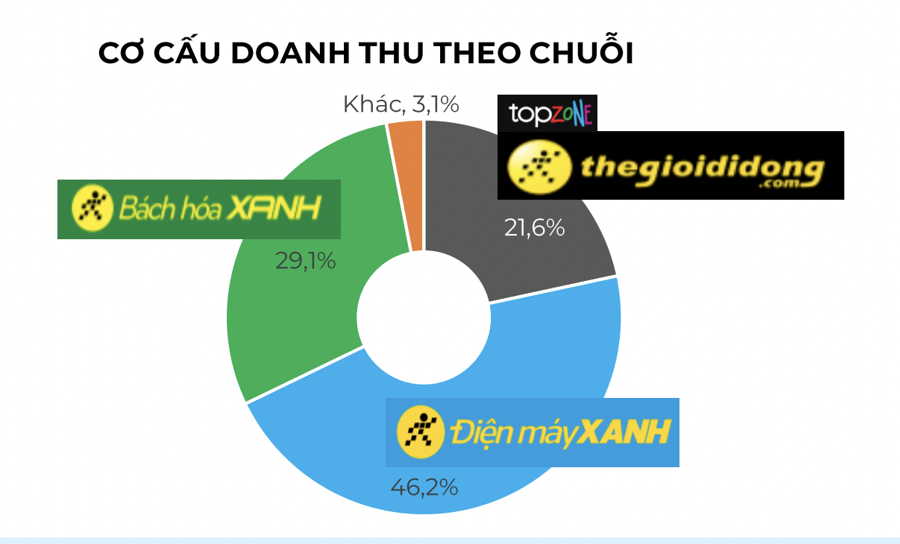

Bach Hoa Xanh, a leading Vietnamese retailer, announced impressive financial results with a revenue of over 3.2 trillion VND, marking a 40% growth compared to the same period last year. The average revenue per store reached approximately 1.9 billion VND, showcasing a strong performance.

Bach Hoa Xanh’s Impressive Performance and Future Prospects

During a recent investor meeting, MWG’s leadership shared insightful information about the company’s operations and financial health.

Mr. Nguyen Duc Tai, Chairman of MWG, reiterated the company’s philosophy: “At The Gioi Di Dong, we don’t focus on our competitors; we focus on our customers. We strive to meet their current needs and even anticipate their desires and future changes. By doing so, we earn their support and loyalty.”

Mr. Tai also addressed the dissolution of two subsidiaries, 4KFarm and Logistics Toan Tin. He assured that the closure of 4KFarm would not impact Bach Hoa Xanh’s profit goals. The decision to disband these companies was part of a strategic restructuring plan to enhance efficiency. 4KFarm, despite producing high-quality and safe vegetables, incurred high production costs, making it challenging for consumers to accept the product’s pricing.

Regarding Toan Tin, the goal was to provide logistics services externally, but the profits were meager compared to the scale of the operation. As a result, they decided to refocus and exclusively serve Dien May Xanh.

Mr. Tai shared his satisfaction with Bach Hoa Xanh’s performance, stating that while they initially aimed for a simple revenue of 1.2 billion VND per store, they have now surpassed expectations, reaching 1.9 billion VND and potentially achieving over 2 billion VND. However, he acknowledged the time and effort required to attain this success.

For 2024, the goal is to prioritize profitability over aggressive expansion. They aim to open new Bach Hoa Xanh stores while maintaining a profitable position.

Positive Outlook for The Gioi Di Dong and Dien May Xanh

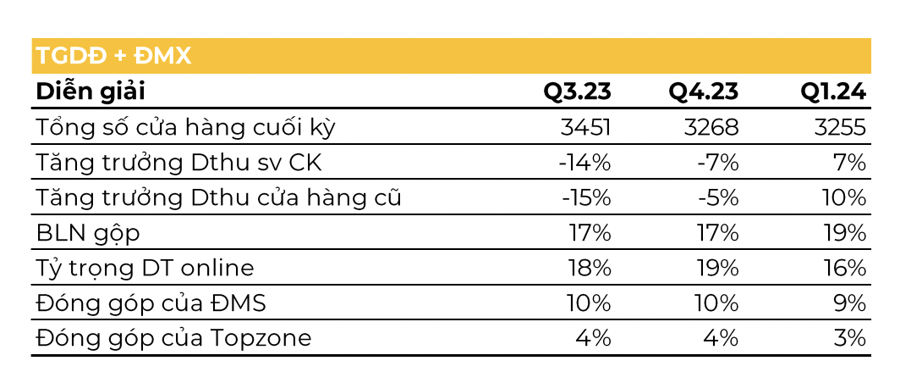

Mr. Doan Van Hieu Em provided insights into The Gioi Di Dong and Dien May Xanh’s performance and future prospects. With the early arrival of hot weather and its expected longevity, there is a heightened demand for cooling products such as air conditioners, refrigerators, and coolers. The company has thoroughly prepared in terms of product inventory, promotional programs, and especially installation services for air conditioners, setting them apart from the competition.

Mr. Hieu Em expressed confidence in achieving exceptional results this year. “In the first quarter, and continuing into the second quarter and beyond, we have prepared well in terms of resources to maximize sales opportunities and create a ‘water flowing into a trough’ effect,” he said. He also mentioned the successful large-scale restructuring, which reduced operating costs, and affirmed their determination to achieve the revenue and profit targets approved by the General Meeting of Shareholders.

Market research showed a 15% decline in the mobile phone market in the first quarter, while The Gioi Di Dong achieved a 5% growth. Similarly, the entire electrical appliance market grew by 6%, but Dien May Xanh outperformed with a 12% increase.

Consumer finance loans currently account for 30% of the company’s revenue, and this ratio is expected to increase due to rising consumer demand. Despite a challenging external market, The Gioi Di Dong and Dien May Xanh are poised to deliver differentiated results.

During the meeting, the company’s leadership also addressed the significant increase in salary expenses compared to the same period in 2023. They explained that in 2023, when the company faced challenges, a policy was implemented where high-level and middle-level management shared the difficulties by reducing or forgoing their salaries and bonuses to minimize the impact on employee income. With the improvement in business performance, this policy was discontinued, resulting in a notable increase in salary expenses in the first quarter of 2024.

The reduction in the number of employees during this period was mainly due to voluntary resignations, with a very low rate of involuntary departures. The company strategically reduced less efficient positions, ranging from lower to higher levels, across all provinces and cities in Vietnam.