This information was shared at the “No Cash Day” 2024 press conference with the theme “Promoting the Development of Safe Cashless Payments.” The event was held on the afternoon of May 28, 2024.

Commercial banks are rushing to complete their systems to implement this process. Experts also believe that consumers need to be cautious when transacting online as criminals always find ways to manipulate users’ psychology.

Speakers at the Q&A session on May 28, 2024

|

Combating Cybercrime

Mr. Le Anh Dung, Deputy Director of the Payment Department of the State Bank of Vietnam, shared that from the end of last year until now, fraud has been rampant, with scammers exploiting the weakest link in the payment chain: the users.

The representative from the Payment Department emphasized: “The key here is communication and awareness-raising among the public. Secondly, commercial supply chains must enhance their system security and provide safe and secure services to their customers.”

Regarding collaborative solutions to prevent fraudulent and fake transactions, Mr. Nguyen Hoang Long, Deputy General Director of NAPAS, shared that NAPAS has been working with the Risk Management Subcommittee of the Banking Association and its member banks to develop solutions. NAPAS is currently drafting a set of procedures for coordination between NAPAS and the banks based on the current legal framework.

When a bank detects a fraudulent transaction, it can immediately inform the receiving banks through this procedure. The receiving banks can then take appropriate actions in accordance with their internal regulations.

Face Verification to Protect Users

According to Mr. Le Anh Dung, after years of anticipation, the government has recently issued Decision 1813 approving the project for the development of cashless payments in Vietnam for the period of 2021-2025. This decision underscores the role and added value that cashless payments bring to individuals and businesses.

Following this decision, there will be circulars to ensure synchronization and provide a legal basis for Decree No. 52/2024/ND-CP on cashless payments, which will come into effect on July 1, 2024.

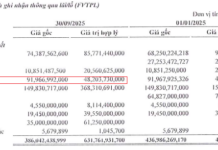

Addressing users’ concerns about the requirement for face verification for transactions over VND 10 million per time or VND 20 million per day, as per Decision 2345 of the State Bank, Mr. Le Anh Dung shared that the State Bank carefully considered this threshold of VND 10 million per transaction.

According to statistics, 70% of money transfers are below VND 10 million. Therefore, the State Bank set this limit to balance strong transaction authentication while ensuring a smooth user experience.

“The State Bank also set the daily limit of VND 20 million to prevent criminals from exploiting loopholes by making multiple transactions below the VND 10 million threshold. This limit aims to prevent fraud and protect users rather than cause them inconvenience,” Mr. Dung added.