Contrary to expectations, the market did not pick up momentum in the afternoon session, and stock prices did not surge as anticipated. The VN-Index closed 1.15% higher, a modest improvement from the morning session’s close.

Surprisingly, the HoSE matching trading volume decreased by 9.3% in the afternoon compared to the morning, reaching 9,838 billion VND. Including HNX, the overall trading volume dropped by 11.1%. Given the strong upward momentum previously, a more vibrant money flow would have been expected.

Additionally, the breadth of the VN-Index at the end of the day did not show much difference, with 300 stocks rising and 129 falling, slightly worse than the morning session (299 gainers and 102 losers). The price range followed a similar pattern, with 91 stocks on the HoSE rising more than 1% by the closing bell, compared to 95 in the morning.

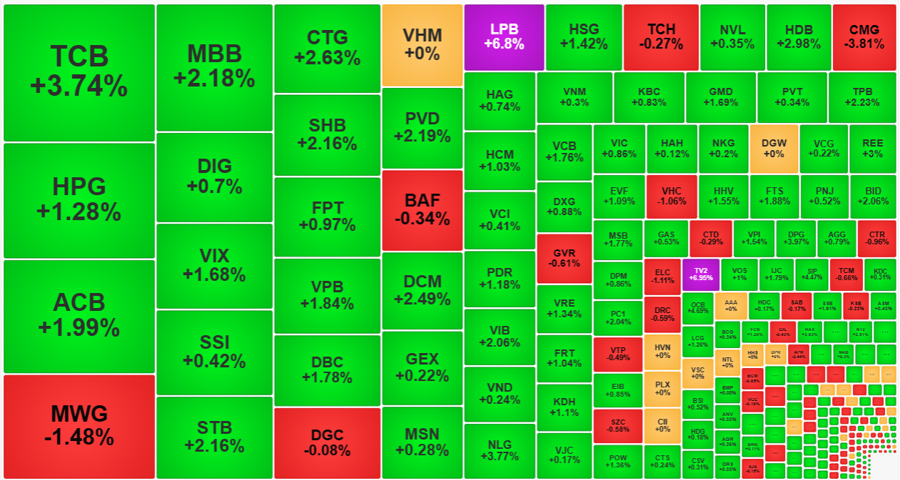

Of course, there were individual stocks that made more significant progress in the afternoon. For instance, in the VN30 basket, 15 stocks rose compared to the morning session’s close, while 13 declined. Most bank stocks continued to perform well. Notably, TCB stood out with a jump from a 2.7% increase to a 3.74% gain, an additional 1.01% rise in the afternoon alone. VCB, the stock with the largest market capitalization in the index, edged up by 0.54%, resulting in a 1.76% gain for the day. This narrow margin was enough for VCB to surpass BID as the stock contributing the most to the index’s gain. TCB also climbed up the ranks and took second place behind VCB. Other bank stocks, including VPB, TPB, SSB, SHB, HDB, and ACB, witnessed positive price improvements in the afternoon.

Bank stocks remained prominent and attracted impressive trading volume. Out of the top 10 stocks supporting the VN-Index, nine belonged to the banking group. In this group, only VBB declined by 2.5%, while SGB and ABB remained unchanged, and the rest recorded gains. Fourteen bank stocks rose over 2%, and six others increased within the range of 1% to 2%.

However, liquidity in this group weakened slightly. The total matching trading volume of bank stocks in the afternoon dropped by 27% compared to the morning session, reaching approximately 2,500 billion VND. This was also a contributing factor to the overall weaker liquidity in the afternoon session.

The robust money flow into bank stocks following supportive news indicates a market thirsty for information. Factors such as financial results, bonus announcements, or additional issuances have become mundane. However, the positive aspect is the significant amount of money waiting on the sidelines, ready to join the market with the right catalyst.

The total matching trading volume on the two listed exchanges today reached approximately 22,840 billion VND, a slight increase of 6% from the previous day. This is the second consecutive trading session where the market has crossed the 20,000-billion-VND threshold, excluding negotiated trades. This trading volume is quite large compared to the recent average. Specifically, in the 15 consecutive sessions before, the average matching trading volume was only about 15,300 billion VND per day, meaning the last two sessions have seen a more than 45% increase in trading volume. The market is approaching the mid-term peak of March 2024, and the rising liquidity indicates a resurgence of excitement. This could be late-stage money from the previous rally phase entering the market with conviction.

Currently, the VN30-Index has surpassed the March 2024 high thanks to the strong performance of bank stocks, but the VN-Index is lagging slightly, still about 1.66% away from its peak. However, with the strength of bank stocks, this gap could be closed within one to two trading sessions. If the VN-Index breaks its record, it will be a significant boost to the current bullish sentiment.