Sanvinest’s Annual General Meeting: Discussing Future Plans and Strategies

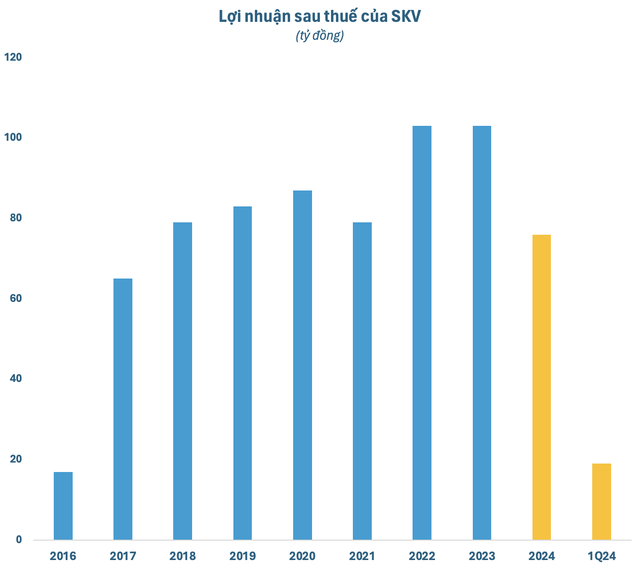

On May 6th, Sanvinest, the leading beverage company specializing in bird’s nest products, held its annual general meeting to discuss important matters. The meeting reflected on the company’s impressive performance in 2023, with record-high revenue of VND 2,121 billion and a net profit of over VND 103 billion. As a result, a 30.1% cash dividend was approved for 2023.

Looking ahead, Sanvinest has set a cautious tone for 2024, with revenue and net profit targets of VND 1,700 billion and VND 76 billion, respectively. These figures represent a 21% and 26% decrease from the previous year. The company also plans to increase its focus on export markets, particularly China, with a target of VND 250 billion in exports for 2024.

To support this growth, Sanvinest has adjusted the scale of its premium beverage factory, increasing its capacity to 30,000 products per hour, and investing VND 344 billion. Additionally, the company has approved a collaboration program to invest in house-based swiftlet farming in several provinces, aiming for sustainable sourcing of bird’s nest.

Sanvinest’s products on display.

First-quarter performance dip attributed to strategic decisions

Sanvinest’s first-quarter consolidated financial statements revealed a 42% drop in revenue and a 37% decrease in net profit compared to the same period in 2023. This dip was addressed by Ms. Trinh Thi Hong Van, Chairwoman of the Board, who attributed it to strategic decisions made in 2023. She explained that to meet the ambitious revenue targets for the company’s 20th anniversary, Sanvinest allowed its distribution system to import a large volume of products, including those needed for the first months of 2024. This resulted in a significant impact on the first quarter of 2024.

Additionally, the company’s performance targets for 2024 were adjusted downwards to align with market conditions and purchasing power. As a result, Sanvinest’s leadership agreed to modify its business targets for 2024, ensuring feasibility and long-term sustainability while safeguarding shareholder interests.

To enhance competitiveness, Sanvinest has been diversifying its product portfolio. In late 2023, the company launched a new line of Sanvinest Khanh Hoa Bird’s Nest essence products, featuring five compact, elegantly packaged, and high-quality offerings. This year, Sanvinest plans to further enhance the packaging and expand distribution across traditional channels, hospitals, and supermarkets. The company is also committed to introducing and selling these products through a professional sales team and PGs, with the goal of making the essence line a primary revenue driver in the future. For its traditional glass bottle and can products, Sanvinest has increased the bird’s nest content while maintaining prices to stay competitive in the challenging market.

Regarding the significant increase in accounts receivable at the end of 2023, Mr. Nguyen Khoa Bao, CEO of Sanvinest, explained that the company allowed its distribution system to maintain high inventory levels and offered extended payment terms to its distributors and agents. As a result, customer receivables saw a substantial spike. However, Sanvinest actively monitors and collects debts, and any distributor or agent failing to meet payment deadlines will have their reward programs reduced or cut. As of the first quarter of 2024, the company has successfully recovered the full amount of the VND 258 billion in receivables.

Partnerships and export ambitions

Sanvinest has obtained the necessary licenses for direct exports to China and has established an official partnership in this market. In the last two months of 2023, the company exported products worth VND 6 billion to China. While China presents a significant opportunity, the company’s leadership acknowledges that building a distribution network there will take time.

In April 2024, Sanvinest signed a business cooperation agreement with Tong Ren Tang, a prominent state-owned Chinese company specializing in traditional Chinese medicines, including bird’s nest, ginseng, and mushrooms. Representatives from Tong Ren Tang visited Sanvinest’s raw material processing plant and were highly impressed. The two companies are expected to sign a contract and place orders for bird’s nest products in the near future.

Sanvinest’s management has carefully laid out its business strategy for the coming years, including a focus on exports to China. The initial direct exports to China in late 2023 were valued at VND 6 billion, and the company aims to increase this to approximately VND 250 billion in 2024, with further growth expected in subsequent years. To support this ambition, Sanvinest has commissioned the first phase of its raw material processing plant and is proceeding with the second phase, which includes constructing a premium beverage factory with a capacity of 30,000 products per hour and a total investment of VND 420 billion. Additionally, the company will implement a collaborative program to invest in house-based swiftlet farming to secure a stable supply of raw materials and control production costs.

Benefitting from favorable borrowing rates

Regarding the expansion of the premium beverage factory’s capacity in the second phase, the Board of Directors has adjusted the project’s scope to include a capacity of 30,000 products per hour and additional facilities such as a product introduction center, office building, auditorium, worker accommodation, traditional house, auxiliary house, and underground water tank. The total adjusted investment for the project is VND 420 billion.

For the second phase, Sanvinest will utilize its development investment fund of VND 80 billion, borrow VND 220 billion, and contribute VND 47 billion from its own capital. The company’s management emphasized that they are taking advantage of the government’s policy to promote bank credit to stimulate economic growth, resulting in relatively low borrowing costs. Despite increasing debt as the project progresses, Sanvinest is confident in its ability to manage cash flow and ensure timely repayment of principal and interest while maintaining business efficiency.

As a large and reputable enterprise, Sanvinest has consistently enjoyed credit limits and preferential interest rates from banks. Additionally, the company benefited from the government’s 2% production support program in 2022 and 2023. In practice, Sanvinest’s interest rates in 2023 ranged from 2.8% to 5% annually. The company also took advantage of the competitive savings interest rates offered by banks in early 2023, earning 6-7% on its deposits. Currently, Sanvinest is borrowing from VCB Khanh Hoa at preferential rates, with 2-month, 3-month, and 6-month terms at 2.3%, 2.5%, and 3.4%, respectively. The company’s leadership is committed to seeking bank loans to minimize financial costs.