thousands of retail pharmacies that have been available on the market for decades. An Khang’s operating model has many similarities with the Long Chau chain, but according to the assessment of buyers, An Khang’s location is not “prime” and the selling price is not as competitive as the drugstore chain belonging to FPT Retail.

In addition, because An Khang does not focus much on prescription drugs for chronic diseases like Long Chau, it will be difficult for An Khang to gain market share from the hospital pharmacy channel.

In a recent report, SSI Securities stated that An Khang still has the opportunity to gain market share from smaller pharmacies in the long term thanks to the factor of having electronic invoices, helping patients to make compensation claims from private health insurance, and drugs with a clear origin is the primary concern of patients. SSI Research believes that in the short term, An Khang pharmacy needs to refine the product portfolio in a more diverse direction, this will take a lot of time, so the pharmacy chain may still not make a profit in 2024 and 2025.

SSI Research estimates that An Khang pharmacy chain revenue will reach 2,500 billion in 2024 (up 16% year-on-year) and 2,900 billion VND (up 15% year-on-year) in 2024, but losses of 339 billion VND and 243 billion VND, respectively.