According to VietstockFinance, the combined revenue of 47 civil construction enterprises listed on the stock exchange reached nearly VND 17.7 trillion in Q1/2024, up 23% over the same period. The total net profit exceeded VND 1.1 trillion, 3.8 times higher than the previous year.

Notably, the profit of Vinaconex, HOSE: VCG, accounted for more than 40% of the total industry profit.

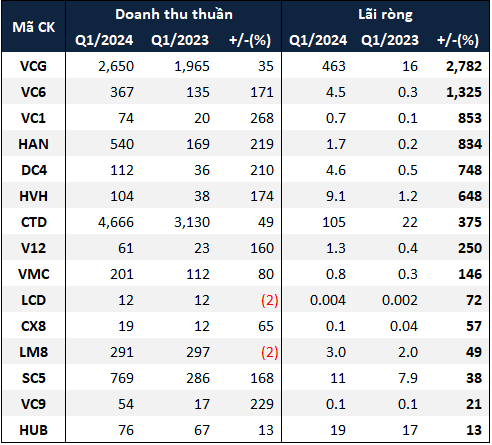

Out of the 47 enterprises in the statistics, 15 reported profit growth. Both VCG and VC6 of HNX saw double-digit growth compared to the low base in Q1/2023.

|

15 construction companies with increased profits in Q1/2024 (in trillion VND)

Source: VietstockFinance

|

Specifically, VCG’s profit reached VND 463 billion, nearly 29 times higher than the same period last year, equivalent to achieving more than 50% of the 2024 profit target in just Q1. VCG attributed this remarkable result to its focus on real estate business operations. However, the financial statements show that the 35% increase in revenue mainly came from the leasing and other services segment, which brought in nearly VND 761 billion, 3.4 times higher than the previous year. The real estate business segment also doubled to over VND 270 billion. The construction segment still accounted for the highest proportion, with nearly VND 1,359 billion, a slight decrease of 1%. In addition, the reduction in interest expenses by almost 40% contributed to the profit improvement.

VC6’s performance was also largely due to a 2.7-fold year-on-year increase in revenue, reaching VND 367 billion, entirely from construction contracts. As a result, the company’s net profit was nearly VND 5 billion, 14 times higher than the previous year.

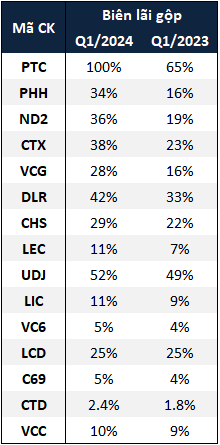

A common factor between VCG and VC6 is the improvement in their gross profit margins in Q1/2024. VC6’s margin increased by 1 percentage point, while VCG’s margin surged by 12 percentage points.

|

Construction companies with improved gross profit margins in Q1/2024

Source: VietstockFinance

|

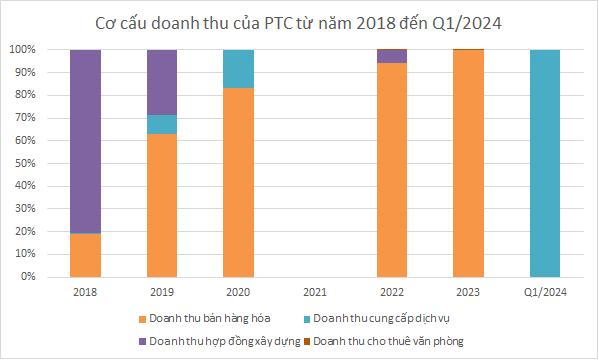

Notably, PTC of HOSE achieved a perfect 100% gross profit margin. This was due to the company only generating revenue from services (with no cost of goods sold) during the period, while its office rental, electricity sales, and construction contract segments did not bring in any revenue.

* PTC had no revenue in 2021 – Source: Author’s compilation

|

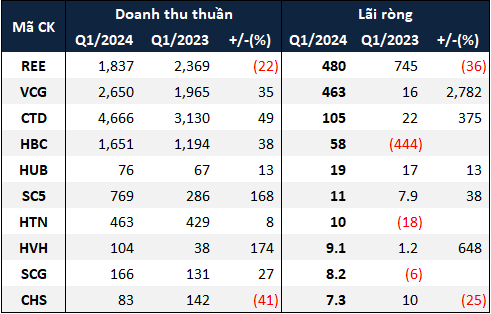

The exceptional profit growth propelled VCG to the second position in the top 10 construction companies with the highest net profit, only behind REE. Two industry giants, CTD of HOSE and HBC of HOSE, also made it to this list.

According to the financial statements for Q3 of the 2024 fiscal year (from Jan 1 to Mar 31, 2024), CTD recorded revenue of nearly VND 4,666 billion, 1.5 times higher than the same period last year, thanks to a corresponding increase in construction contract revenue, reaching nearly VND 4,660 billion. Additionally, CTD benefited from a one-off gain of over VND 58 billion in profit from a bargain purchase. With a net profit of VND 105 billion, CTD returned to the VND 100 billion profit milestone for the first time since Q3/2020.

HBC returned to profitability in Q1 with a net profit of nearly VND 58 billion, compared to a loss of VND 444 billion in the same period last year. This improvement was due to the absence of below-cost business and a significant increase in financial income, which reached nearly VND 114 billion, compared to less than VND 3 billion in the previous year. This was mainly attributed to a gain of over VND 109 billion from the sale of investments.

|

Top 10 construction companies with the highest net profit in Q1/2024 (in trillion VND)

Source: VietstockFinance

|

Challenges Ahead

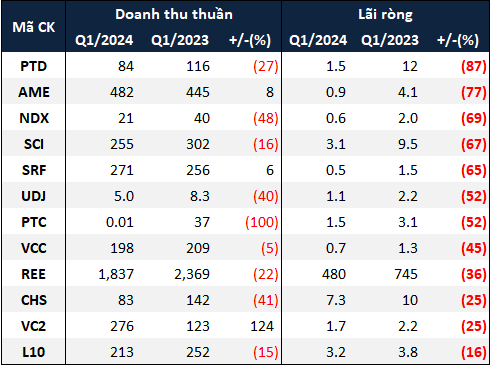

Alongside the companies with positive results, 12 enterprises reported a decline in profits, and 13 companies incurred losses in Q1.

Most of the companies with reduced profits experienced a contraction in revenue. PTD of HNX witnessed the sharpest decline in profit, at 87%, with a net profit of just over VND 1.5 billion. Its revenue also decreased by 27%, amounting to VND 84 billion.

However, not all companies with increased revenue saw profit growth. Notably, AME of HNX and SRF of HOSE experienced a 77% and 65% drop in net profit, respectively, despite an 8% and 6% rise in revenue.

AME faced challenges due to a significant increase in interest and management expenses, resulting in a net profit of less than VND 1 billion. On the other hand, SRF’s cost of goods sold grew faster than its revenue, and its management expenses were 26% higher than the previous year, leading to a loss from business operations. A one-off gain of VND 7 billion prevented SRF from falling into a deeper loss, and the company managed to stay in the black with a net profit of half a billion VND.

|

12 construction companies with decreased profits in Q1/2024 (in trillion VND)

Source: VietstockFinance

|

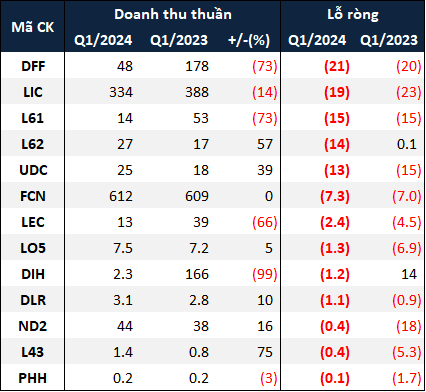

Among the loss-making companies, most had also been in the red during the same period last year. The heaviest loss was reported by DFF of UPCoM, at VND 21 billion, compared to a loss of over VND 20 billion in the previous year. LIC of UPCoM continued to struggle with financial expenses, resulting in consecutive quarterly losses.

|

13 construction companies with net losses in Q1/2024 (in billion VND)

Source: VietstockFinance

|