Market liquidity increased from the previous trading session, with the VN-Index matching volume reaching over 666 million shares, equivalent to a value of more than VND 16 trillion; HNX-Index reached nearly 80 million shares, equivalent to a value of over VND 1.7 trillion.

VN-Index opened the afternoon session with a tug-of-war between buyers and sellers, but positive signals quickly returned as buying pressure pushed the index higher, closing at the day’s high. In terms of impact, GVR, BID, CTG, and VJC were the most positive influences on the VN-Index, contributing over 5.6 points to the index. On the other hand, DHG, HDB, and GMD were the most negative influences, taking away more than 0.3 points from the index.

| Top stocks impacting the VN-Index on May 6, 2024 |

HNX-Index followed a similar trajectory, positively influenced by IDC (3.89%), PVS (3.05%), SHS (3.3%), and MBS (3.75%), among others.

|

Source: VietstockFinance

|

The securities sector was the top-performing industry, surging 4.15%, led by FTS (+6.97%) and BSI (+6.86%). This was followed by the plastics & chemicals manufacturing sector and the transportation & warehousing sector, which rose 3.9% and 3.63%, respectively. On the other hand, the healthcare sector was the only group to post a significant decline of -1.42%, dragged down by DHG (-3.96%), DBD (-0.19%), and TRA (-0.37%).

In terms of foreign trading activities, foreign investors continued to be net buyers on the HOSE exchange, focusing on stocks such as MWG (VND 100 billion), DIG (VND 43 billion), PDR (VND 38 billion), and VND (VND 37 billion). On the HNX exchange, foreign investors net bought nearly VND 60 billion, mainly in IDC (VND 23 billion) and PVS (VND 9 billion).

| Foreign Trading Activities |

Morning Session: Securities Stocks Lift VN-Index

The VN-Index closed the morning session up 14.45 points, or 1.18%, at 1,235.48 points, near the intraday high.

As of 11:30 am, the HOSE index closed near the intraday high, mainly thanks to the strong performance and upward momentum of securities stocks.

SSI and VND rose over 3%, while HCM and FTS surged 5.67% and 6.79%, respectively. Notably, BSI hit the daily limit up of 6.86% towards the end of the morning session. Other securities stocks, including SHS, MBS, VIX, CTS, AGR, VDS, and TVS, also provided strong support to the VN-Index. It is also worth mentioning the positive contribution of VCI, a large-cap stock, which jumped more than 4%.

Closely following was the plastics & chemicals manufacturing sector, rising 3.38%, with GVR up 5.61%, DGC up 3.03%, and DCM and DPM up 1.09% and 1.24%, respectively.

In the construction materials sector, steel stocks continued to make positive contributions, with HPG up 1.57%, followed by HSG (+2.25%), NKG (+3.51%), and POM (+3.03%). Other construction material stocks, such as VCS (+1.08%), VGC (+2.53%), HT1 (+2.74%), and FCM (+2.22%), also played a significant role in the sector’s performance.

10:40 am: Market Leaning Towards the Upside

VN-Index rose 10.50 points, trading around 1,231 points. HNX-Index gained 2.38 points, trading around 230 points.

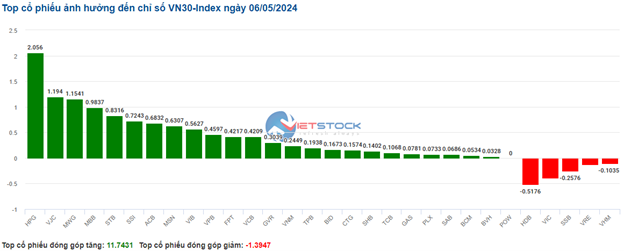

Most stocks in the VN30 basket witnessed strong buying interest. Notably, HPG, VJC, MWG, and MBB contributed 2.05 points, 1.19 points, 1.15 points, and 0.98 points to the VN30 index, respectively. On the other hand, HDB, VIC, SSB, and VRE faced selling pressure, dragging the index down by more than 1 point.

Source: VietstockFinance

|

The upward momentum was driven by the securities sector, which witnessed a nearly absolute dominance of green on the screen. Specifically, SSI rose 2.16%, VND gained 2.96%, VCI climbed 2.89%, and HCM advanced 4.35%… Only VFS faced selling pressure, but the decline was negligible.

Following the securities sector was the banking sector, which also displayed a similar level of strength. Specifically, VCB added 0.54%, BID rose 1.32%, CTG increased 0.31%, and TCB gained 0.21%…

While the real estate sector also contributed to the market’s upward momentum, it exhibited some degree of divergence, with green slightly outweighing red. Stocks like BCM, NVL, KBC, and PDR… rose over 1%. However, the big three of VIC, VHM, and VRE remained in negative territory, falling 0.79%, 0.36%, and 1.07%, respectively.

Compared to the opening, buyers maintained their upper hand. There were 466 gainers (including 22 stocks hitting the ceiling price) and 161 losers (including 12 stocks hitting the floor price).

Source: VietstockFinance

|

Market Open: Positive Start to the Session

Building on the gains from previous sessions, the VN-Index advanced, supported by the VN30 basket, wholesale, and securities sectors.

As of 9:30 am, green dominated the VN30 basket, with 21 gainers, 7 losers, and 2 stocks trading flat. Notable gainers from the opening included PLX (+1.39%), MSN (+1.00%), MWG (+0.36%), SSI (+0.87%), VIB (+0.94%), and MBB (+0.89%). On the other hand, HDB and VIC were among the top losers, falling (-1.43%) and (-1.24%), respectively…

Additionally, the wholesale sector contributed significantly to the market’s performance, rising 1.4%. Stocks in this sector recorded gains, including PLX (+1.39%), DGW (+1.19%), PET (+0.21%), and VFG (+3.22%).

Following closely was the securities sector, which climbed 1.07%. This gain was mainly driven by stocks such as VCI (+1.18%), HCM (+0.95%), BSI (+1.18%), SSI (+0.87%), VND (+0.74%), SHS (+1.1%), FTS (+1.28%), VIX (+0.89%), and MBS (+0.37%).