The Deputy Prime Minister, Le Minh Khai, has signed Decision 426/QD-TTg, dated May 17, 2024, approving the ratio of state capital held in the Industrial Investment and Development Corporation (Becamex IDC) from 2024 to 2025.

The decision states that the approved ratio of state capital held in Becamex IDC will decrease from 95.44% of charter capital to over 65% by the end of 2025.

It also abolishes the plan for the arrangement of BCM (number 29) under Section 2 of the Plan for Maintaining State Capital, which is included in Appendix III of the Decision No. 1479/QD-TTg dated November 29, 2022, issued by the Prime Minister, approving the plan for rearranging enterprises with state capital and state-owned enterprises for the 2022-2025 period.

Becamex IDC is known as the “king” of industrial parks in Binh Duong province and is also the leading infrastructure developer in Vietnam. With seven directly operated industrial parks covering a total area of over 4,700 hectares, Becamex IDC is the largest industrial park investor in Binh Duong province, holding more than 30% of the provincial market share and ranking third in Vietnam with a 3.6% national market share.

In addition, Becamex IDC has also ventured into a joint venture with a Singaporean company to establish the Vietnam-Singapore Industrial Park Joint Venture Company (VSIP), in which Becamex IDC owns 49% of the capital. VSIP is a leading developer of integrated industrial parks and urban areas in Vietnam, with 12 projects across the country spanning over 10,000 hectares.

With nearly 50 years of development, Becamex IDC has 23 member companies operating in various fields, including industrial parks, construction, commerce, real estate, services, telecommunications, information technology, building materials, ports, education, and healthcare. Many of these enterprises are listed on the stock exchange, such as the Binh Duong Business and Development Joint Stock Company (TDC), Becamex IJC (IJC), Becamex ACC (ACC), and Becamex BCE (BCE).

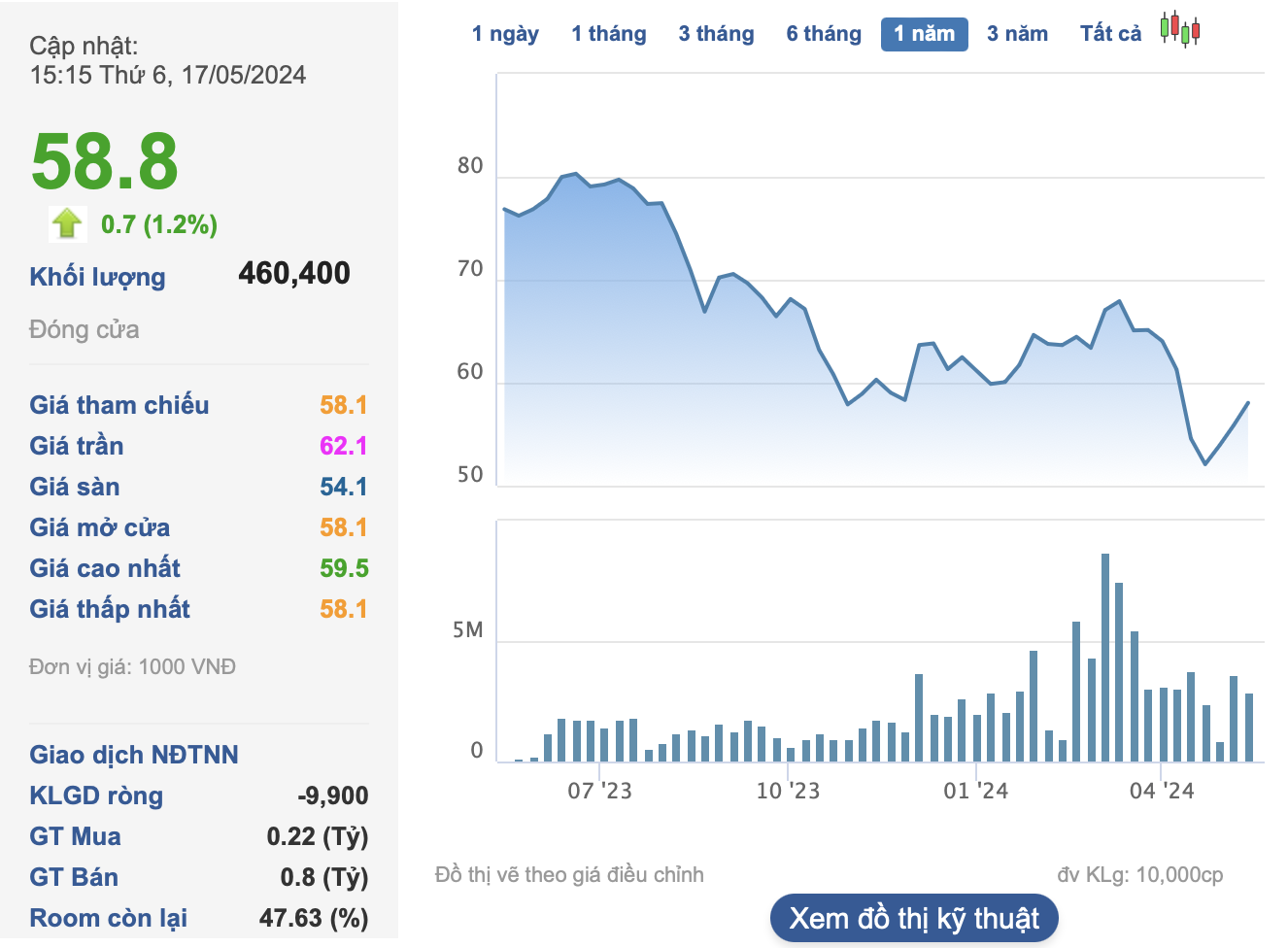

The BCM stock was first traded on UPCoM in 2018 and later listed on the HoSE in August 2020. Currently, the BCM share price stands at 58,800 VND per share, reflecting a nearly 14% increase over the past month but still 6.5% lower than the beginning of the year. The corresponding market capitalization is nearly VND 61,000 billion (USD 2.5 billion).

At a recent meeting with exemplary state-owned enterprises, chaired by Prime Minister Pham Minh Chinh and Deputy Prime Ministers Le Minh Khai and Tran Luu Quang, Mr. Quang Van Viet Cuong, Deputy General Director of Becamex IDC, shared that the corporation aims to achieve a market capitalization of over USD 5 billion by 2025.

In terms of financial performance for the first quarter of 2024, Becamex IDC recorded a slight increase of 3% in revenue compared to the same period in 2023, amounting to VND 812 billion. After deducting the cost of goods sold and expenses, the company reported a post-tax profit of VND 119 billion in the first quarter of 2024, representing a 60% surge compared to the previous year. The net profit stood at VND 118 billion.

In a related development, on May 27, 2024, Becamex IDC will finalize the list of shareholders eligible to attend the upcoming annual general meeting of shareholders, scheduled to be held in Binh Duong on June 27, 2024.