In today’s world, credit cards have become an indispensable payment tool in modern life. With their convenience, speed, and the ability to make purchases without carrying cash, credit cards are a popular choice for consumers, especially when dining out or shopping. However, along with the convenience, there are also risks associated with this form of payment that many people worry about.

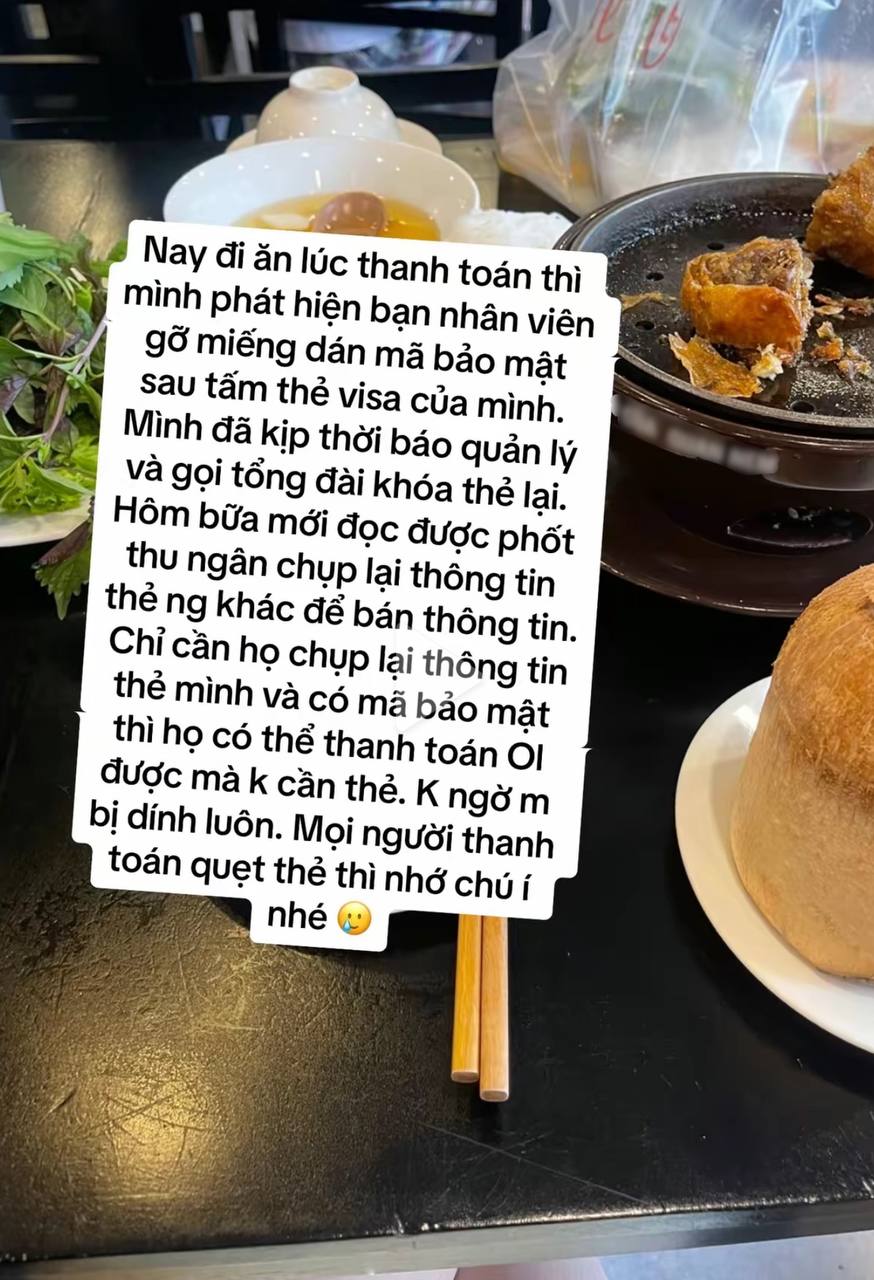

Recently, a young woman shared her experience while dining at a well-known restaurant. During the payment process, she accused the staff of removing the CVV security sticker from the back of her Visa card. The customer quickly notified the restaurant manager and called her bank to block the card immediately.

CVV (Card Verification Value) is a 3-digit code used to verify Visa cards, including debit and credit cards. It serves as a security code for the card and is often used for verification, especially in online transactions.

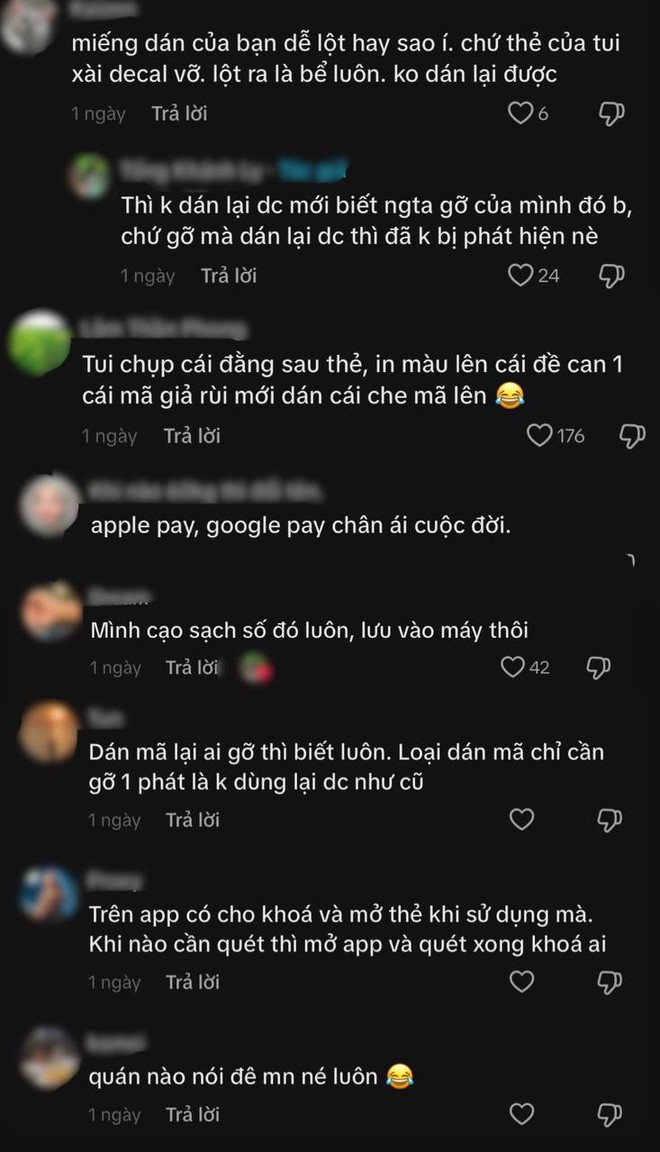

The young woman’s story attracted over a million views, along with thousands of shares and comments. As paying by credit card in restaurants is a common practice for many people, numerous similar stories, along with personal perspectives and card protection methods, were shared in the comments section of her post.

Based on the information shared by the customer, here are some tips provided by the online community to protect your credit card and be more vigilant during transactions:

Use security stickers for the CVV code: Apply a tamper-evident sticker provided by your bank over the CVV code. These stickers are made of fragile vinyl, which easily breaks into pieces if someone attempts to remove or tamper with it, thus providing an effective way to protect your CVV/CVC code.

Remove the CVV/CVC code from your card: After memorizing or securely storing the CVV code, you can use a sharp object to gently scratch off the numbers from your card. Rest assured, your card will still function normally.

Always keep your card in sight: It is advisable to make the payment yourself at the counter to prevent any misuse by individuals with malicious intentions.

Utilize mobile payment apps: When using Apple Pay or Google Pay in stores, on websites, or within apps, users are required to authenticate their identity using Face ID or Touch ID. These methods offer a higher level of security compared to contactless payment cards, which do not require any additional authentication.

Block your card: In case of loss, information leakage, or any suspicious activity, immediately contact your card-issuing organization through Internet Banking, their hotline, or by visiting a bank branch.

Regularly review your transactions: Keep a close eye on your card transactions to detect any unauthorized or fraudulent activity promptly.