The US dollar continues to strengthen globally. |

Prioritizing Exchange Rates?

As of May 27, 2024, the central exchange rate of the US dollar to the Vietnamese dong recorded an increase of 22 VND compared to the end of April 2024. Looking back at the increase of up to 243 VND in April, it can be seen that the appreciation pace of this exchange rate pair is slowing down. Similarly, the buying and selling prices of the US dollar at Vietcombank, after increasing by up to 638 VND in April in both buying and selling directions, have only increased by 163 VND in the buying direction and 23 VND in the selling direction since the beginning of May compared to the previous month-end.

The US dollar continues to strengthen globally. |

The State Bank of Vietnam (SBV)’s increase in foreign currency supply to support the foreign exchange market is considered one of the reasons for the stability of the US dollar/dong exchange rate in the past month. Some information shows that from April 22, 2024, to the end of last week (May 24, 2024), the amount of foreign currency that the SBV has sold immediately to commercial banks exceeded 3.5 billion USD.

In the context of foreign currency supply and demand showing signs of imbalance in the past time, the above move of the SBV has brought about immediate effectiveness and positively affected the market psychology.

However, recent data from the General Department of Customs shows that in the first half of May, the trade balance fell into a state of trade deficit (2.6 billion USD). The economic recovery increases the demand for importing raw and essential materials for production, along with the demand for foreign currency to pay for imports. Therefore, the exchange rate still faces potential pressures.

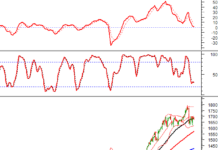

Commercial banks have had to continuously list the selling price of the US dollar at the ceiling rate. Specifically, as of May 27, 2024, with the central exchange rate at 24,268 VND/USD and the prescribed bandwidth of ±5%, the ceiling rate is 25,481 VND/USD. And this is also the selling price of USD that Vietcombank listed on this day.

|

If calculated from the beginning of May to the end of last week, the SBV is still net withdrawing VND 18,625 billion. If calculated from March 11, the authority is net injecting VND 32,831 billion through the bill and OMO channels. But this net injection figure is insignificant compared to the amount of VND that has been withdrawn through the SBV’s foreign currency and gold sales channels, amounting to more than 93,000 billion VND. |

Looking back, Vietcombank’s USD selling price was usually lower than the ceiling rate by 400-500 VND, and sometimes even by more than a thousand VND. The fact that the difference has now dropped to zero is a notable signal. The last time this difference was at a particularly low level was in November 2022 when the economy faced a liquidity crunch in many markets. Especially, it was probably because the selling price had hit the ceiling and could not be adjusted further, so Vietcombank’s selling price has only increased slightly by 23 VND since the beginning of May.

Given this situation, rumors emerged last week about the possibility of widening the bandwidth for the USD/VND exchange rate. However, the Director of the Monetary Policy Department (SBV) immediately denied this, stating that “With the current mechanism of managing the central exchange rate and the bandwidth of ±5%, the market exchange rate has had enough room to fluctuate,” and emphasized that “Some recent information about changes in SBV’s exchange rate management is inaccurate and inconsistent with the Government’s goal of stabilizing the market and stabilizing the macro-economy, creating instability in the market. Therefore, businesses and people need to be cautious about these rumors.”

In addition, another solution to support the foreign exchange market implemented by the SBV in recent days is to increase the interest rate for bill issuance and the lending rate for collateralized paper on the open market (OMO). According to analysts, this policy can, for the time being, help the SBV not need to increase the operating interest rate but still keep the interbank interest rate high, limiting foreign exchange speculation from idle capital of credit institutions.

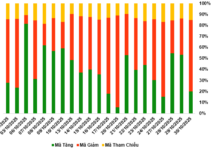

Specifically, on May 22, 2024, the SBV increased the bill issuance interest rate by 0.1 percentage points to 4%/year, while the interest rate in the OMO market also increased by 0.25 percentage points to 4.5%/year. Just one day later, the agency continued to increase the bill interest rate by 0.2 percentage points to 4.2%/year. Compared to the benchmark of 1.4%/year when the SBV started issuing bills again (March 11, 2024), the bill interest rate has taken a big step forward.

Is Dong liquidity under pressure?

To cope with the depreciation pressure of the domestic currency, central banks in the region have two choices: either sell foreign currency as the Bank of Japan has done recently or raise interest rates to enhance the attractiveness of the domestic currency as Bank Indonesia has done. It can be seen that the SBV is flexibly using both of these tools, while the US dollar in the international market may continue to hover high as the US Federal Reserve (Fed) is still delaying interest rate cuts.

Recently, David Solomon – CEO of Goldman Sachs, predicted that the Fed would not cut interest rates in 2024. Previously, in April 2024, Goldman Sachs’ team of economists forecast that there would be only two interest rate cuts this year, with the first cut in July and the second in November.

The increase in the OMO interest rate has led to an increase in the interbank interest rate, which is another sign that the system’s liquidity is no longer abundant as before. After the SBV’s move in the OMO market, the overnight lending interest rate in the interbank market surged to 5.1%/year on May 23, 2024, up to 55 basis points (bps) from the previous day. The one-week, two-week, and one-month terms also increased by 57 bps, 47 bps, and 55 bps, respectively, to 5.27%, 5.02%, and 5.42%.

Especially, the increase in the OMO interest rate is accompanied by a high borrowing volume of credit institutions through this short-term capital support channel. On May 22, 9 out of 9 members participated and won the bid of VND 25,000 billion; on May 23, 8 out of 8 members participated and won the record of more than VND 43,063 billion; on May 24, 7 out of 7 members participated and won the bid of VND 27,019 billion.

Accordingly, in just the last three days of last week, the total net injection through the bill and OMO channels reached VND 96,433 billion. Notably, along with the move to increase the OMO interest rate, the borrowing term has also increased from seven days to 14 days since May 23, 2024, indicating a longer-term liquidity support need.

If calculated from the beginning of May to the end of last week (May 24, 2024), the SBV is still net withdrawing VND 18,625 billion. If calculated from March 11, 2024, the authority is net injecting VND 32,831 billion through the bill and OMO channels. But this net injection figure is insignificant compared to the amount of VND that has been withdrawn through the SBV’s foreign currency and gold sales channels.

Specifically, with 3.5 billion USD sold at an exchange rate of VND 25,450/USD, the amount of VND that the SBV has withdrawn is estimated to be more than VND 89,000 billion. Meanwhile, up to May 24, 2024, the amount of SJC gold bars sold by the SBV to stabilize the market was 48,500 taels. With the auction price fluctuating in the range of VND 81.3-89.4 million/tael, the amount of money the SBV received from the gold bar auction is estimated at VND 4,200 billion. Thus, the total amount of VND withdrawn through these two channels is VND 93,200 billion.

Therefore, the liquidity pressure of the VND system is gradually increasing, which can affect the interest rates in other markets. Along with the recent move to increase the bill and OMO interest rates, is the regulator prioritizing exchange rates and, for the time being, accepting sacrificing interest rates?

Triệu Minh