Low-Interest Rates Spur Investors to Seek Alternative Investments, Boosting Vietnam’s Stock Market

The persistently low-interest rates on 12-month fixed deposits, which have remained below 5% annually for over a year, have caused a significant shift in investment behavior. Disenchanted with the low returns offered by banks, investors have been seeking alternative investment avenues, with the stock market emerging as a favored option.

Over $2 Billion Inflows into the Stock Market

As of the end of March 2024, total deposits stood at 13.4 quadrillion, a decrease of 0.76% from the beginning of the year. Of the 500,000 billion that flowed out of the banking system, a substantial amount found its way into the stock market, alongside gold.

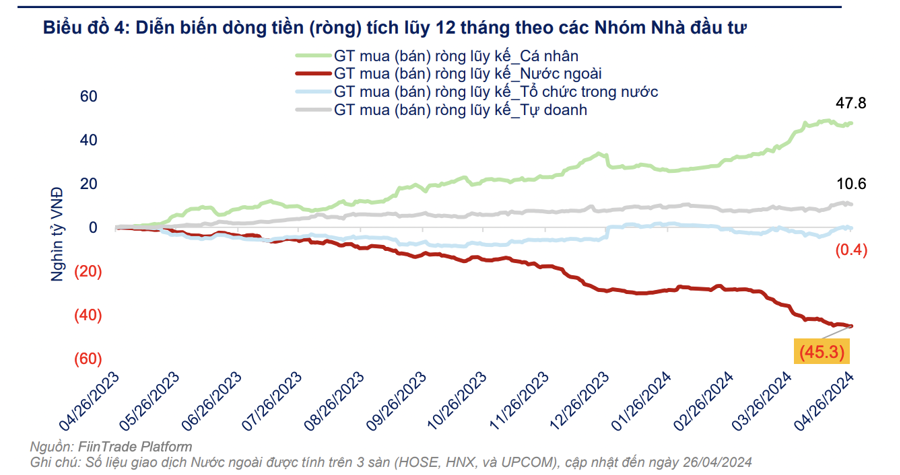

According to statistics, domestic individual investors net bought 4,130 billion VND in April, bringing the total net purchase value since the beginning of the year to 20,440 billion VND. In the 12 months since April 2023, domestic individuals have been net buyers of nearly 48,000 billion VND, while proprietary trading firms have net bought 10,600 billion VND.

Combined, these two groups have net purchased 58,400 billion VND, equivalent to $2.3 billion, according to FiinTrade data.

This strong domestic buying power has counterbalanced foreign outflows. In the first four months of 2024, foreign investors net sold 16,800 billion VND, equivalent to 73.9% of the net selling value in 2023 (over 22,800 billion VND). In the past 12 months, foreign investors have net sold a total of 45,300 billion VND, with significant selling activity in December 2023 and March 2024.

In the over 20-year history of Vietnam’s stock market, the current domestic capital inflows are among the strongest, second only to the boom of 2021 when nearly $4 billion in net purchases propelled the VN-Index beyond the 1,500-point mark. Compared to previous years, the pace of net buying by domestic investors is unprecedented.

As a result, market liquidity has improved significantly in the initial months of the year, with trading volumes of 30,000-40,000 billion VND becoming a regular occurrence. The market is only taken by surprise when volumes dip to around 20,000 billion VND, sparking various conspiracy theories and tales of accumulation before a market surge.

In reality, securities companies’ investor deposits are hitting record highs in 2024. According to the latest statistics from VnEconomy, based on data from over 70 securities companies, customer deposit balances exceeded 100,000 billion VND as of the end of March 2024, mainly comprising funds deposited by investors trading securities through securities companies. Compared to the figure at the end of 2023, customer deposits have increased by more than 20,000 billion VND.

This marks the fourth consecutive quarter of increasing investor deposits at securities companies, and the highest level on record.

With over 100,000 billion VND at the end of March, the current deposit balance is comparable to the levels seen in early 2022 when the VN-Index peaked at 1,528 points in January of that year. During that period, investor deposits at securities companies consistently remained above the 90,000 billion VND mark, even hitting a record 100,000 billion VND. Subsequently, a surge of money flowed into the market, driving liquidity to unprecedented highs of over $2 billion, and the VN-Index twice breached the 1,528-point mark in Q1/2022.

The inflow of domestic capital has been further bolstered by the opening of over 110,000 new securities accounts in April, bringing the total increase to over 500,000 new accounts since the beginning of 2024.

Will the VN-Index Go on a “Rampage” Like Gold?

The selling pressure from foreign investors has been largely overlooked as domestic investors have taken the driver’s seat in leading the VN-Index. When domestic capital pours in, the index has no choice but to surge, and vice versa.

Looking back at the 2021-2022 period, we can see that in 2021, domestic capital net bought nearly $4 billion, driving the VN-Index to repeatedly set new historical highs, culminating in the 1,500.81-point peak on November 25.

In contrast, in 2022, domestic capital net sold nearly 34,000 billion VND, exerting significant downward pressure on the VN-Index. The market witnessed numerous sessions of sharp declines, with the most dramatic being the session on November 16, 2022, when the VN-Index plummeted to 873.78 points, a 35% drop from its peak of 1,536 points.

Low-interest rates have been a key enabler for domestic capital inflows. During both the 2021 period and the present, interest rates have remained in a low range, flooding the market with cheap money. In 2022, high-interest rates dealt a blow to the stock market.

The current context is even more favorable than the 2021 period. Not only are interest rates maintained below 5%, but the economy is also recovering, and corporate profits are surging from previous lows. The fact that the VN-Index has not risen significantly means that it is attractively valued compared to other global markets, while M&A activity remains vibrant across various sectors.

Notably, the push to upgrade Vietnam’s stock market status is not only making the market more appealing to foreign investors but also transforming the VN-Index into a “gold mine” for domestic investors. Any news about a potential upgrade immediately sends the market into a frenzy.

Recently, BSC Securities expressed optimism that in the near future, by June 2025, Vietnam’s stock market could be considered by MSCI for inclusion in the Watch List for an upgrade to emerging market status. This news instantly excited the market, with securities stocks surging in the trading session on May 15.

While foreign investors have been net sellers, the pace of selling by active funds slowed in April 2024. In that month, the net selling value of active foreign funds was 5,400 billion VND, a decrease of 43.4% compared to the net selling value in March 2024.

“However, the economic growth and listed company profit growth prospects for this year are excellent. The stock market is very attractively valued relative to profit growth. Vietnam’s interest rates have come down, and bank liquidity is favorable. The large moves in the stock market have been unwelcome, but they do not change our positive expectations for the development of the Vietnam index,” remarked the head of Pyn Elite Fund.