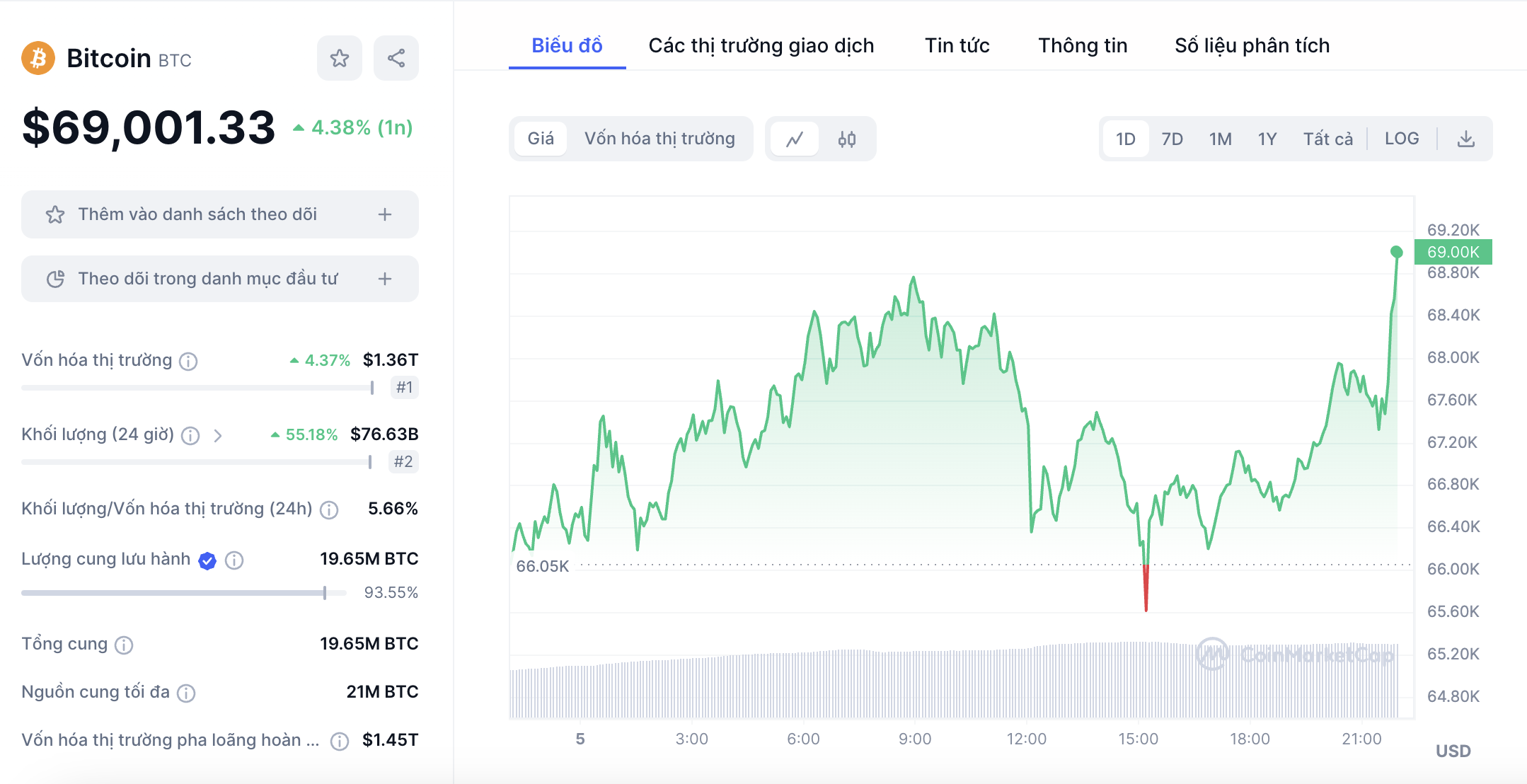

Digital currency Bitcoin. (Photo: Fortune/ VNA)

|

On May 23, the U.S. Securities and Exchange Commission (SEC) approved proposals from Nasdaq, CBOE, and NYSE to list exchange-traded funds (ETFs) related to the digital currency ether, paving the way for wider trading of these financial products by the end of the year.

Although ETF issuers also need to get a green light before their products can launch, this approval is a surprising win for these companies and the digital currency industry, which had anticipated that the SEC would reject the filings.

Nine ETF issuers, including VanEck, ARK Investments/21Shares, and BlackRock, are hoping to debut their ether-linked ETFs after the SEC approved bitcoin ETFs in January this year, marking a significant turning point for the digital currency industry.

May 23 was the deadline for the SEC to decide on VanEck’s filing. Market participants had mostly prepared for a rejection.

However, in a surprising move, SEC officials on May 20 asked the exchanges to quickly amend their filings.

When asked about the Ether ETFs at an industry event on May 23, SEC Chair Gary Gensler, a longtime skeptic of digital currencies, declined to comment.

An SEC spokesperson said in an email announcing the approval that the agency would not comment further. The SEC has rejected spot bitcoin ETFs for over a decade due to concerns about market manipulation but was forced to approve them after Grayscale Investments won a lawsuit last year.

In early 2024, the SEC approved 11 spot bitcoin ETFs. This was a turning point for the world’s largest digital currency and the digital currency industry as a whole.

According to a notice posted on the SEC’s website, the first 11 approved registrations included BlackRock, Ark Investments, 21Shares, Fidelity, Invesco, and VanEck.

This development is a game-changer for bitcoin, allowing institutional and individual investors to access the world’s largest digital currency without directly holding it.

It is also a significant boost for the digital currency market, which has been plagued by a series of scandals.

Analysts from Standard Chartered Bank predicted this week that spot bitcoin ETFs could attract $50-100 billion in investment just this year, potentially pushing bitcoin’s price to $100,000.

Other analysts believe that the inflows into spot bitcoin ETFs will only reach about $55 billion in five years.

Andrew Bond, managing director and senior fintech analyst at Rosenblatt Securities, said this is a very positive development for the institutionalization of bitcoin. He added that the approval of these ETFs would promote the legalization of bitcoin.

Analysts believe that the success in the battle for market share among spot bitcoin ETFs could hinge on two factors: fees and liquidity.

Some funds, including BlackRock and Ark/21Shares, have said they will reduce fees for new filings this week.

The fees charged by the funds to investors for investing in spot bitcoin ETFs range from 0.2% to 1.5%, with many companies even offering a fee waiver for a certain period.

However, for short-term speculators, liquidity may be more important than fees. A spot bitcoin ETF with higher liquidity makes it easier for investors to buy and sell shares quickly at a price close to bitcoin’s actual price.

The approval of the spot bitcoin ETF marks a complete shift in the SEC’s perspective, as the agency had said no to these funds for a decade due to concerns that they could be easily manipulated.

SEC Chair Gary Gensler is also a skeptic of digital currencies. Jim Angel, associate professor at the McDonough School of Business at Georgetown University, said that the spot bitcoin ETF could pave the way for other innovative products in the digital currency space.

For example, many companies have started filing for spot ether ETFs, the world’s second-largest digital currency.

According to the expert, once the barrier is removed, it will be difficult for the SEC to maintain its position of saying no to proposals related to digital currencies.

Many parties have filed for a spot bitcoin ETF since 2013, but the SEC has refused, arguing that they are easily manipulated. However, in August 2023, a court ruled that the SEC was wrong to reject Grayscale Investments’ ETF application, forcing the agency to change its stance.

The spot bitcoin ETFs will be listed on the Nasdaq, NYSE, and CBOE exchanges.

The funds’ assets include bitcoin purchased from digital currency exchanges and held through specialized custodians such as Coinbase Global. To address the SEC’s concerns about market manipulation, Nasdaq and CBOE have created a market surveillance mechanism with Coinbase, the largest U.S. digital currency exchange.

Buying spot bitcoin ETFs allows investors to trade without the complexity and risk of directly holding bitcoin. Traditional digital currency trading involves setting up a digital wallet, creating an account on an exchange, and often includes poorly secured steps that are vulnerable to hacker attacks.

Additionally, ETFs listed on regulated stock exchanges provide greater accessibility to individual investors through their existing brokerage accounts.

This ETF structure also increases bitcoin’s accessibility to institutional investors, as some institutional investors are prohibited from investing directly in alternative assets.

In 2021, the SEC also approved a bitcoin ETF in the form of futures contracts. These funds allow for the buying and selling of bitcoin at a pre-agreed price.

However, these bitcoin futures ETFs do not track price movements accurately, and the cost of rolling over the futures contracts can eat into returns, making this type of ETF less attractive to investors.

The recently approved spot structure is expected to create a much bigger boom than futures contracts, as it can track bitcoin’s price movements more accurately, attracting more participants.

ProShares Bitcoin Strategy ETF, the first bitcoin futures ETF approved by the SEC in 2021, saw about $1 billion worth of shares traded on its first day.

Experts predict that the spot bitcoin ETF will triple this figure on its first day and could reach $55 billion in five years.

Minh Trang