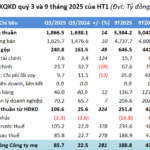

Net profit for Q2 slightly increased

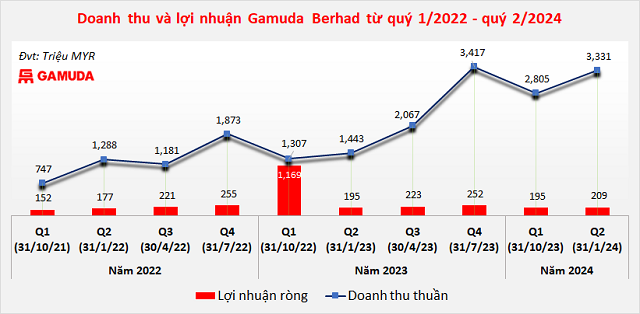

For the second quarter of the financial year 2024, ending January 31, 2024, Gamuda Berhad’s revenue reached nearly MYR 3.4 billion ($719 million), a 50% increase year-over-year, mainly from overseas projects. Net profit was nearly MYR 209 million ($44 million), a 7% increase.

|

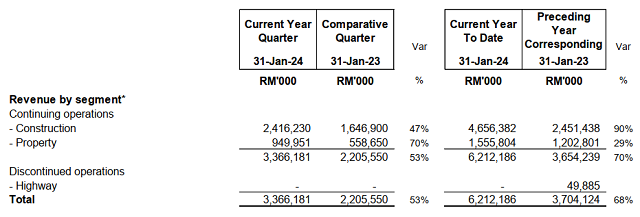

Gamuda’s revenue breakdown for the period

Source: Gamuda

|

Gamuda stated that overseas projects contributed 77% of total revenue and 58% of net profit, making up for the decline in domestic income.

The company’s overseas revenue was nearly MYR 2.6 billion, a 180% increase year-over-year. The project construction segment brought in more than MYR 2.1 billion ($453.6 million), a 220% increase, and net profit exceeded MYR 72 million ($15.5 million), double that of the previous year, thanks to the progress of projects in Australia. The overseas real estate sector contributed over MYR 468 million in revenue, a 78% increase.

Source: Author’s Compilation

|

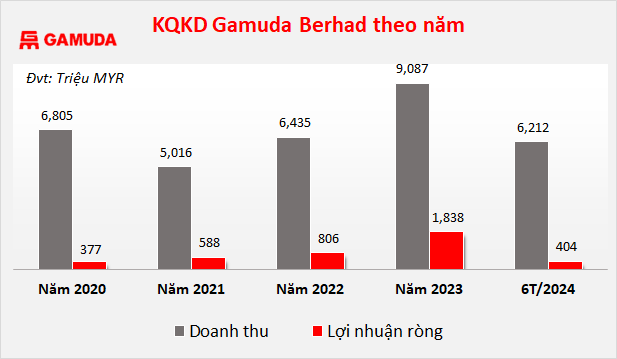

For the first half of 2024, Gamuda’s total revenue exceeded MYR 6.2 billion (over $1.3 billion), a 68% increase, thanks to strong growth in overseas construction and real estate. Meanwhile, net profit decreased by 70% to nearly MYR 404 million (over $85 million).

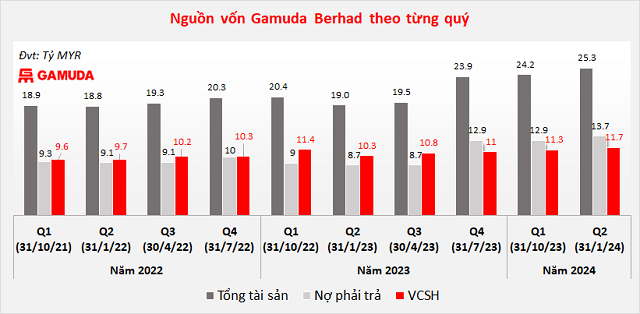

As of January 31, 2024, the Group’s total assets exceeded MYR 25 billion (over $5.3 billion), with total liabilities of nearly MYR 13.7 billion (nearly $2.9 billion), accounting for 54% of Gamuda’s capital.

Source: Author’s Compilation

|

Record-high net profit in 2023

For the financial year 2023 (ending July 31, 2023), Gamuda Bhd’s revenue reached nearly MYR 9.1 billion ($1.9 billion), a 41% increase, and net profit was more than MYR 1.83 billion ($387.4 million), double that of the previous year, thanks to the divestment of the highway business, which brought in nearly MYR 1 billion ($210.7 million). These are the best results ever achieved by the company.

Source: Author’s Compilation

|

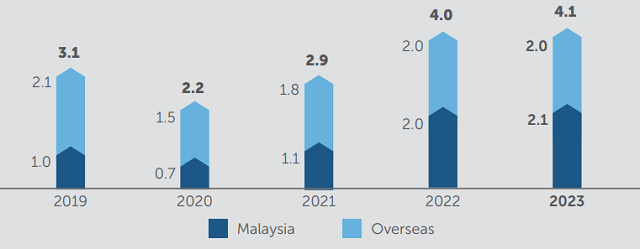

Despite the challenges of inflation and the global interest rate hike cycle, Gamuda Land’s global revenue reached a historical high of MYR 4.1 billion ($864 million) in 2023, a 2.5% increase from 2022. Total overseas sales reached MYR 2 billion ($421.4 million), with Vietnam accounting for the largest share at 76%.

|

Gamuda Land’s real estate sales from 2019 to 2023 (MYR billion)

Source: Gamuda Land

|

Gamuda Land will continue its diversification strategy, especially in strong markets such as Vietnam, Australia, and the UK. Positive results in Vietnam are thanks to Quick Turnaround Projects (QTP), and this will be the strategic focus for the next five years. Notably, the Elysian project in Ho Chi Minh City and Artisan Park in Binh Duong have sold 84% and 70% of their units, respectively.

In addition, Celadon City (Ho Chi Minh City) and Gamuda City (Hanoi) projects also contributed MYR 753 million ($158.7 million) to revenue.

Gamuda Land also emphasized its acquisition of a 98% stake in Tam Luc Real Estate Joint Stock Company in Vietnam for $316 million. The transaction gave the Malaysian company a plot of land spanning over 37,699 square meters in an advantageous location in Thu Duc City, Ho Chi Minh City. In the future, Vietnam will be a key market in the corporation’s investment portfolio.

Will Vietnamese real estate continue to be a cash cow?

Gamuda expects its 2024 results to be driven by construction projects in Australia and Taiwan (China). The estimated construction order book is around MYR 24 billion (over $5 billion), and future unbilled property sales are MYR 6.7 billion (US$1.4 billion).

Gamuda Land aims for property sales of MYR 5.6 billion (nearly $1.2 billion) and expects to set a new record with revenue of MYR 6 billion (US$1.26 billion) in the financial year 2024.

Last year, Gamuda Land achieved a revenue milestone of MYR 4.1 billion – the highest ever. This year’s revenue target comes from existing orders in Vietnam, the UK, Australia, and Singapore that have not yet been recognized. Therefore, the Group expects revenue to be recognized in the financial year 2024 after the completion of QTP projects. Vietnam contributed 68% of QTP pre-sales with a 70% occupancy rate for Artisan Park (Binh Duong) and 84% for Elysian (Ho Chi Minh City) phase 1. Both projects are expected to be sold out by 2024 and 2025.