In its newly released strategic report, BSC Securities assesses that Q1 2024 marks a shift from “economic bottoming” to the “early stage of economic recovery.” Against the backdrop of low-profit levels in 2023, coupled with a clear recovery in Q1 industry profit growth and the narrative of market upgrade, BSC believes that the market will continue the “bull market” trend. Stock investment performance will be closely linked to corporate earnings results and growth potential in the 2024-2025 period.

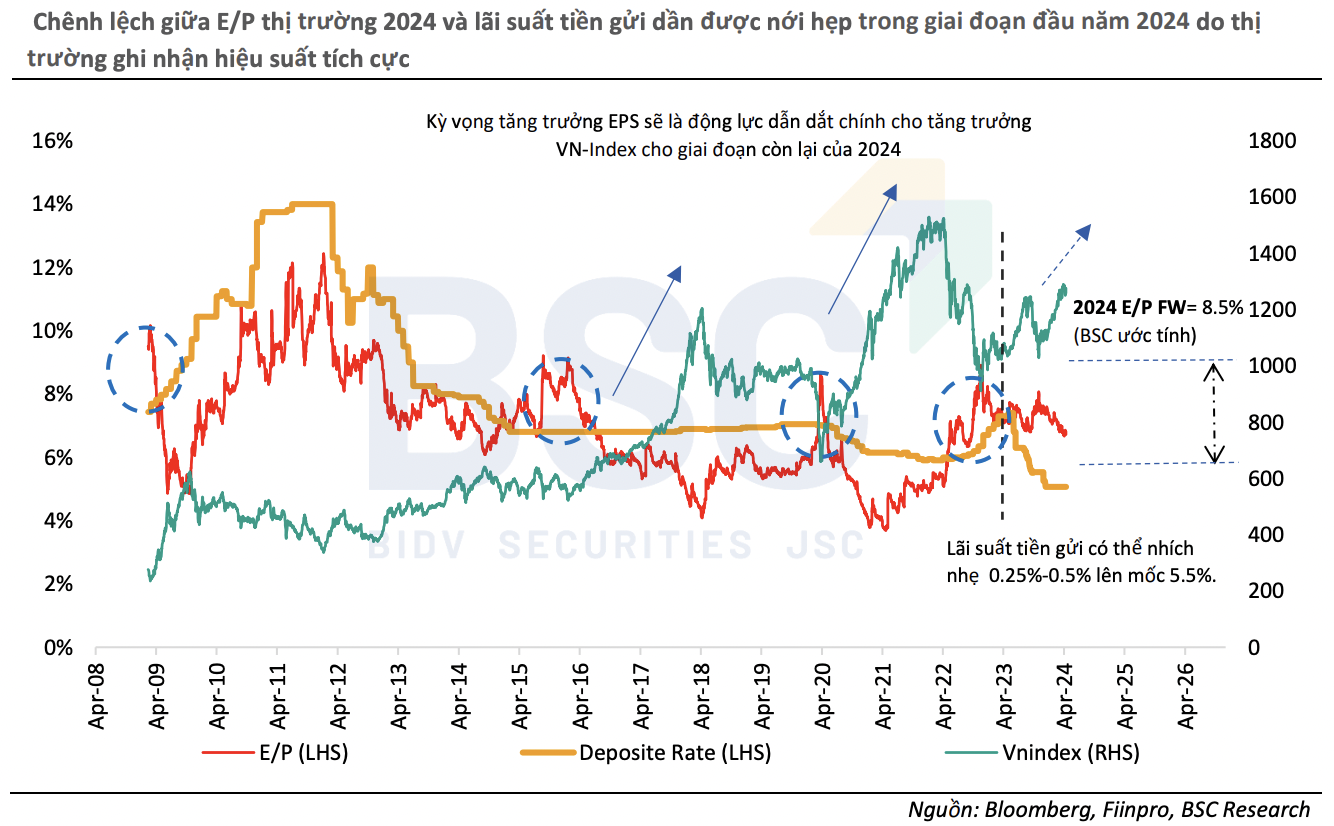

“Expectations of economic recovery and corporate profit improvement are driving the narrowing gap between the VN-Index’s P/E ratio and deposit interest rates. In the second half of 2024, deposit rates may inch up slightly by 0.25%-0.5% in the base case scenario to near Covid-era levels in 2021, but this is still low compared to the 2015-2020 period,” the BSC report states.

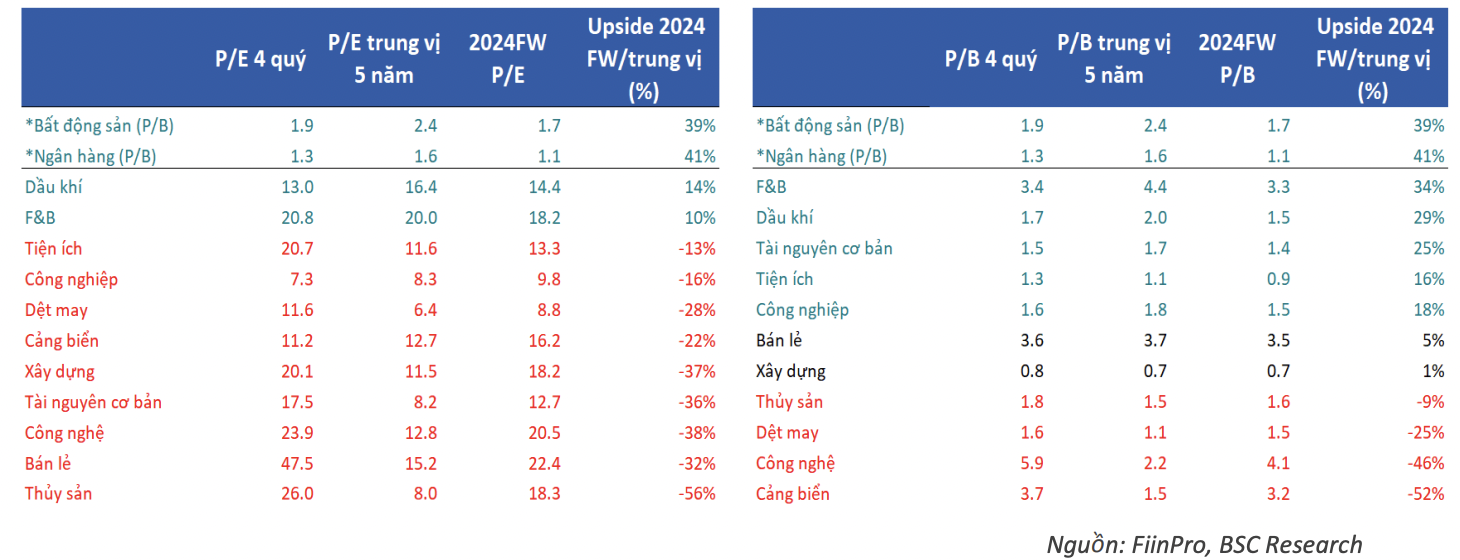

Based on Q1 2024 business results, the profit recovery pace of the overall market in 2024F remains promising at ~20% year-on-year, thus continuing to create a market earnings yield gap compared to savings deposits, attracting more funds to flow into the stock market. The pace of corporate profit growth will remain a core factor for the market’s medium and long-term expectations, similar to the 2016-2018 and 2020-2022 periods. Market valuations also indicate that stock groups are reasonably priced at the beginning of a new cycle.

BSC recommends that investors in 2024 choose “real earnings” over “expectations.” The pace of profit recovery will be a decisive factor for investors to consider to avoid falling into a “value trap” where seemingly cheap stocks fail to recover and grow.

According to BSC, opportunities will be more selective, coming from sectors that have (1) low profits in Q2-Q3 2023, (2) the ability to maintain improving absolute profit levels quarter-on-quarter, and (3) profit margins tending to recover in the last three consecutive quarters.

Based on these conditions, BSC projects that several sectors may attract capital inflows in the coming period, including (1) banking, (2) retail, (3) tourism and entertainment, (4) personal and household goods, (5) chemicals, (6) automobiles and components, (7) basic resources, construction, and building materials, and (8) oil and gas. BSC continues to emphasize its focus on leading stocks within these sectors, which tend to benefit earlier compared to smaller companies due to their advantages.

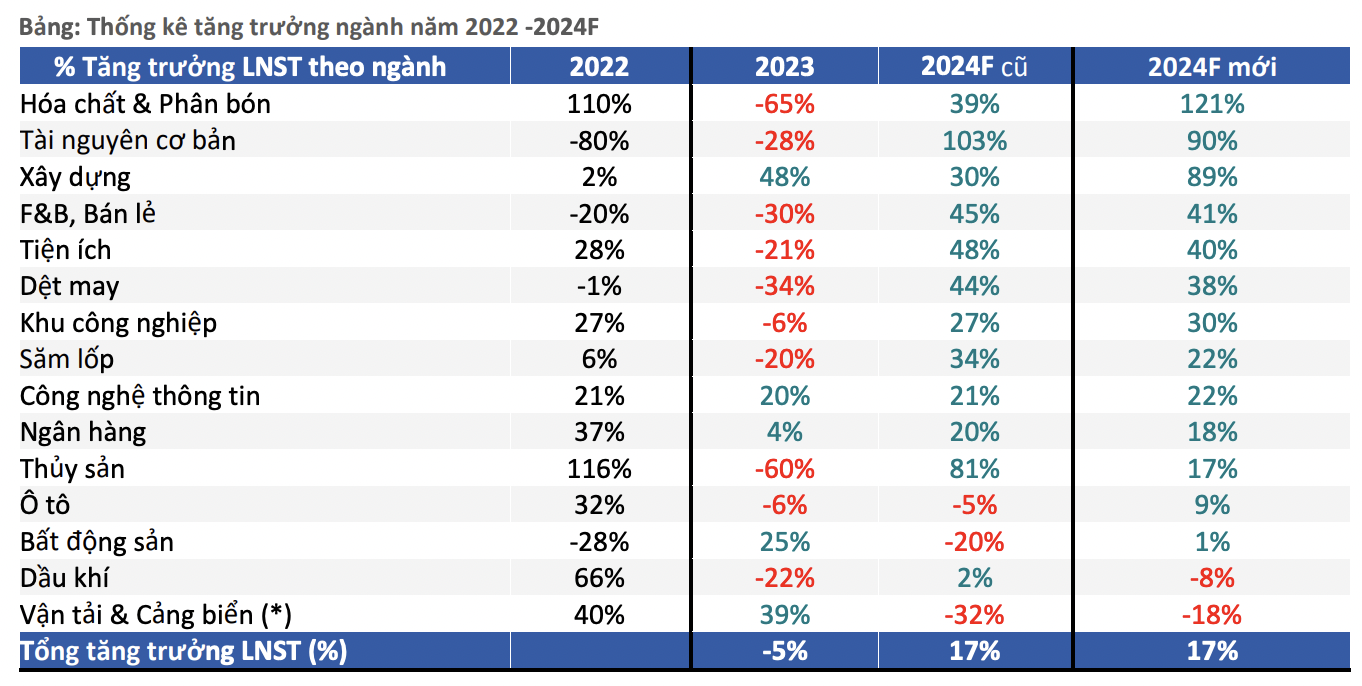

At the same time, BSC adjusts its 2024 profit growth projections, expecting a strong recovery from the low base in the previous year, including chemicals and fertilizers (+121%), basic resources (+90%), construction (+89%), retail and F&B (+45%), utilities (+40%), textiles (+38%), industrial parks (+30%), and banking (+18%).

(*) Excluding profit from port sales