Today’s breakout attempts faced more obstacles, with the market seeing several downturns below the reference level. However, thanks to the rotation of pillars, the VN-Index managed to close with gains for the fourth consecutive session.

Banking stocks were a major disappointment as their upward momentum suddenly vanished overnight. Yesterday, this group led the index higher with a robust performance, but today, only LPB remained among the top performers, rising by 5.45%, while the rest mostly declined or showed meager gains.

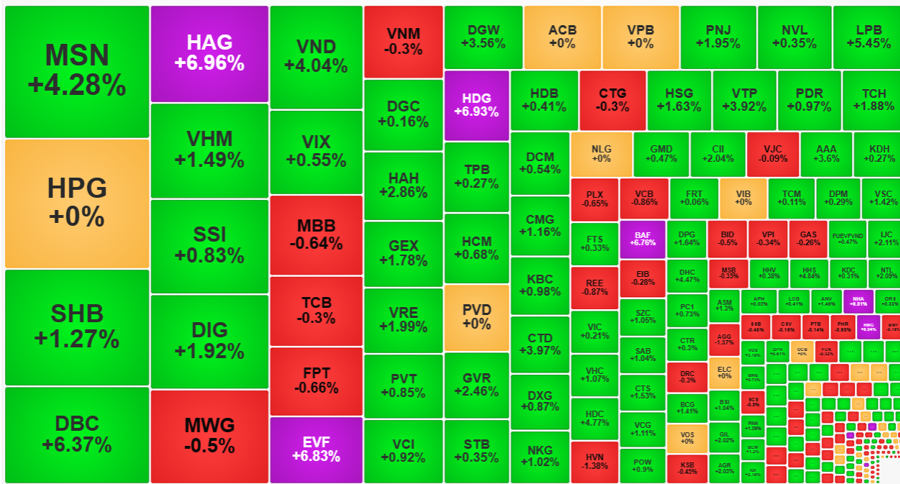

Among the VN30 basket, only four banking stocks closed in the green, and their gains were modest: SHB led with a 1.27% increase, followed by HDB (0.41%), STB (0.35%), and TPB (0.27%). VCB, TCB, SSB, CTG, BID, and MBB were among the decliners. Out of the 27 banking stocks across all exchanges, only ten posted gains.

Liquidity in this sector also took an unexpected plunge, with the total matching value falling by 36% from the previous day to VND3,797 billion, accounting for just 18.5% of the HoSE floor (compared to 28.6% yesterday).

It wasn’t just the banking sector that showed weakness; several large-cap stocks also underperformed. HPG struggled to rise, VIC managed a meager +0.21%, FPT fell by 0.66%, GAS declined by 0.26%, and VNM slipped by 0.3%. Fortunately, the VN-Index was supported by VHM, which climbed by 1.49%, and some mid-cap stocks: GVR (+2.46%), MSN (+4.28%), and SAB (+1.04%). Aside from VHM, the rest are not among the top ten in terms of market capitalization.

In terms of point contribution, no other stock sector could replace banking. This was the primary reason why the VN-Index couldn’t maintain the strength seen in the previous session. The index closed with a 0.34% gain, equivalent to 4.33 points. The VN30-Index’s meager increase of 0.14% further confirmed the lack of momentum in the banking group. This basket closed with 14 gainers and 12 losers.

However, today’s session wasn’t entirely lackluster. Mid- and small-cap stocks regained their momentum. The Midcap index rose by a solid 1.42%, with a dominant breadth of 50 gainers to 14 losers. Smallcaps also joined the rally, climbing by 0.7%. Several midcap stocks even made their way into the leadership group, including LPB, VND (+4.04%), HAG (+6.96%), EVF (+6.83%), PNJ (+1.95%), HDG (+6.93%), and DBC (+6.37%)…

The market breadth also indicated the presence of bottom-fishing cash flow. The VN-Index touched three bottoms below the reference level, and the breadth changed gradually. Specifically, at the first and deepest bottom at 9:30 am, there were only 105 gainers to 180 losers. The second bottom at 10:34 am saw 177 gainers to 205 losers. The third bottom at 2:05 pm had 160 gainers to 254 losers. However, the closing correlation improved significantly, with 234 gainers to 176 losers.

Ninety-two stocks in the gaining group closed with increases of at least 1% above the reference level, accounting for 47.4% of the total matching value on the HoSE floor. This remains a high proportion, especially considering the overall weakness among blue chips. Only four blue-chip stocks stood out: MSN, SHB, VHM, and VRE. The VN30 basket also saw a 15% decline in liquidity compared to the previous session. In contrast, the Midcap group witnessed a more than 10% increase in trading, reaching VND9,363 billion. DBC, HAG, DIG, VND, EVF, HAH, GEX, DGW, PNJ, LPB, and HDG were among the stocks that performed well, with each recording hundreds of billions of VND in liquidity.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)