Closing the last trading session of June 2024, the VN-Index broke below the 1,250-point mark, a 1.3% decrease compared to the previous month, settling at 1,245.32 points. The stock market witnessed a significant decline, largely influenced by the banking sector stocks. According to VietstockFinance data, the banking sector index for June dropped by 2% from the previous month, settling at 672 points.

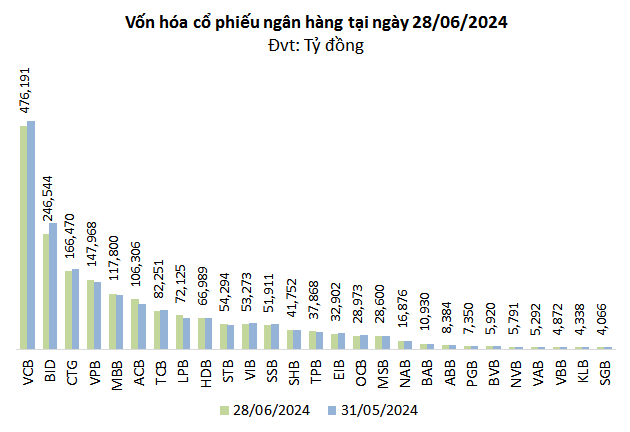

Market Capitalization Evaporated by nearly VND 20.5 trillion

During June, the market capitalization of the banking group decreased by VND 20.49 trillion, falling to VND 1.89 million billion (as of June 28, 2024), a decrease of over 1% compared to the end of May.

Source: VietstockFinance

|

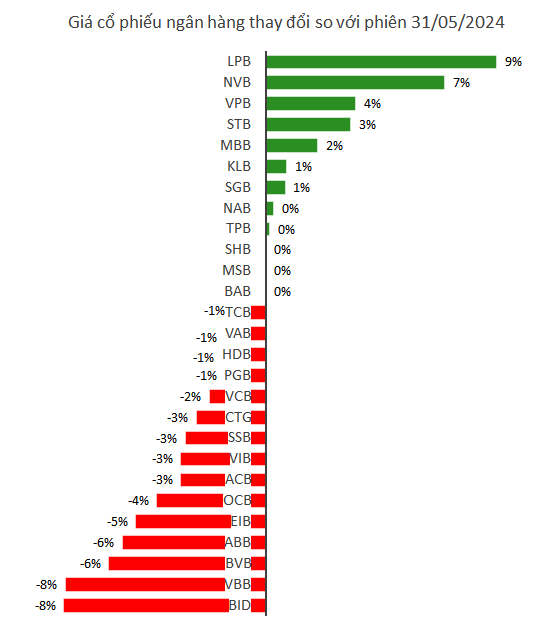

The sector’s market capitalization continued to evaporate due to negative impacts from the three largest state-owned banks. Specifically, BIDV (BID) experienced the most significant decline in market capitalization among the banking system (down 8% from the previous month), while VietinBank (CTG) and Vietcombank (VCB) decreased by 3% and 2%, respectively.

Most of the market capitalization of private banks also retracted. Only a few banks recorded improvements in this regard.

Notably, despite a 3% decrease in share price compared to the previous month, ACB witnessed the most substantial increase in market capitalization among the banking group (up 11%). This growth was attributed to the increase of nearly 583 million circulating shares as of June 27, 2024, following the bank’s completion of a 15% stock dividend payment for the year 2023.

On the other hand, the market capitalization of banks like LPBank (LPB, +9%), NVB (NCB, +7%), and VPBank (VPB, +4%) rose in line with the increase in share prices.

According to data from the General Statistics Office, as of June 24, 2024, credit growth in the economy reached only 4.45%, significantly lower than the 15% credit growth target set by the State Bank of Vietnam for the entire year of 2024.

The slow credit growth directly impacts net interest income, raising concerns about the banking sector’s second-quarter profitability, which is reflected in the banks’ stock prices during the past month.

Source: VietstockFinance

|

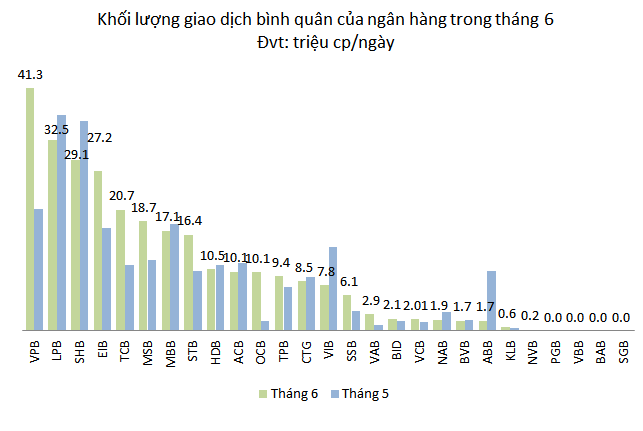

Liquidity Increases

In June, nearly 279 million banking stocks were traded each day, a 15% increase compared to May, equivalent to an increase of nearly 37 million shares per day. Along with this, the trading value increased by 19%, reaching nearly VND 6,139 billion per day.

Source: VietstockFinance

|

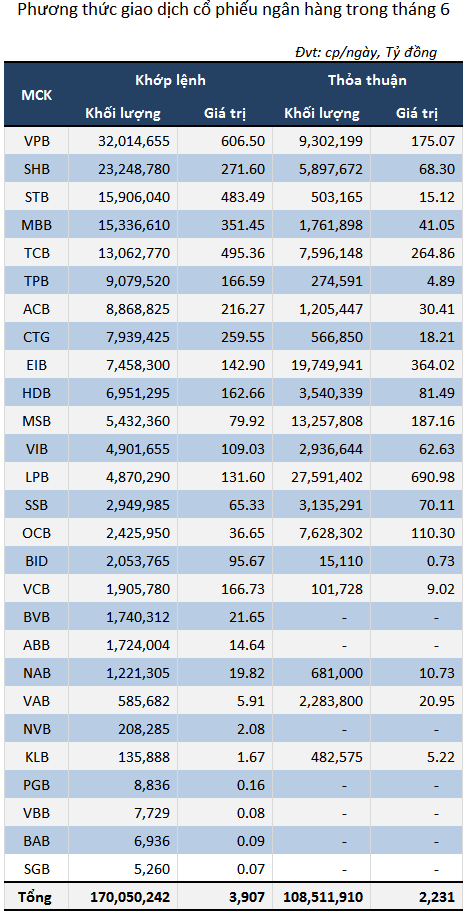

Notably, banks that witnessed a significant increase in liquidity include OCB (5.7 times), VAB (3 times), VPB (2 times), TCB (85% increase), and SSB (83% increase). Conversely, VBB experienced the most substantial decline in liquidity in the system, falling by 92% to 7,729 shares per day.

This month, VPB led in terms of liquidity, with more than 32 million shares traded daily through the matching method and over 9 million shares traded via put-through, resulting in an average total trading volume of over 41 million shares, double that of the previous month.

SGB recorded the lowest liquidity among banks, with only 5,260 shares traded daily, a 22% decrease from the previous month, and a corresponding value of nearly VND 70 million per day.

Source: VietstockFinance

|

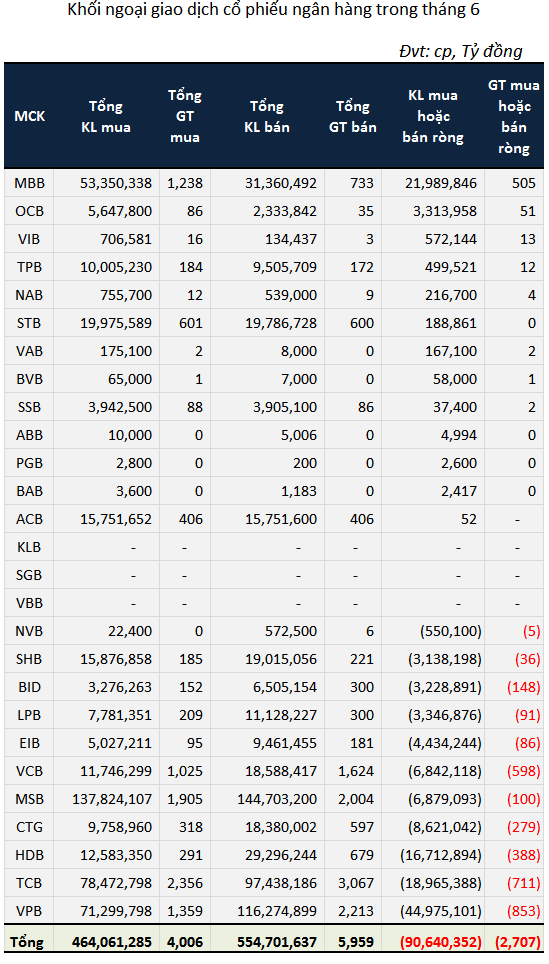

Foreign Investors Sold a Net Amount of VND 2.707 trillion

The selling pressure from foreign investors persisted in June, with nearly 91 million banking stocks sold on a net basis, a decrease of over 70% compared to the previous month. The net selling value reached VND 2,707 billion, a decrease of over 60% from the previous month. This marks the fifth consecutive month (since February 2024) that foreign investors have net sold banking stocks.

Source: VietstockFinance

|

In June, MBB was the banking stock that foreign investors bought the most, with 22 million shares (worth VND 505 billion). Conversely, VPB was the stock that foreign investors net sold the most, with nearly 45 million shares, equivalent to a value of VND 853 billion.