The MB Securities Joint Stock Company (MBS) Board of Directors has announced plans to issue shares to existing shareholders to raise charter capital.

Accordingly, MBS will issue over 109.4 million new shares, equivalent to a 4:1 ratio (for every 4 shares held, shareholders will have the right to purchase 1 new share). The offer is made to existing shareholders based on the list of shareholders at the record date, who will be allocated the right to purchase the additional shares. These shares will be freely transferable.

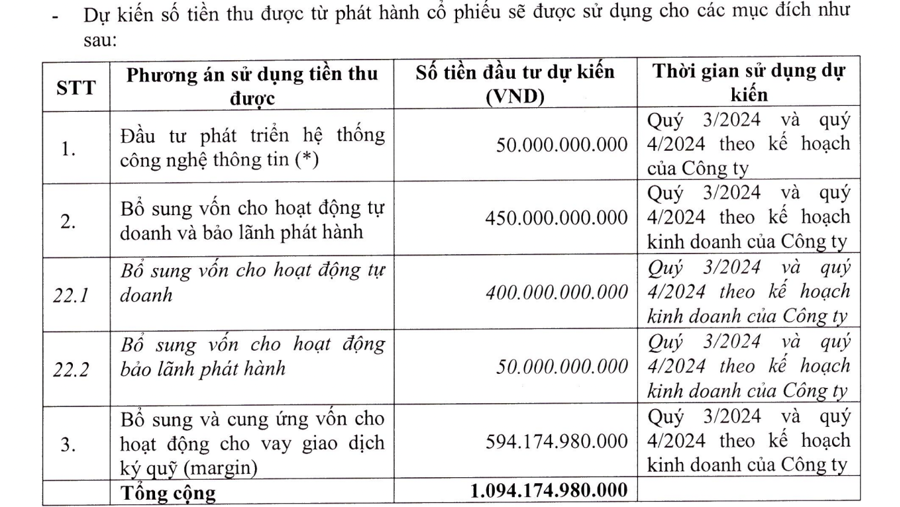

The expected offering price is VND 10,000 per share, while MBS is currently trading at a historical peak of VND 31,600 per share on the stock market. The offering price is one-third of the market price. With this pricing, MBS expects to raise over VND 1,094 billion. MBS plans to allocate VND 50 billion for investment in information technology development, VND 450 billion for proprietary trading and underwriting activities, and VND 594 billion to supplement margin lending capital.

The offering is expected to take place in 2024, after obtaining the approval and registration certificate for public offering from the State Securities Commission of Vietnam.

In addition to this capital increase plan, the MBS General Meeting of Shareholders also approved the issuance of over 28.7 million shares in a private placement to a maximum of 30 professional securities investors. These shares will be subject to a one-year lock-up period from the completion of the offering.

The offering price will be agreed upon but not less than the book value of VND 11,512 per share, corresponding to a minimum proceeds of VND 331 billion. These funds will be used to supplement the company’s working capital for various business activities such as margin lending…

According to MBS, the capital increase is necessary and significant as it aims to enhance the company’s financial strength, increase the scale of operating capital and margin lending, improve MBS’s operational capacity and competitiveness, and offer new financial products to its clients.

At the 2024 Annual General Meeting of Shareholders, Mr. Phan Anh, CEO of MBS, stated that the company’s capital scale is relatively small compared to other securities companies in the market. As of December 31, 2023, MBS’s total equity was VND 5,038 billion, with a charter capital of over VND 4,300 billion, ranking 13th in the securities market. He highlighted that this is the biggest challenge in conducting business activities and serving customers.

Additionally, the competition among securities companies is becoming more intense, with the emergence of new large and small securities companies that are actively increasing their capital. MBS also faces competition in lending rates from Korean securities companies, and the net interest margin (NIM) for lending is narrowing in the race to reduce transaction fees. While lower fees benefit investors, they impact MBS’s business operations.

MBS has been in discussions with three potential foreign strategic partners over the past year, aiming to secure support in terms of capital and technology. Mr. Phan Anh expressed his hope to finalize these partnerships this year.

The MBS management also shared that their target for 2024 is to increase their market share from 5.3% to 7%, a significant challenge that they plan to address by leveraging the customer base of their parent company, MB Bank.

Regarding proprietary trading, MBS’s challenge in recent years has been the lack of aggressive investment in stocks. Therefore, this year, MBS aims to double the scale of proprietary trading compared to 2024, reducing the current pressure on brokerage revenue, which contributes a large proportion to the company’s total revenue. MBS aims to balance its revenue streams, as currently, its revenue from proprietary trading is below 20%, while other market participants derive half of their revenue from this segment.

For 2024, MBS has set ambitious targets, aiming for a revenue of VND 2,786 billion and a pre-tax profit of VND 930 billion, representing a 53% and 30% increase, respectively, compared to the previous year. The company aims for a minimum return on equity (ROE) of 13.8%. If achieved, this would be the highest profit in MBS’s history.